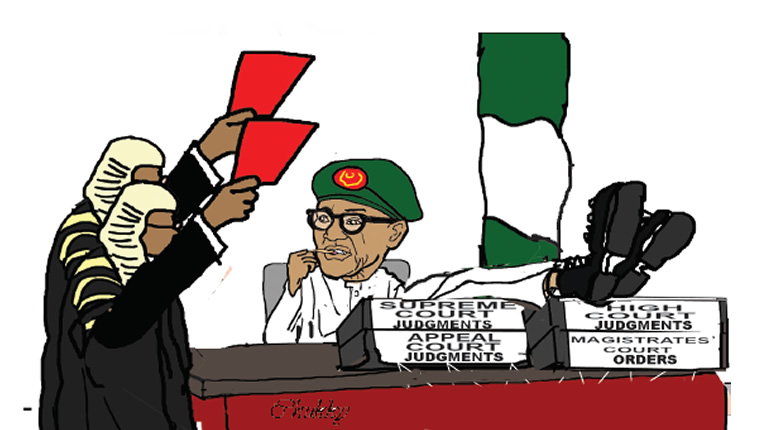

The Supreme Court, on Friday, descended heavily on the President, Major General Muhammadu Buhari (retd.), for disobeying its earlier order that the old N1,000, N500 and N200 notes should be allowed to circulate with the newly redesigned notes until the final determination of the suit filed by some state governments on the matter.

The apex court also ordered that the old naira notes be allowed to circulate side by side the new notes until December 31, 2023.

A seven-man panel of the Supreme Court led by Justice John Okoro gave the judgment. Other justices that sat on the case are Emmanuel Agim, Amina Augie, Mohammed Garba, Ibrahim Saulawa, Adamu Jauro and Tijanni Abubakar.

In the judgment delivered by Justice Agim, the apex court held that Buhari breached the constitution in the manner he issued directives for the redesigning of the naira.

On the disobedience of the Supreme Court’s earlier order on the new notes, Justice Agim said Buhari’s broadcast of February 16, 2023 that only the N200 note should remain legal tender made the country’s democracy look like a mere pretension.

Justice Agim stated, “Let me consider the issue of the President’s disobedience of the 8-2-2023 interim order that the new and old versions of naira notes continue to circulate as legal tender until the determination of the pending application for interlocutory injunction. It is not in dispute that the 1st defendant refused to obey the said order.

“The President’s 16-2-2023 national broadcast reproduced here in pages 27-31 demonstrates this disobedience. In disobedience of the order, he directed that only the old N200 naira notes be re-circulated. Interestingly, there is nothing to show the implementation of even that directive. I agree with the 9th plaintiff that the 1st defendant is not entitled to be heard by this court when it has effused to respect the authority of this court and the authority of law from which the authority of the President and the government of Nigeria derives.

“The rule of law upon which our democratic governance is founded becomes illusory if the President of the country or any authority or person refuses to obey the orders of courts. The disobedience of orders of courts by the President in a constitutional democracy as ours is a sign of the failure of the constitution and that democratic governance has become a mere pretension and is now replaced by autocracy or dictatorship.”

The court also dismissed the preliminary objections by the Attorney-General of the Federation, Abubakar Malami, as well as those of Bayelsa and Edo states, and stated that it had jurisdiction to entertain the suit.

Kaduna, Kogi and Zamfara were the first to sue the Federal Government over the naira redesign policy and were joined on February 15 by Cross River, Sokoto, Lagos, Ogun, Katsina, Ondo and Ekiti states.

Later, Nasarawa, Niger, Kano, Jigawa, Rivers and Abia states joined the suit.Rivers and Abia states had filed separate suits that were consolidated with the main one.

Edo and Bayelsa had joined the side of the Federal Government to oppose the suit.

The defendants had earlier questioned the jurisdiction of the court and argued that the proper party in the suit was the Central Bank of Nigeria and not the President or the federation.

Justice Agim held that the President failed to consult the National Council of States, the Federal Executive Council and the National Economic Council before directing the CBN to introduce new naira notes.

The apex court maintained that Buhari usurped the powers of the CBN when he issued the directive banning the old naira notes from February 10, 2023 and by doing so made the action ultra vires.

It held that the unconstitutional use of powers by Buhari on the naira re-designing breached the fundamental rights of the citizens in various ways, adding that such use of powers by the President was not permitted under democracy and was an affront to the constitution.

