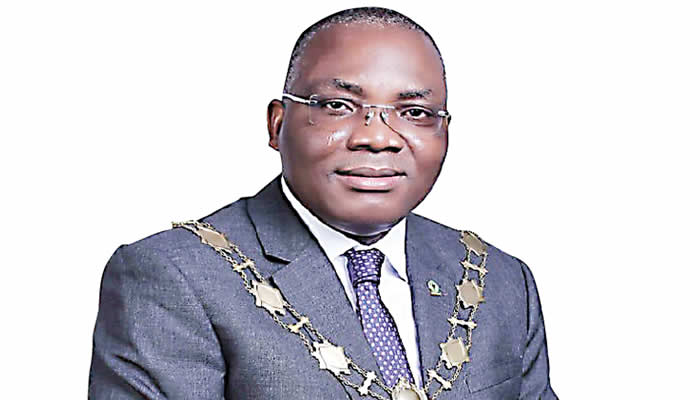

Dr Bayo Olugbemi, the immediate past President/Chairman of Council of the Chartered Institute of Bankers of Nigeria, tells BLESSING ENENAITE about his career, challenges and achievements

What inspired you to go into banking?

Nothing inspired me into banking. My decision to join the banking industry was through divine direction. It was not my plan. My plan was just to work anywhere and earn money, then go back to the university. I worked in a production firm and after eight months, I got a job with the then Union Bank as a clerk.

What were your roles as the president of CIBN?

CIBN is an institutional body which conducts examinations for those who want to come into the industry as bank workers. I led a crop of professionals through the governing council. Office holders (at the institute) include the president, the first vice president, the second vice president, the national treasurer and the secretary in council, who is also the chief executive. We ensure that the regulations formulated by the governing council are implemented.

You presently rounded up your tenure as the president of CIBN. How would you describe your experience?

It was very inspiring and engaging. I came into office at the height of the COVID-19 pandemic. We had to conduct an online election where I was sworn in as the president on May 15, 2020. In my first eight months in office, we basically had virtual meetings, engagements, lectures and conferences. Although we did not know that there was going to be a pandemic, we were ready for it. It was tough but we were able to surmount the challenges.

What were your achievements as the president of CIBN?

I will not say ‘my’ achievements. Rather, I will say ‘our’ achievements because we operate a presidency. God helped us to achieve a lot. At times, when negative things happen to humans, it can become a source of fortitude for someone. Before the coronavirus pandemic, when we had meetings, we would not have more than 50 or 70 per cent attendance. (However), in 2020, when we had our Annual Bankers Conference, there were about 1,200 persons in attendance. The pandemic made us to do hybrid annual conferences in 2020 and 2021. These conferences attracted up to 20,000 people, both online and physical. That also spurred us to be very innovative with what we do. For example, our annual conferences used to be held in one centre in Abuja. But with the pandemic, we had a hybrid conference. It was not just physical in two centres— Abuja and Lagos— it was online. That innovation expanded the horizon of the people that attended the programme.

Before now, people outside Nigeria did not usually attend, except for one or two persons. But, at the height of the pandemic, our members scattered all over the world attended our events online. That also brought a lot of income for us. As a matter of fact, the last conferences were free because we had a lot of sponsors online. Back then, we usually had between five to 20 people in attendance. During the pandemic, hundreds of people attended. The fees had to be reduced. What mattered was the turnover. It has been very engaging. Aside from bringing more people to our conferences, we also brought a concept of building a legacy with lecture centres across the six geo-political zones; one hall per zone. The aim was to access polytechnics and universities in the country that have linkage with CIBN. We did an evidence-based assessment to rank them to know who is number one.

In the first stage, we decided to build at least six CIBN lecture halls for tertiary institutions. We laid six foundations. Three (of the buildings) have been completed and commissioned. The Polytechnic Ibadan, Oyo State, for the South-West; Abubakar Tafawa Balewa University, Bauchi State, for the North-East; and the Federal Polytechnic, Nekede, Imo State, for the South-East have been commissioned.

The foundations for the lecture halls for Rivers State University (South-South), Kano State Polytechnic (North West); and Federal Polytechnic, Nasarawa State (North-Central) have been laid. They will be commissioned later in the year. Aside from developing our people academically, we also try to build physical structures, which has not been done before.

What were the challenges you encountered in office and how did you surmount them?

There is no venture that anyone goes into that they won’t face challenges.

For example, there were physical restrictions during the pandemic but it later turned out to be a blessing in disguise for us. We were unable to go out but we conducted our affairs online. We were able to get more engagements all over the world. What would have been a minus for us actually turned out to be a plus.

You are also the Managing Director and Chief Executive Officer of First Registrars and Investors Services Limited. How do you efficiently manage the demands of both offices?

We have built a structure for our people so that I don’t have to be in the office all the time. The COVID-19 pandemic also forced me to be working from home. One position does not disturb the other. I hardly go to the office. I work mostly from wherever I find myself. Virtually, I have been doing what I need to do. It has been easy for me to carry out my duties as the MD of First Registrars, President and Chairman of Council of CIBN, and provisional pastor in The Redeemed Christian Church of God, where I oversee a parish of the church. The experience so far has been seamless. The pandemic was a blessing in disguise because the church was being run virtually then.

