Most forex brokers offer apps on iOS & Android, but that does not mean that all of them are good, as there are many differences to watch out for.

A good forex trading app needs to contain the necessary tools required for trading & should be easy to use by beginners.

Based on range of factors, the Android app by HFMis best overallin terms of feature, fees& more as per our reviews.

List of Best Forex Trading Apps in Nigeria for Beginners

Although forex brokers also make provision for desktop and web versions of their trading software, having your app on your phone allows you trade on the go.

The important features of forex trading apps that Nigerian traders should look for include regulation/legality of the app, fees involved, ease of deposit & withdrawal, security features, number of instruments, user interface/speed, compatibility, support channels, and promotional features.

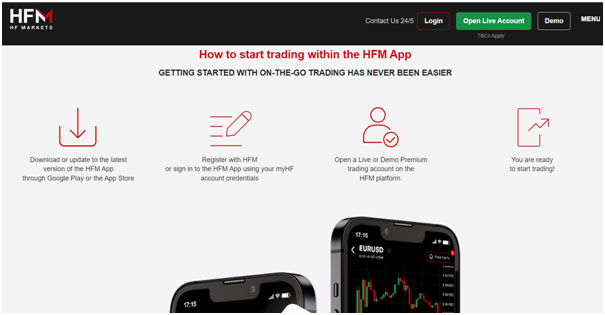

#1. HFM Mobile App – Best Overall Forex Trading Appin Nigeria

HF Markets Fintech Services Ltd. offers the HFM App on the App stores.

The HFM app has a 4-star rating & over 1 million downloads on the Google Play Store, and a rating of 3.8 on the Apple Store.

HF Markets is registered as an International Business Company (IBC) with registration number 22747 IBC 2015 in St. Vincent & the Grenadines. Nigerian traders are registered under a foreign country.

But HFM holds licenses from multiple Tier-1 regulators, including the FCA.

HFM Trading Fees

The HFM mobile app lets you open accounts in 4 base currencies: Naira, US Dollar, Euro, & Japanese Yen.

While HF Markets has many account types which can be managed on the app, only one is supported for live trading and that is the HFM Premium Account.

The premium account comes with variable spread, a $10 minimum deposit, and 1:500 maximum leverage. However, the average spread for EUR/USD on HF Markets is 1.4 pips.

HFM Payment Methods

HFM supports Naira accounts. You can use several methods including Nigerian bank transfer, credit cards, Neteller, Skrill, and Perfect Money to deposit and withdraw on HFM App. The App also supports crypto deposits and withdrawals through Bitpay and CryptoPay.

| Transaction Methods | Minimum Threshold | Duration |

| Nigerian Bank Transfer | Deposit=N4,000 (Max=4 million)

Withdrawal= $10 |

Deposit = Instant

Withdrawal = Up to 2 days |

| Card Payment | Deposit=$5

Withdrawal=$5 |

Deposit=Up to 10 minutes

Withdrawal=Between 2 to 10 business days. |

| Neteller | Deposit=$5

Withdrawal=$5 |

Deposit= Up to 10 minutes

Withdrawal= Instant |

| Crypto (Bitpay) | Deposit= $5

Withdrawal = $5 |

Deposit= Up to 10 minutes

Withdrawal= Up to 2 business days. |

HFM charges zero fees on all its payment platforms aside BitPay which attracts a 1% fee on withdrawal.

HFM Number of Instruments

Available tradable instruments on the HFM app include over 50 currency pairs. You can also trade CFDs on forex, several stocks, bonds, commodities and more than 10 indices.

HFM App also allows cryptocurrency trading which includes Bitcoin, Ethereum, Litecoin and Ripple.

HFM App Speed &Ease of Use

The size of the HFM app is 15 MB so installation will be fast and not take up memory.

The latest version of the HFM app comes with bug fixes to improve its speed and performance.

HFM app lets you manage all your accounts from the app thus making it fast and convenient to use.

HFM App Features

- One Wallet, Multiple Accounts: You can manage all your accounts from your HFM wallet

- Customized Trading: You can trade by the amount of money you wish, or you could trade by lots, or smaller units of currency pairs.

- View Trade History: After you close your position the HFM app can let you view the history of the transaction as this helps you prepare your trading journal.

- The Demo account also makes learning easy and you don’t need to be under pressure since you trade with virtual money.

Just like with the desktop and web platforms, the HFM app also gives you access to charts, indicators, real-time quotes, and support in various languages.

HFM Mobile Operating System Supported

It works on both Android and iOS devices. For the Android devices the operating system should be Android 6.0 and above.