Among others, the Supreme Court held that unlawful use of executive powers by the President inflicted unprecedented economic hardship on the citizens.

Earlier on, the court examined the defendants’ argument that it lacked jurisdiction to decide on the case.

Dismissing the argument that the CBN was the proper party to be sued, the court stated that it was not the action of the CBN that was being challenged, but the validity of the decision of the President to redesign the naira, release the new notes into circulation and withdraw the old notes without consultation with Nigerians through the Council of States and the National Economic Council.

Citing Section 23(2)1 of the Constitution, the court held that the dispute between the Federal Government and states must involve law or facts.

The apex court further held that Buhari in his broadcast admitted that the policy was flawed with a lot of challenges.

The court held that the CBN did not have to be joined as a party in the suit as it had no powers to carry out the policy without the directive of the President and that the suit was not an action against the banks or the CBN.

Justice Agim said, “I hold that this court has jurisdiction to determine all the suits.

“In light of the above, I hold that no reasonable notice was given to the public in line with Section 20 of CBN Act, 2007 before the President gave the directive of the redesign of new naira and the withdrawal of old notes.

“Therefore, the directive is invalid and the implementation invalid.”

History of disobedience

The Supreme Court had on February 8 granted an interim order suspending the implementation of the policy and put on hold the February 10 deadline for the old N1,000, N500 and N200 notes to cease being legal tender.

The court ordered that the old and the new notes should be in circulation together pending further hearings in the suit.

But Buhari in a broadcast on 16 February ordered that only the old N200 note should be re-circulated and insisted that the old N500 and N1,000 banknotes had ceased to be valid.

The Buhari regime has a history of disobedience of court orders. In August 2019, Omoyele Sowore, a candidate in the just concluded presidential election and publisher of SaharaReporters, an online news platform, was arrested by the Department of State Services in Lagos and transferred to Abuja.

The DSS obtained an ex parte order to keep Sowore for 45 days. Barely 24 hours to the expiration of the 45 days detention order, the AGF office filed charges of treasonable felony, cybercrime offences and money laundering against him before the Federal High Court in Abuja.

Sowore’s lawyer, Femi Falana (SAN), applied for his bail pending his arraignment. Justice Taiwo Taiwo granted the prayer, but the DSS refused to release him.

On December 2, 2016, Justice Gabriel Kolawole of the Federal High Court in Abuja ordered the release of the leader of the Islamic Movement in Nigeria, Ibraheem El-Zakzaky, and his wife, Zeenat, from the custody of the DSS.

As of the time of that ruling, El-Zakzaky and his wife had been in DSS’ custody since December 2015 following an altercation between members of the Nigerian Army and the IMN in Zaria, Kaduna State.

Aside from the order to release them, the court also ordered that the DSS should pay the couple the sum of N50m as compensation.

This court order was disobeyed.

On August 5, Justice Darius Khobo of the Kaduna State High Court granted El-Zakzaky leave to seek medical attention in New Delhi, India.

The couple left for India and within a week were back in the country without receiving medical attention.

A former National Security Adviser, Col. Sambo Dasuki (retd.), was also kept in custody for long despite the fact that the Federal High Court in Abuja granted him bail from the custody of the DSS on July 2, 2018, where he had been detained since December 29, 2015.

The Economic Community of West African States Court of Justice on October 4, 2016, ordered his release from the illegal custody; a judgement which the DSS also failed to obey.

Another judgment, which the Federal Government may have disobeyed was the one made by the Federal High Court in Abuja directing the Federal Government to set the overall limits for the “amounts of consolidated debts” of the nation’s federal, state and local governments.

Justice Kolawole gave the judgment on February 20, 2018, in a suit filed by the Centre for Social Justice.

The Legal Adviser to Amnesty International, Dr Kolawole Olaniyan, had accused the President of showing “stunning disregard for the rule of law and human rights, ignoring Nigerian judges on at least 40 occasions.”

The London-based lawyer, who accused the President of treating judges with disdain, also questioned the sincerity of Buhari’s anti-corruption fight.

Olaniyan made the claims in a piece titled, ‘Buhari is ignoring Nigerian judges – We must not let him get away with it’, which was published by The PUNCH.

He said, “It’s hard to overstate the significance of this disregard of court orders not just for the operation of the rule of law but also effective respect for constitutional and international human rights, such as freedom of expression, peaceful assembly, association and access to information. Yet, Buhari is carrying on, irrespective of human rights and the rule of law.