What is your career trajectory?

I was working and studying for my Bachelor’s degree in Accounting at the University of Lagos. I was also preparing for the state CIBN exams at the same time. I got both simultaneously to the glory of God. I worked with Union Bank, Rims Merchant Bank, United Securities Limited, Diamond Bank, then I moved to First Bank.

Before one can become the CIBN president, one has to first lead a branch. I was the second vice president of the Lagos State branch for two years, and the first vice chairman for two years. From there, I became the national treasurer, then second vice president, and first vice president. Then, I was elected as the president of CIBN for two years.

There are many people in the banking sector. How were you able to distinguish yourself to get to this level?

The most important part of my life is the God factor. He has been with me all the way. God’s grace has always been there for me. It has not been very easy. One thing that has got me to this level is hard work and being a man of impeccable character. Also, integrity is very important. ‘Make your word your bond’ as they say in the industry. In addition, tenacity of purpose and perseverance are important factors. There can be pressures and disappointments here and there. Before one grows in one’s career, one has to be focused. One must also keep learning. I am still learning. I am studying for another doctorate.

You have been in the industry for almost 40 years. What are the elements that have brought you this far?

The elements that have brought me this far are the God-factor, focus, being a man of (good) character and hard work. Also, one must keep learning. After my Bachelor’s degree, I went back for my Master’s degree in Business Administration. After that, I became a qualified stockbroker, accountant, marketer and administrator. I am a member of some organisations. I am still learning and studying.

Did you ever have the ambition to become the president of CIBN?

Not at all. I joined the banking industry by God’s divine direction and enablement. However, when I was writing my banking exams, I knew I was embarking on a journey to the top, either as general manager or director level. When I was leaving Union Bank in 1991, I mentioned to my colleagues that I was going to come back and I would be attaining a top position. But, I did not go to Union Bank. I went to First Bank. I did not set out to be the CIBN president but God directed my path.

With your experience in the banking industry, what were the most frequent complaints of customers and what measures have been put in place to ensure that such issues are dealt with?

Most of the complaints have been about wrong deductions and overcharging. We have a committee (that looks into such issues). If a customer has a complaint against his bank, or a bank has a complaint against another bank, they can actually write a petition to that committee. Most of our recommendations have been upheld by the Central Bank of Nigeria.

As a matter of fact, the complainants don’t even have to go to court except they choose to or it is a court-binding case. Once the petition is written, the committee will call all the parties involved and resolve the case amicably. Customers out there should know that there is an ombudsman in the industry that they can direct their complaints to if they are wrongly charged by any bank.

It is an oft-repeated business maxim that ‘the customer is king’. However, in recent times, there have been recent cases of bank customers being fleeced by banks, especially with unauthorised charges and deductions. What do you have to say concerning this?

That is unprofessional. There are three rules in banking and business generally. The first is that, ‘the customer is king’. The second is that ‘customers cannot be wrong’. The third rule is that, ‘if the customer is wrong, go to rule one’. So, if any bank employee is going contrary to that, the person is not being professional. The ombudsman is the sub-committee of the bankers’ committee on ethics. Once complaints are brought there, they would be handled appropriately.

In what ways do you think the rights of customers can be protected?

There are rules and regulations guiding customers’ expectations. In the CBN, there is a customer protection department. There are many avenues through which customers can be protected. If a customer is being cheated, they can either go to the customer protection department of the CBN or to the ombudsman of CIBN to file complaints.

The best (department) in the banking sector to lay complaints is the committee on ethics. If your right is infringed, there is a mechanism and protocol (in place for you) to seek redress.

In the past, the banking profession was envied and many people desired to work in the sector. However, that seems not to be the case anymore. What do you think is the cause?

It is not only in the banking industry and it is not only in Nigeria. All over the world, banking has become an entrepreneurial business. It used to be run by the government in the past but in the eighties and nineties, individuals became involved. In the process, we also have people who are fraudulent. That is why the people that come into the industry must have integrity. If we get any report of any misbehaviour, we will deal with the person through our committee.

The CIBN also has a tribunal that handles cases of members who breach the law. The tribunal has coordinate power with the federal or state high court. There are mechanisms to handle these issues. The shine, which is said to have been taken off, is not only in the industry but in society at large.

In recent times, there have been a series of bank robberies which has forced some bank to shut down their branches in those affected areas. What role does the CIBN play in such situations?

The CIBN regulates individuals that are members of the banking industry. We don’t regulate banks. It is only the CBN that regulates banks. CIBN does not handle such issues. It is the CBN that gives approval to banks to close down or operate. If a bank is constantly being attacked by armed robbers in a particular area, it is only normal to either beef up security in that branch or close it down. If the bank does not do that, at the end of the day, they will keep losing lives and money. It is not in the interest of the bank to keep operating when they are constant victims of armed robbery attacks. One cannot blame them if they shut down their operations. It is the government that should protect lives and properties.