HFM App Security Features

Aside from your username and password, the HFM app also allows Two Factor Authentication (2FA) which requires entering a unique code as an extra layer of security.

HFM apps also automatically log out users after a certain period of inactivity. Additionally, the app is regularly updated to address any security vulnerabilities. All data transmitted between the app and the server are also encrypted.

HFM APP Support& Help

The HFM app offers 24/5 live chat support which provides immediate assistance to customers. The app also has a phone number and email support.

You are also assigned a personal account manager who you can call at any time to help you sort out issues.

HFM customer service is also very active on social media, especially on Twitter, Instagram, LinkedIn and Facebook.

HFM App Bonus / Promotions

HFM offers several bonuses and promotions to its array of loyal customers. These include a 100% supercharged bonus, 30% rescue bonus and 100% credit bonus. All bonuses however have terms and conditions.

HFM App Pros & Cons

Pros:

- Tier-1 regulation from FCA UK

- Manage all your accounts from the app

- Demo Account

- Bonus on deposits

- Naira account

Cons:

- Only premium account available for trading

- No Meta Trader

Get more information about HFM’s mobile apps for Nigerian traders

#2. FXTM MetaTraderApp– Trading App with Cross-Device Trading + Naira Account

FXTM Trader has a 4.2-star rating and over 1 million downloads on the google play store. However, FXTM has no physical local office or branch in Nigeria.

FTXM Trader App operates under the trademark Forex Time Limited.

FXTM is a multi-regulated forex broker, and has licenses from FCA, FSCA & other major regulators.

FXTM Fees

FXTM has a minimum account opening requirement of $10 or N10, 000 on the standard micro account, and $500 or N80, 000 on advantage and Advantage Plus Accounts.

The FXTM Micro and Advantage plus accounts charge Zero commissions while

Commissions on the Advantage account start from $0.40 to $2.

When it comes to spread for majors, the typical spread for EUR/USD is 1.9 pips however for the Advantage account the spread is zero.

FXTM Payment methods

FXTM supports Naira accounts. FXTM mobile app offers various deposit and withdrawal methods which include local instant bank transfer, credit card, bank wire and E-Wallet. Alternative methods available include Skrill, Neteller, Bitcoin and Perfect Money.

| Transaction Methods | Minimum Threshold | Duration |

| Nigerian Bank Transfer | Deposit = None

Withdrawal = None |

Instant transactions for deposit and withdrawal |

| Card Transfer | Deposit= ($5)

Withdrawal= None |

Deposit= Instant

Withdrawal= Within 24 hours. |

| Bank Wire | Deposit= ($10)

Withdrawal= None |

Deposit= Within 2-3 days

Withdrawal= Within 24 hours. |

| Skrill | Deposit= None

Withdrawal = None |

Deposit=Within 24 hours

Withdrawal=Within 24 hours |

FXTM Number of Instruments

There are more than 250 tradable instruments on their mobile application. You can trade multiple asset classes as CFDs.

These include majors, minors and exotic currency pairs, Contracts for Differences (CFDs) on Stocks, ETFs, Indices, Commodities as well as cryptocurrency.

FXTM Speed & Ease of Use

The FXTM app version 4.21.12 is about 27MB and takes less than a minute to install. The app size is small so it will not take up memory.

Once installed it asks you signup and it takes you straight to demo or live trading.

FXTM Features Available

- Live Quotes: The FXTM app has real-time quotes and interactive charts that could help you stay up to date.

- Cross-Device Trading: The FXTM app allows you trade across different devices so a trade you started on your desktop can be completed on your mobile app.

- Mark your Favourite Instrument: You can keep track of the performance of instruments you are interested in by marking them.

- MyFXTM Portal: Opening, funding, and trading is all done from your FXTM portal making it convenient.

- Demo Account: The Demo account also makes learning easy and you don’t need to be under pressure since you trade with virtual money.

- FXTM app also offers a one-click trading feature which makes trade placing quicker and easier. It offers trading alerts which notify you of the price level. Thereby, allowing you to quickly react to market conditions.

FXTM Mobile Operating System Supported

The FXTM app is compatible with both Android 6.0 and above and iOS operating systems.

The FXTM app is powered by Meta Trader platform so alternatively you can download MT4 or MT5 and login with your FXTM credentials.

FXTM AppSecurity

The FXTM mobile app is designed with security in mind, incorporating features such as two-factor authentication (2FA) and SSL encryption to protect your personal and financial information.

While using the FXTM app you can also ask for your data on the app to be deleted.

There is also inactivity time out which automatically log out users after a period of inactivity to prevent unauthorized access.