“Anytime the courts have told Buhari’s government to do something it doesn’t like, it has refused to obey it.

“Even Buhari’s attorney-general, Abubakar Malami (SAN), once said the rule of law is what the authorities determine it to be.

“The government always has explanations on why it should not obey lawful court orders, seemingly replacing binding legal decisions with the vagaries of politics, and obeying the decisions whenever they suit it.

“This disdainful arrogance for the courts and our constitutional jurisprudence wasn’t even normalised during periods of military dictatorship in Nigeria.”

Govs hail S’Court

Governors Nasir El-Rufai of Kaduna State, Yahaya Bello of Kogi State and Bello Matawalle of Zamfara State were in court to witness the judgment.

Speaking to journalists after the judgement, El-Rufai said, “The Supreme Court of Nigeria has given us all the reliefs that we sought for a very unanimous judgment. I will be accepting this victory for Nigeria because this policy, which was designed and targeted at a political party, has caused untold hardship.”

He said the policy of “currency confiscation” had ended and Nigerians would not be burdened by restrictive limits.

“So, Nigerians can go to the bank and collect whatever they have deposited and get on with their lives,” he added.

El-Rufai alleged that the naira redesign policy was the plan of the Peoples Democratic Party to win the general elections.

He added that the CBN governor, Godwin Emefiele, deceived the President into approving the policy.

El-Rufai said, “First let me say that this is a policy of the PDP. Emefiele was appointed central bank governor by the PDP originally.

“So, let’s not forget where he came from and he is the one that put this policy together to help the PDP win the 2023 general elections. He deceived the President into thinking that it is possible to withdraw N2tn from circulation and reprint everything in three months.

“No country in world history has done it. He and the attorney-general deceived the President and gave the President wrong information.”

He emphasized that contrary to speculations, the state governments challenged the policy for the sake of their citizens and not for elections.

Fielding questions from journalists, El-Rufai refuted claims that the APC was at war with itself, adding that the President was ill-advised and misguided by both the attorney general and the central bank governor.

“These are people that wanted to run for presidential or governorship elections in our party and didn’t make it,” he noted.

El-Rufai added, “We went to court because our people in our states are suffering. We left elections in the hands of God, and we all know the results.

“Even though this policy was designed to ensure that we did not win the presidential election, we have won.

“But the policy must go because the Supreme Court has decided that it was unlawfully conceived.”

The Kogi State governor, on his part, said the judgment would make Nigeria better, adding, “This particular decision today has laid a solid foundation for our incoming President, the President-elect.”

Bello said the judgment had proved that nobody could take the law for granted.

Matawalle stated, “Many people have been challenging us that we went to court because we have a lot of money, but it is not true.”

He challenged the Economic and Financial Crimes Commission to go to any of his properties and see for itself.

Ondo State Governor, Rotimi Akeredolu, commended the Supreme Court for the verdict, saying the ruling was well-considered.

Akeredolu blamed the CBN governor and the AGF for allegedly misadvising the President on the policy, adding that the apex bank acted irresponsibly on the matter.

The governor stated these in a statement he issued on Friday.

According to him, the ruling of the apex court is in tandem with the position of his government on the matter.

He said, “The CBN governor and the attorney general of the federation and minister of justice misadvised the President to assume powers of an emperor answerable only to himself and no other authorities as enshrined in the law.

“It is deplorable to witness small businesses collapse with unbelievable rapidity. We have been regaled with tales of the dehumanisation of ordinary Nigerians who have been forced to strip themselves naked in banking halls weeping to be given their monies kept with the banks. Some have lost their lives needlessly for being unable to access their deposits in the banks upon demand. The governor of the CBN acted most irresponsibly when he claimed to be exercising powers, which the CBN Act does not invest in his office.

“He was quoted as saying that he was fighting corruption, money laundering and vote-buying. He acted ultra vires, goaded by his political permutations. The AGF equally misled the President to act beyond the limits of his executive powers. Nigerians have been punished unduly. As the Supreme Court has pronounced, the law must be allowed to rule. There are statutory functions allotted to bodies in the 1999 Constitution, as amended. These bodies must be allowed to exercise those functions. Anyone purporting to act in contravention of the extant laws does so, either ignorantly or mischievously. The letters of the law are simple and understandable if the people in authority embrace less mischief.”

