Specifically, he urged regulators and the banks to deploy more FinTechs and money agents to the hinterlands to address the worrying situation.

“You need cash to pay for transport. For instance, in Abuja how do you take ‘drop or along’ or use a Keke NAPEP without cash, or buy foodstuff on the road or in canteens, or even buying recharge cards?

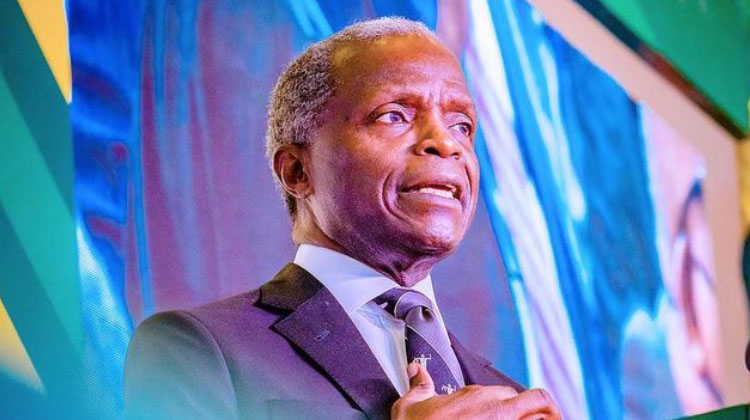

“Parents with kids in public schools give money daily to their children for lunch, most commerce is informal, so you need cash for most things,” Osinbajo was quoted as saying in a statement by his spokesman, Laolu Akande. .

During the interactive session with a number of FinTech investors and ecosystem players, the vice president said that the Central Bank of Nigeria and the commercial banks should work with all FinTechs that have mobile money agents in order to reach the farthest places in the country.

“It seems to me that banks must engage their mobile money operators – FinTechs with mobile money licenses and many of them have micro-finance bank licenses now and already have a network of mobile money agents or human banks or human ATMs (as they are sometimes called) who are responsible to them and they can supervise by themselves. They can do currency swaps and open bank accounts.”

Speaking further about some of the concerns arising from the redesign of the new naira notes, the VP stated that “more disturbing is the fact that after depositing your old notes, there are no new notes, so people everywhere in the urban areas and rural areas simply have no money.”

The Vice President acknowledged that “there are logistical challenges that have to be addressed by the CBN and the banks, especially from the point of view of the average Nigerian and those in the hinterland who hardly use any electronic platforms.”

He also observed that while there has always been a certain failure rate in online banking and money transactions, they have become even more difficult now with the increase in the number of transactions congesting the system.

He said, “so where in the past you used POS or any of the electronic platforms, you had maybe 20%-30% failure rate, now because everyone is trying to get on those platforms, obviously, the failure rate is much more and the problems are much more pronounced.”