When you open an account with ZAR as your account base currency, it means your trading activities, funding, and withdrawals will be in ZAR (Rand). This way, you do not have to pay any extra conversion fees.

In our research, HF Markets rated highest on multiple factors & they have ZAR base currency with all their Account types.

Best Forex Brokers with ZAR Accounts

- Exness – Overall Best ZAR Account Broker

- Tickmill – Best MT4 Forex Broker with ZAR Account

- HF Markets – Forex Broker with ZAR Account& low spreads

- FxPro – Forex Broker with ZAR Base Currency Option &Automated Trading

- XM Broker-Forex Broker with ZAR Account & Low Minimum Deposit

- FXCM – Forex Broker with ZAR Accountfor Active Traders

- Markets.com – Best MT5 Forex Broker with ZAR Account

- IFX Brokers– Local Forex Broker with Multiple ZAR Funding Options

- KhweziTrade-ODP Licensed Forex Broker with ZAR Account

In this research below, we compare each broker that has ZAR accounts. We used several criteria including License/regulation, Spread, Minimum deposit, and funding methods.

| 💼 Forex Broker with ZAR Account | 📝 FSCA License Number | 🪙 Min deposit | 🪙 USD/ZAR spread | 💳 ZAR funding methods | 🛒FX pairs |

| Exness |

51024 | Standard account is R190, Professional account is R9,500 | 194.4 pips | EFT via Local Bank | 100+ |

| Tickmill

|

49464 | 1900 ZAR | 79.2 pips | EFT via Local Bank | 60+ |

| HF Markets

|

46632 | 100 ZAR | 119 pips for Premium & Cent accounts, & 86.7 Pips for Zero account | EFT via Local Bank | 50+ |

| FxPro

|

45052 | Standard account: 1,900 ZAR

Pro & Raw accounts: 19,000 ZAR, Elite account: 570,900 ZAR. |

86.87 pips | EFT via Local Bank | 70+ |

| XM

|

49976 | 100 ZAR | 166 pips | EFT via Local Bank | 50+ |

| IFX Brokers

|

48021 | Standard account, Cent Account, and Islamic account: 190 ZAR

Premium account: 4,750 ZAR VIP account: 19,000 ZAR |

N/A | Yes. OZOW, PAYFAST, Master/Visa, Skrill, Neteller, Bank Wire | 60+ |

| FXCM

|

46534 | 950 ZAR | N/A | EFT | 40+ |

| Markets.com

|

46860 | 1,900 ZAR | 166.6 pips | EFT | 50+ |

| KhweziTrade

|

44816 | 500 ZAR | 1050 pips | EFT | 39+ |

Which Forex Broker Has the Best ZAR Accounts?

1. Exness – Overall Best ZAR Account Forex Broker for Swap-Free Trading

Pros

- No overnight fees (swaps) on Forex, Crypto, Indices, & Gold positions

- Domestic FSCA regulation

- No inactivity fee

- ZAR base currency

- Beginner focused Cent Account, lets beginners test the markets with little capital

- On the average, the Zero Account does not charge you spreads on major instruments

- Local deposit & withdrawals via EFT

- Customer service is available 24/7

- Demo account

- CFDs on popular Indices such as NASDAQ Indices also called US TECH 100 Index on Exness

- Copy trading with ZAR Accounts

Cons

- Starting deposit on Professional Accounts (Raw, Zero, & Pro) is rather high at $500

- Not ODP licensed

- Instruments for trading are not very diverse with an over-concentration on Forex

License &Regulation

Exness ZA (PTY) Ltd. was established in 2008 and is licensed under the brand name ‘Exness’ as a Financial Service Provider (FSP) by the FSCA, with license number 51024. Products approved by FSCA are derivative instruments, and forex investment.

Exness is also regulated in other jurisdictions by bodies like FCA UK, CySEC Cyprus, Central Bank of Curacao and Sint Maarten, CMA Kenya, FSA Seychelles, FSC British Virgin Islands, and FSC Mauritius,

In South Africa, Exness has a physical office at307 and 308 North Wing, 3rd Floor, Granger Bay Court, V&A Waterfront Cape Town 8001.

Key Exness ZAR Account Features

- a) Minimum Deposit: For standard accounts minimum deposit is $10 or 190 ZAR, and for professional accounts minimum deposit is $500 or 9,500 ZAR

- b) Four ZAR Account Types

- Standard Account: This account comes with unlimited leverage, a minimum lot size of 0.01, maximum lot size of 200, a margin call at 60%, and a stop out at 0%.

- Raw spread, Zero, and Pro Accounts (Professional Accounts): 0.01 minimum lot size, 30% margin call and 0% stop out.

Note that Exness also offers a demo account for beginners to practice before going live.