Akeredolu implored the Federal Government to obey the ruling of the Supreme Court immediately, saying there was no other alternative open to it.

He added, “We congratulate the states which challenged this obnoxious policy implementation and hope that our banks will release the deposits of Nigerians in their custody upon demand forthwith as there will be grave consequences for continued seizure of the hard-earned monies of citizens.

“There is no gain asserting the obvious. The whole policy may have been well conceived. Its implementation has been politically driven. The CBN governor is a partisan of injustice and oppression. Most governments, perhaps with the exception of a negligible few motivated by the possibility of deriving unexpressed political advantages, cannot meet simple obligations to their citizens. It is most unfortunate.

“As we enjoin the officials of the Federal Government who may be directly involved in putting into effect the spirit and the letter of the Supreme Court ruling to do so immediately, the Ondo State Government will not hesitate to proceed against persons and institutions whose activities impede its ability to discharge statutory obligations to the people. There is no justification for the pains to which our people have been subjected for obvious political reasons

Buhari apologises

Meanwhile, the President has apologised to Nigerians over the cash crunch caused by the naira redesign policy.

Buhari, who spoke in Hausa language in Kaduna on Thursday, also begged the residents of the state to vote for the governorship candidate of the APC, Senator Uba Sani.

He said the naira redesign policy was not meant to cause hardship to Nigerians, but enhance the economy.

He said, “First of all, I want to once again thank you for the confidence you have in me by electing me president on the platform of our party, the APC.

”I want to use this opportunity to inform you that Uba Sani is our candidate for the governorship election in Kaduna State. I am begging you to vote for him and all APC candidates for the House of Assembly to help him work.

“Uba is a leading member of this journey. We worked together in the Senate and he demonstrated capacity and competence. He will perform better than expected.

“I apologise to you for the hardship caused by the naira redesign policy. We changed the currency notes not because we want you to suffer. The policy is for the good of every Nigerian.

“Kaduna is home to me. Therefore, I urge you to vote for Uba Sani and all our APC candidates for the State Assembly.”

Gbajabiamila wants compliance

Meanwhile, the Speaker of the House of Representatives, Femi Gbajabiamila, has asked the CBN to comply with the judgment.

Gbajabiamila, in a statement issued in reaction to the Supreme Court judgment on Friday, also hailed governors El-Rufai, Bello and Matawalle for challenging the Federal Government and the CBN in court over the policy.

Gbajabiamila said, “It has always been the position of the House of Representatives that despite the noble intentions behind the currency swap policy, the design and implementation of the policy have been fatally flawed and contradictory to the ends of law and public policy. The decision of the Supreme Court suspending the currency swap policy introduced by the Central Bank of Nigeria and extending the implementation deadline to December 31, 2023, validates the position of the House in its entirety.

“The remarkably haphazard implementation of the currency swap policy fell way short of international standards. It deviated from the prior practice of the CBN without providing any benefits to the Nigerian people or the economy of Nigeria, both of which have suffered significant harm as a result. The Central Bank of Nigeria must respect the apex court’s judgment and act quickly to give it full effect. This is necessary to reverse some of the damage done to our economy and prevent the continued suffering of the Nigerian people.”

The Speaker congratulated the APC governors for approaching the Supreme Court to “give a final settlement on this matter,” stating, “This was the right thing to do. It showed their collective adherence to the rule of law and their determination to take bold actions that serve the best interests of the Nigerian people.”

Gbajabiamila said while Nigerians anticipate action by the CBN, there was still the need to examine and understand “how this policy intervention turned out in the way it did.”

He noted that the House would exercise its authority to review the “actions and inaction, the failures of law and procedure that set the conditions for this profound failure of public policy.”

According to him, this is necessary to ensure the lawmakers take the right legislative actions to prevent future recurrence.

APC wants Emefiele, Malami out

The National Vice Chairman (North-West), All Progressives Congress, Mallam Salihu Lukman, on Friday called for the resignation of Emefiele and Malami for allegedly misleading the President on the new naira redesign policy.

Lukman lamented that the sudden implementation of the cash swap policy and tight deadline had brought untold hardship to Nigerians.

The Kaduna politician, therefore, noted that the right thing for public office holders like Emefiele and Malami to do after such public office abuse was to accept their limitations and resign honourably.