FXTM Support& Help

FTXM Mobile app offers 24/5 (Monday to Friday) support to assist users with any inquiries or issues. Users can use the in-app live chat, place a phone call or email to get assistance. FXTM also maintains social media support through Twitter, WhatsApp and Telegram.

FXTM App Pros & Cons

Pros:

- Tier-1 regulation from FCA UK

- Naira account

- MT4 & MT5 variants

- You can request for your data to be deleted

Cons:

- No weekend customer support

Find out more about FXTM’s MetaTrader & other apps

#3. Exness Trader App– Best Trading App with Lowest Fees for Intraday Trading

Exness app has a rating of 4.2 stars and 10 million + downloads on Google Play Store and 4.8 on Apple Store.

Exness is a well-regulated forex broker and has multiple licenses. But traders from Nigeria are registered under Exness (SC) Ltd.

Exness Trader Fees

Exness doesn’t charge commissions on trading but when you are using their Raw Spread Account and Zero accounts, commissions start from $3.5.

The typical spread for EUR/USD is 1 pip per lot/side.

Exness Payment Methods

The Exness app does not support Naira accounts. The Exness app offers a range of payment methods for deposit and withdrawal of funds. Although available payment methods may vary depending on the country of residence.

Some of the common payment methods accepted by Exness include Bank Wire Transfer, Credit/Debit Cards such as Visa/MasterCard, E-wallets such as Neteller, Skrill, WebMoney, Perfect Money, FasaPay, Qiwi Wallet and Cryptocurrencies which include Bitcoin, Litecoin, Ethereum, Bitcoin Cash, Ripple.

| Transaction Method | Minimum Threshold | Duration |

| Online Bank Transfer | Deposit= $10

Withdrawal= $3 |

Deposit= 30 Minutes

Withdrawal= 24 Hours |

| Neteller | Deposit=$10

Withdrawal=$4 |

Deposit= Within 30 Minutes

Withdrawal = Within 24 hours |

| Bank Card | Deposit= $10

Withdrawal = $10 |

Deposit=Instant

Withdrawal= 24 Hours |

| Skrill | Deposit=$10

Withdrawal =$10 |

Deposit= 30 minutes

Withdrawal= 24 hours |

Exness App Number of Instruments

There are more than 120 currency pairs which include major, minor and exotic on Exness mobile app. The app also offers Contract for Differences (CFDs) on more than 200 stocks drawn from major companies across US, Europe and Asia.

Exness mobile app allows clients to trade CFDs on precious metals like gold and silver, energy products like crude oil, and agricultural products like wheat and corn. The app also provides access to global indices such as S&P 500, NASDAQ and FTSE 100.

Users can also trade CFDs on a number of cryptocurrencies on the app. Popular cryptocurrencies on the Exness mobile app include Bitcoin, Ethereum and Litecoin.

Exness App Speed & Ease of Use

Free VPS Servers: Exness provides free Virtual Private Servers (VPS) in their offices which ensure that when you connect an Expert Advisor to the app from anywhere in the world, the robot executes instructions fast even when network is bad.

The size of the Exness mobile app is 20.92 MB so installation is fast and memory space isn’t taken up.

Exness App Features Available

Multi-currency account: which allows users to trade in their preferred currency. Thereby, eradicating the need for a currency converter.

MT4 & MT5: Exness is powered by MetaTrader so you can login to MT4 or MT5 using your Exness credentials.

Free Trading Signal:Exness offers free market signals to help you decide on when and what to trade.

Push Notifications: Exness app gives you push notifications, so you don’t miss any trading opportunity.

Demo Account: Exness offer free demo account that is available for unlimited period.

Exness App Mobile Operating System Supported

The Exness app is supported on android, iOS and has an APK version. With the Android Package Kit (APK) executable file, you can download the Exness app in regions where Google and Apple don’t offer the app.

Exness App Security Features

Exness offers Two-factor authentication (2FA) which helps prevent unauthorized access.

The mobile app uses secure login protocols, such as SSL encryption, to ensure your login details are protected. You can also set up a separate trading password to access the trading functions of the app.

Exness App Support & Help

The Exness app has prompt live chat customer support which is available 24/7 (Monday – Sunday). There is also phone call support which functions in several languages. Customers can also use email support and receive responses within a reasonable timeframe.

Exness also offers social media channel support through Facebook, Twitter,LinkedIn and Instagram.