There has been a recurring issue of bank workers given high targets to meet in terms of attracting customers and huge deposits into their banks. Does that have to happen?

There are entrepreneurial bankers whose jobs it is to make profits and give returns to their shareholders. However, the target is alien to banking. But, because they (banks) want to outdo one another, they ‘mobilise their forces’ to meet targets, which are sometimes unrealistic and unrealisable. Nevertheless, in any business, nobody can stop one from doing whatever one does that is within the ambit of the law.

We also have the issue of morality and conscience. No one can stop banks from giving targets (to their employees) because they want to meet the budget approved by their respective boards. In meeting their budgets, they must attract deposits. The banks will also need money to will give their customers who are taking loans. It is because of things like that that the banks set targets.

What are the benefits of belonging to CIBN?

As a professional banker who belongs to CIBN, one has a pool of professionals whom one can relate with, either at conferences, bankers’ dinners and other events. CBN has been very supportive of us to implement the competency framework. CIBN collaborates with other associations and institutions of higher learning to train our members. It helps to broaden their horizon. We also have a mentoring scheme where old bankers mentor the younger ones.

What are some of the lessons you learnt as the president of CIBN?

I learnt that collaboration is very important. One has to collaborate with not just people in one’s industry but the whole economic system. Our engagements with tertiary institutions have also been an eye-opener for me. We have embarked on projects in different states in the country. It is very important that we give back to the grassroots, and we have been well received.

If you were not a banker, what would you have become?

I would have become a journalist (laughs). Those days and even now, I go around with newspapers and I always listen to the news. I don’t joke with my newspapers. I read them as if I am studying for exams. I could not become a journalist but my son is, and he is doing well.

You are a graduate of a Bible school. What propelled this decision?

By God’s grace, I am a born again Christian and pastor. After I became a pastor in 1996, I needed to know more about the word of God. Hence, I enrolled in Bible school. Moreover, I am a constant learner. I decided to educate myself more about God’s word.

As a pastor, have you ever faced a situation at your workplace that tested your faith?

No, I haven’t. All the challenges I have faced, I overcame them with God’s power. I am a man of faith and my faith has always been strong.

What are the bold steps you have taken in the course of your career?

The first bold step was when I moved from Union Bank in 1991. I was told that where I was going then, there would be challenges. Nevertheless, God promised that he would make a way for me. In Union Bank, I was well loved and I was being promoted as of when due. But, God asked me to leave the bank and I left. The second week I got to the (new) place, I saw the challenge. Within six months, God took me to another place. There have been times I told God I wanted to leave a particular place and He would make a way for me. Someone would just call me for an interview and I would get another job. For the first 18 years (of my career), I changed jobs about six times. I spent nine years in Union Bank, but in the next place (I went), I spent only six months. I have spent 22 years in First Bank.

Do you have any regrets in life?

No, I don’t. God has been very faithful.

Who are your biggest cheerleaders?

My family members, especially my wife, children and brothers are my biggest cheerleaders.

What other offices do you aspire for?

Whatever plans God has in store for me, I will take. I often ask God, ‘what next’? Aside from being the MD of First Registrar Investors Services Limited, I am a senior pastor in RCCG. I oversee 140 parishes with almost 20,000 members. That is a huge job too. If I leave First Registrar and I quit CIBN today, the work of the church is more than enough for me to do. I do other things too because I am involved in a lot of non-governmental organisations, both within and outside the church. I have a lot to do. Maybe one day, I may become a professor. I am on the road to that.

Have you ever felt like giving up?

No way! I do not give up. Let me give you an instance. In 2001, we were bidding to be the registrars to the Lagos State government but it was given to a surveyor of Union Bank and the secretary (position) was given to a surveyor of First Bank. My bank director then said, ‘Well, they have given us one of the slots’ (which is a trustee position). I told him that I was not a trustee, that I was a registrar. My boss said I should not bother (since it is not what I wanted). I went further and through prayers, I got the position of registrar. My major clients have been from the Lagos State government. I can mention more than five mandates we got because I refused to give up.

How do you combine work with family?

God’s grace has been sufficient for me. When I am not doing my office work and I am not in church, I am in my house. We (I and my family) have time where we pray together. At times, we used to travel together too. But, my children are all grown up now. The youngest is 25 years old.

Are any of your children following your career path?

In banking, none of my children are following my path. But, I have a child who is an accountant; and another who is a lawyer. Also, one of my children is following my first love, which is journalism. He is a broadcaster, writer and poet.

How do you unwind?

I unwind by staying with family and friends. I attend events and go to church too.

How do you like to dress?

I like to dress simply. But as a banker and pastor, I dress formally.

What is your favourite food?

I don’t know which one now but I used to like bread and rice. As I am growing older, I have dropped bread. Now, it is rice.

Copyright PUNCH.

All rights reserved. This material, and other digital content on this website, may not be reproduced, published, broadcast, rewritten or redistributed in whole or in part without prior express written permission from PUNCH.

Contact: [email protected]