In a statement titled, ‘Cashless policy: Supreme Court invalidates actions of the Federal Government’, Lukman expressed delight in the ruling of the apex court declaring the cashless policy as unconstitutional and an utter violation of the fundamental rights of Nigerians.

He said, “It is also unfortunate that President Muhammadu Buhari could be misled into such acts of illegality and abuse of executive powers as pronounced by the Supreme Court. We, and indeed all Nigerians, are grateful to the Supreme Court justices led by Justice Akomaye for this landmark judicial intervention.

“Given the injurious nature of the consequences of the cashless policy of the Federal Government as was implemented thus far, and the damage of the Supreme Court ruling to the profile of President Buhari, Godwin Emefiele and Abubakar Malami must take personal responsibility for this act of illegality by the Federal Government. In advanced democracies, public officers who commit such acts of illegality voluntarily resign from their appointments.

“Therefore, if indeed, the cashless policy of the Federal Government was supposedly designed to conform with extant legal provisions of the Nigerian federation, now that it turned out in the direct opposite, both the CBN governor, Mr Emefiele, and the attorney-general of the federation, Mr Malami, should accept the limitations of both their knowledge of the law and commitment to democracy by resigning from their respective offices forthwith. Rule of law is fundamental to democracy and individuals who flagrantly violate the laws or promote acts that breach the constitution of the Federal Republic of Nigeria must not be tolerated.”

When contacted on the calls for Malami’s resignation, an aide to the AGF, Umar Gwandu, said, “People are entitled to their opinions in view of constitutional provisions relating to freedom of expression. It is the beauty of democratic governance and as such their constitutional rights as expressed are noted.

“Let us make abundantly clear that the Attorney-General of the Federation and Minister of Justice, Abubakar Malami, SAN, has been discharging the statutory constitutionally recognised responsibility in the interest of the general public.

“In the discharge of this task, the attorney-general offers legal opinion(s) bearing in mind the public interest consideration devoid of any ulterior motives of certain individuals. He is guided in this responsibility by public interest and the interests of justice as the driving considerations.

“It is always about the consideration of public interest and the interest of justice and no more than provide operational compass for him in taking decisions and not the calls and the undertones of which are mischievously tainted with political colouration.

“To think that he misguides is a figment of the imagination of individuals attempting to confuse the public with their myopic views.”

Bank customers react

The National President, Association of Mobile Money and Bank Agents in Nigeria, Victor Olojo, said the judgment was a good development.

He said, “The Supreme Court has proved itself to be the last hope of the common man. The policy was not well thought out even though the intention was good, but it further impoverished Nigerians.

“The policy showed the ineptitude of the CBN and as a matter of fact, Nigerians would not forget in hurry the hardship and pain that this policy caused. I hope that the CBN obeys the court order to the letter.”

According to Olojo, the ruling is a welcome development for the association.

“We hope that future policies of the CBN will put in place proper mechanisms before carrying out policies that affect Nigerians like this,” he added.

A Fidelity Bank customer in Lagos, Adetiloye Oyeyipo, said he was elated by the decision of the apex court.

“I think it is the right step in the right direction, especially now that the elections are almost over. Nigerians need to return to normalcy. People are hungry and things are moving slowly in the country,” he stated.

A Zenith Bank customer, Tolulope Abimbola, said the CBN would not be hurt by letting the common man thrive.

She added, “The policies of the CBN should be towards the common man. I went out on Wednesday and everywhere was dry due to the paucity of funds.

“This decision will make transactions and commuting easier for Nigerians.”

However, some Nigerians said they were eagerly waiting for the reaction of the CBN and Buhari to the judgment.

A real estate agent, Alex Omenka, said, “The Supreme Court has said its own, but we don’t know what the President is going to say.

“It was the same thing the last time; the Supreme Court said one thing and Buhari came the next day to say another. We are waiting for Buhari to speak.”

Another bank customer, Blessing Hassan, said, “The apex bank has not said anything. Until then, we keep waiting.”

Another bank customer, Chinomso Ikeazota, stated that the CBN and other stakeholders needed to align with the Supreme Court ruling for it to stand.

Ikeazota said, “It will stand if the CBN will align. Let’s wait till Monday before we start collecting and spending the old notes.

“Once the Supreme Court issues an order, we should obey, but this our country is something else which is why I’m saying we should wait; let them align.”