Exness App Pros & Cons

Pros:

- Tier-1 regulation from FCA UK

- Free VPS Server

- Low Spreads

- APK App File

- Demo Account

Cons

Find out more about Exness’s mobile trading apps

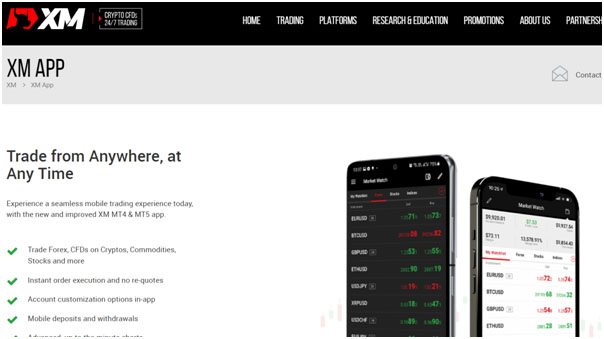

#4. XM Mobile App – Best Forex App for Trading without commissions

The XM app is developed & offered by XM Global Ltd., who are regulated by the Cyprus Securities and Exchange Commission (CySEC).

Traders based in Nigeria are registered under their offshore regulation when you register through their app.

The XM mobile app has a rating of 3.8 stars with over 5 million downloads on google playstore.

XM App Fees

XM does not charge commissions; their only trading fees are their variablespreads. This is the same with all their trading accounts.

XM Ultra Low Account has the lowest spread of 0.6 pip while micro and standard accounts attract a minimum of 1 pip spread. Maximum leverage on XM is 1: 1000.

XM Payment Methods

The XM app doesn’t support Naira accounts. It offers several methods for the deposit and withdrawal of funds which include card payment, local bank transfer, and e-wallets such as Skrill.

XM Number of Instruments Supported

XM mobile app supports more than 1,000 tradable instruments including over 50 currency pairs, and Contracts for Differences (CFDs) on more than 600 companies across the globe.

The mobile app also offers CFDs on commodities such as wheat, sugar and cocoa. Users can also trade popular cryptocurrencies such as Bitcoin, Ethereum and Ripple. The app also enables CFDs on major indices

XM Speed and Ease of Use

The XM app is lightweight at 18.87MB so it installs quickly and doesn’t take up memory space

You can customize the app so features you need are close by, and this makes for speed. You can also top-up your account right from the app.

XM Features Available

- MT4 & MT5: XM app is powered by MetaTrader so you can login/trade on MT4 or MT5 using your XM credentials.

- Forex Trading Signals: The XM app provides daily forex signals to aid you in deciding when and what to trade.

- Demo Account: A free Demo account is available.

- Free Daily Technical Analysis: Analysis of past price movements of currencies and other securities is sent to you daily for free.

- The app also has real-time market news and analysis, giving traders access to up-to-date market insights and an economic calendar to help traders make informed decisions.

XM Mobile Operating System Supported

The XM mobile app is available on both Android and iOS. However, the Android version must be Android 7.0 or higher.

XM Security Features

XM mobile app uses Two Factor Authentication (2FA) to secure your account and prevent unauthorized access.

The XM app also uses Secure Socket Layer (SSL) encryption to secure all communications between its servers and clients.

However, data on the app can’t be deleted on your request.

XM Support& Help

The XM mobile app offers customer support in more than 30 languages through various channels, including phone, email, and live chat. Its customer support is available 24/7 (Monday – Sunday).

The mobile app also has a Frequently Asked Questions section where answers to many queries can be found.

XM Pros & Cons

Pros

- Powered by MetaTrader

- 24/7 customer service

- Demo account

- Bonus on deposits

Cons

- Runs on Android 7.0 Operating System and above

- No Naira accounts

Read more about XM’s mobile apps

#5. AvaTrade Go App – Well Regulated Trading App with Fixed Spreads

The App has a rating of 4.7-star rating and over 1 million downloads on the Google Play Store and a 4.8 rating on Apple Store.

AvaTrade Fees

Trading on the Avatrade Go app attracts zero commission. However, you could be charged a spread fee which starts from 0.03 pip. For EUR/USD, the fixed spread on AvaTrade’s app is 0.9 pips, which is quite low.

AvaTrade Payment Methods

AvaTrade does not support transfers in Naira via bank accounts for Nigerian traders. You can only deposit & withdraw via other methods.

Deposits & withdrawals are through e-Wallets, Wire Transfer, Credit/Debit Card.

AvaTrade Go Number of Instruments

There are more than 50 currency pairs tradable on the Avatrade mobile app. Users can also trade Contract for Differences (CFDs) on more than 700 stocks across the globe.

The app also offers CFDs on commodities and energies including gold and crude oil and natural gas. Users can also trade popular indices such as S&P 500, FTSE 100, and Nikkei 225.

While users can trade ETFs and Bonds, the Avatrade mobile app also enables CFDs on cryptocurrency including Bitcoin, Ethereum, Litecoin, Ripple, and more.