For a Point of Sale operator, Rebecca Reuben, the Supreme Court ruling was something to cheer about. She expressed her willingness to start collecting and spending the old notes.

She said, “Is it not Nigerian money? I will collect it and spend it. In fact, I saw them spending the money in Agbara, Ogun State yesterday (Thursday).”

A bank branch manager, who spoke to Saturday PUNCH on condition of anonymity, said bank workers were relieved as the naira redesign policy had put undue pressure on them and their institutions, which culminated in attacks on bankers and banking facilities.

The bank manager said as of Friday evening, no directive had emanated from the CBN on the possible implementation of the judgment, but expressed the hope that by Monday, a clear directive would be given to the banks.

When contacted, the acting Director of Corporate Communications Department, CBN, Dr Isa Abdulmumin, declined to make any comment on the judgment as he claimed that he had not received any directive to say anything on it.

A Senior Advocate of Nigeria, Wahab Shittu, said, “The Supreme Court is the ‘uncommanded’ commander. Once it sneezes, the country catches a cold. Once it makes a pronouncement, it takes immediate effect.

The order of the Supreme Court does not require any other authority, including the CBN directive, for immediate compliance. Anyone standing in the way of the implementation of the Supreme Court’s order should be immediately arrested, cited for contempt and taken to prison.”

Bankers await directive

Employees of financial institutions across the country, on Friday, described the Supreme Court judgment as a welcome development.

The Association of Senior Staff of Banks, Insurance and Financial Institutions said the judgment was a vindication of stakeholders in the banking sector, who had expressed concern about the CBN policy.

It, however, faulted the call by Governor Nasir El-Rufai of Kaduna State on customers to immediately go to the banks to get their money, describing it as inciting.

Speaking with one of our correspondents, the President of ASSBIFI, Olusoji Oluwole, “If you listened to his (El-Rufai’s) statement that customers should immediately go to their banks and demand their money, I see that as another round of incitement that we have just survived.

“It bothers me that a high-profile office holder in this country will make that kind of statement. To start with, I am not even sure if any bank has money in their vault because they were expected to have sent the old notes to the CBN.

“We do not even know what the CBN still has in its possession, because it is expected to have started destroying those old notes; so, those are things that ought to have been taken into consideration.

“What I expected to have heard was that the Federal Government should immediately act on that judgment so that the CBN will be able to come out with a directive to banks and by Monday, we will know where we are.”

The National Union of Banks, Insurance and Financial Institution Employees described the declaration as a welcome development following the hardship Nigerians had been subjected to as a result of the redesign of the naira.

The President of NUBIFIE, Anthony Abakpa, said, “It (judgment) is a big relief because people are suffering. The hardship that the naira redesign put Nigerians in is worrisome. If the government can uphold the judgment, that is fine.

“Banks have a regulator. The next thing for the government to do is to direct the Deposit Money Banks to open their doors and push the money in the vault of the CBN to the banks to be able to continue to run.”

CPPE lauds ruling

Similarly, the Centre for the Promotion of Private Enterprise commended the ruling of the Supreme Court and expressed the hope that the President, Major General Muhammadu Buhari (retd.); the CBN Governor, Godwin Emefiele; and the Attorney-General of the Federation and Minister of Justice, Abubakar Malami, would comply with the order in the interest of the rule of law, good order and public interest.

In a statement by its director, Dr Muda Yusuf, the CPPE said, “We welcome the Supreme Court ruling as it protects the citizens from a policy, which is, by all accounts, disruptive, repressive and draconian. It is also punitive, cruel and insensitive. Indeed, Nigerians deserve an apology from the promoters and proponents of the policy, especially the arbitrary and uninformed mopping up of cash in the economy.

“The CBN currency redesign policy inflicted indescribable agony, suffering and distress on the majority of Nigerian citizens. The trouble was not with the redesign, but the deliberate and unrestrained mopping up of cash in the economy. To date the CBN had mopped up about N2tn cash from the economy, thereby paralysing the retail sector, crippling the informal economy, stifling the agricultural value chain, immobilising the transportation sector and disrupting the payment system in the economy.

“It is true that the CBN has the right to redesign currency, but it does not have the right to dispossess the citizens of their cash. The choice of the mode of store of value is a fundamental right of citizens. The CBN has no right to impose that choice on citizens.”

It added, “It is a flagrant violation of the rights of citizens for the CBN to withhold the cash of citizens under the guise of currency redesign. The CBN Act does not give the CBN that right. The Act cannot be superior to the constitution of the country. The CBN cannot request the citizens to bring their cash for a swap, only to deprive them access to it.

“A swap presupposes that whatever old notes were received by the banks must be replaced with new ones instantly. Otherwise, the period of the swap should be extended until the CBN is in a position to do so. In many other climes, such swaps are done over 12 to 20 months, or even more, to minimise disruption.

“The claim by the CBN that the economy has too much cash outside the banking system has no basis in economic theory; neither can it be supported by empirical evidence. As of December 2022, the total money supply was N52tn; the cash component of money supply was N2.6tn, which was just five per cent. Similarly, the country’s Gross Domestic Product was N202tn, which gives a cash to GDP ratio of 1.3 per cent. These ratios are some of the lowest around the world, which shows that the Nigerian economy is not really a cash-dominant economy. Cashless transactions in 2022 were about N400tn, according to the NIBSS. The truth is that nothing is broken. And we don’t fix what is not broken. Of course, we can do better, but not by crudely mopping up cash in the economy.

“The contention that the arbitrary mopping up of cash will curb inflation and enhance monetary policy effectiveness equally has no basis going by available data. It is also on record that about N15tn has been mopped up with the Cash Reserve Ratio. Indeed, the bigger threat to monetary policy effectiveness and inflation is the N22tn ways and means finances of the CBN.

“The entire exercise was a needless disruption of economic activities, especially among the most vulnerable segments of the economy, unfortunately.”

Economists react

Experts have said that the Supreme Court ruling on the naira redesign policy will revive the economy.

They said this in separate interviews with one of our correspondents on Friday.

A professor of Capital Market, Uche Uwaleke, urged the CBN to obey the ruling of the apex court.

He said, “I advise the CBN to comply with the ruling since it has come from the final court in the land. Doing so will help revive economic activities and reduce the current difficulties being experienced by Nigerians on account of the policy.

“Be that as it may, it’s important to recognise that the CBN has recorded some achievements in terms of the objectives it set out to achieve. The reduction in huge cash circulating outside the commercial banks, the surge in electronic transactions and increase in financial inclusion are part of the achievements recorded thus far. The time frame till Dec 31, 2023 provides an opportunity for the CBN to re-assess the policy and improve on its implementation without causing distortions to the economy.”

A professor of Marketing, Uchenna Uzo, in his submission, noted that the ruling would affect confidence in economic pronouncements of the government by local consumers and foreign investors.

He said, “They had moved us in one direction and now they have cancelled it completely, saying we can use old notes.

“It is going to put the spotlight on how much trust businesses have on regulatory pronouncements. What I foresee is that whenever there is a regulatory pronouncement, people will plan for the fact that it can be reversed quickly. So, they may not implement it immediately. It will also affect consumer confidence when people know that today, one thing is said and tomorrow, it can easily be changed. Winning their total compliance may be a bit difficult. I think the wait-and-see game will be played for longer before people actually comply.”

Uzo added that the ruling would bring much needed reprieve to the informal sector, saying, “Looking forward, the velocity of the circulation of money within the economy is going to now be faster, especially in the informal sector, whose velocity is four times more than the velocity within the formal sector. The first effect is a higher level of flow of old notes in the informal sector right now. That is what we will see.”

The Head of Economics Department, Covenant University, Ota, Ogun State, Prof Evans Osabuohien, commended the extension of the use of old naira notes as legal tender until December 31, 2023.

Osabuohien gave the commendation in an interview with the News Agency of Nigeria in Ota on Friday.

The don said the extension of the validity of the old naira notes was a right decision and came as a relief to Nigerians.

He said, “The Supreme Court’s decision should be appreciated by all Nigerians because it will reduce the suffering of the masses.

“This is a welcome development; the issue of cash crunch has inflicted serious hardships on Nigerians.”

He noted that the cash crunch had led to loss of man-hours by Nigerians as they continued to queue at banks on a daily basis and yet were not able to withdraw their money.

This development, he said, had made many citizens resort to getting cash from Point of Sale operators who charged higher commission.

Osabuohien said that the extension of the use of old naira notes would give people enough time to plan and adjust toward phasing out of the old currency.

The don appealed to the Federal Government to obey the Supreme Court’s decision to reduce the hardship on Nigerians.

He also called on commercial banks to improve their electronic channels to facilitate business transactions in the country.