AvaTrade Go Speed and Ease of Use

At 18 MB the Avatrade Go app is light and easy to install and doesn’t take up memory space.

You have access to all your MetaTrader accounts on the app thus making it convenient to trade.

AvaTrade Go Features Available

Avatrade mobile app works so much like the web and desktop versions with additional mobile advantages which include copy trading, video tutorials and other educational resources.

AvaTrade Go Mobile Operating System Supported

Avatrade Mobile app is available for both iOS and Android devices. It also works from Android version4.4 and above.

AvaTrade Go Security

The Avatrade Go app lacks Two Factor Authentication but the app uses Secure Socket Layer (SSL) encryption: Avatrade uses SSL encryption to secure all data that is transmitted between the app and the Avatrade servers.

AvaTrade Support& Help

Avatrade mobile app offers customer support in multiple languages, including English, Spanish, French, Italian, German, and Arabic, among others. Customer support is available from Monday – Friday, through in-app live chat, email and phone calls.

AvaTrade Bonus/promotions

Avatrade offers a sign-up bonus. You could earn $40 with a deposit of $200. For deposits over $200 you get 20% back as bonus.

AvaTrade Go Pros & Cons

Pros:

- Tier-1 Regulation from ASIC

- Zero Commission

- Demo account

- Works on older Android version 4.4 and above

Cons:

- No Naira accounts

- No Nigerian Cards accepted

- No weekend customer service

Read about AvaTrade Go App on their website

Forex Trading Apps in Nigeria Compared

| App Name | Operating System | Number of downloads | Powered By | Min. Deposit | Naira Account |

| HFM App | Android & iOS | 1 million + on play store | Proprietary | $10 | Yes |

| FXTM Trader | Android & iOS | 1 million + on play store | MetaTrader | $10 | Yes |

| Exness Trader | Android, iOS, APK | 10 million + on Play store | MetaTrader | $10 | No |

| XM | Android, & iOS | 5 million + on Play store | MetaTrader | $5 | No |

| AvaTrade Go | Android, & iOS | 1 million + on play store | MetaTrader | $100 | No |

| FxPro cTrader | Android | 100,000+ | cTrader | $100 | No |

How to Choose a good Forex Trading App?

a. Regulation

Ensure that the broker is regulated by a reputable authority in their jurisdiction. If it not regulated within your jurisdiction, go for a foreign broker that has a license issued by multiple Tier-1 regulators and has a good reputation in the industry.

b. Check App Rating and Review

Ensure you check the app rating on both Google and Apple Store. You can also read verified reviews to have more insight into the app.

c. User interface

Choose a trading app that has a user-friendly interface that makes it easy to navigate and use.

d. Availability

You should first search if the app is available on both iOS and Android. You should also ensure the app is compatible with your device to ensure a smooth trading experience.

Download the demo app, and see if you are able to use it easily on your device or not.

e. Fees and commissions

Different trading apps charge different fees and commissions for trades, so it’s important to compare and choose an app with competitive pricing. You should also consider spread and other costs such as inactivity fees.

f. Minimum Deposit

Check and compare the minimum deposit. Some apps do not have a minimum deposit while some could require a minimum deposit which is above your budget.

g. Security

Trading apps should have robust security measures in place to protect your personal and financial information. Look out for Two Factor Authentication and Biometric login, especially during the withdrawal process.

h. Customer support

Look for a trading app with reliable and accessible customer support in case you encounter any issues or have questions. At least 24/5 support should be the least threshold.

i. Local Presence

A local office will give you more confidence and a better opportunity to get your queries resolved. It should be preferable that the broker has a local office in Nigeria, and a phone number where you can make a call, in case you need help.

j. Trading Instruments

Be sure the app offers a wide variety of instruments so you can easily trade them when the need arises. Sometimes you have to hedge currency risk by taking an opposite position in another currency pair and if this is not available you may record losses.

k. Education and research

Look for a broker that provides a variety of educational resources and research tools to help you make informed trading decisions.

Frequently Asked Questions

Which Forex Trading App is the Best in Nigeria?

HFM Android App is good for beginner traders looking to trade currencies at low fees. The app is also well rated on the App store, with many downloads.

Which Forex Apps are Safe in Nigeria?

Trading Apps of Tier-1 regulated forex & CFD brokers are generally safe. You must make sure that the broker is regulated, and don’t download app of any unlicensed broker, otherwise you risk losing your funds.

What should I look for in a Trading App?

The most important thing you should consider is the safety of your funds. Make sure that app trading app that you download must from a regulated broker and verified source.

Other factors that you should consider are the fees, features of the app, ease of use etc.