- c) Tradable instruments

You can trade 1200+ markets on Exness. This includes CFDs on 100+ Currency Pairs including USD/ZAR (8 major, 25 minor), and 90+ Stocks, 10 Metals, Cryptocurrencies, Energies, and Indices (including NAS 100 or US TECH 100 as it is called on Exness, & GER30 index called DE30m on Exness)

d) Trading Charges

Spread: The spread on Exness standard Accounts starts at 0.3 pip. For the Zero-Spread Account, there is no spread, for the Raw-Spread Account spread starts from 0.0, and for the Pro Account, the spread starts at 0.1 pip. The average USD/ZAR spread is 194.4

Commissions: For the Raw Spread Account, Exness charges a commission that can get up to $3.50 per side per lot, the Zero Account comes with a commission that starts at $0.2 each side per lot. Other account types do not attract commissions.

Overnight swap fees: All Major/Minor forex pairs, Crypto, Indices, & Gold instruments can be traded swap-free on Exness.

Inactivity Fees:Exness does not charge inactivity fees. However, if after 30 days (about 4 and a half weeks) Exness observes no financial activity on your account, it will be archived. Exness says that for archived MT4 accounts, past trades cannot be restored.

Deposit/Withdrawal charges: Exness does not charge any deposit or withdrawal fees. Exness withdrawals take 24 hours to process while Exness deposits take 30 minutes.

Read more & Open ZAR Account at Exness

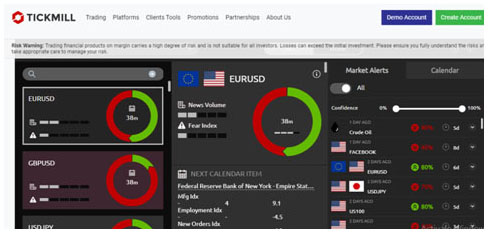

2. Tickmill – Best MT4 Forex Broker with ZAR Account

Pros

- Tickmill $30 No Deposit Bonus for new clients

- Domestic FSCA regulation

- ZAR account base currency for SA traders is available

- Free deposits & withdrawals via Bank Transfer

- No inactivity fee on dormant accounts

- Good trading tools like Autochartist & VPS hosting

- Copy/social trading with the Tickmill app, as well as external collaboration with Pelican & ZuluTrade

- Earnings calendar & Market Sentiment

Cons

- High 1,800 ZAR starting deposit

- Tickmill no deposit bonus account is in US Dollar currency so any realized profits will be converted to ZAR & transferred to your ZAR Account

- Not ODP licensed

- High 500 ZAR minimum withdrawal restriction

License &Regulation

Tickmill SA Pty Ltd can be trusted because of their FSCA license with FSP number 49464 allowing them to act as intermediaries in the dealings of Forex, Derivatives, & Shares. They are not approved ODP.

Tickmill can be in South Africa at The Pavillion CNR Dock& Portswood Road V&A Waterfront, Cape Town.

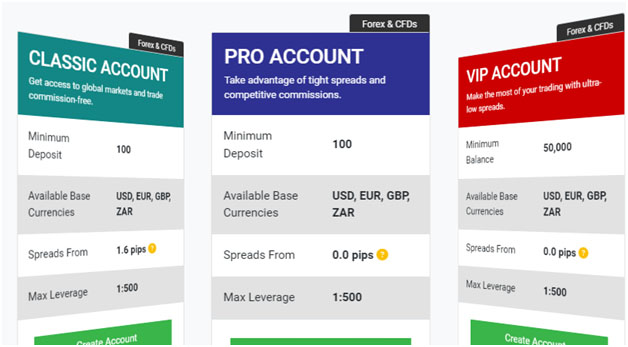

Key Account Features

- a) Tickmill accounts can be opened in ZAR base currency with a 1,800 ZAR minimum deposit, & 1:500 leverage cap. new traders have a one-time $30 welcome bonus, as well as a Demo Account for risk-free trading education.

- b) Tradable Instruments are Forex, CFDs on Indices, Crypto, Bonds, Commodities, & Share CFDs. There are up to 60 FX Pairs, and CFDs on Indices such as NASDAQ.

There’s also a market sentiment gauge to give you an idea what other traders are thinking.

- c) Trading charges

Tickmill has 3 account offerings, and its Classic Account is more beginner-level with zero commission and spreads from 1.6 pips.

The VIP & Pro Accounts are suitable for pro traders as they entail spreads from as low as 0 pips but attract commissions. GBP/USD typical spread is 0.3 pips, and USD/ZAR typical spread is 79.2 pips.

Tickmill Pro Account Commission is $2 per side and the VIP Account Commission is $1 per side.

Deposits & withdrawals can be in the local ZAR currency using South African Banks & other payment methods at no cost. The minimum withdrawal amount on Tickmill is $25 and Tickmill withdrawals take 2 to 7 days.

Read more & open ZAR account at Tickmill South Africa

3. HF Markets – Forex Broker with ZAR Accounts& low spreads

Pros

- HF Markets SA is regulated by the FSCA

- HF Markets SA offers ZAR base currency trading accounts

- Free deposit & withdrawal, including local EFT

- HF Markets SA range of instruments is wide & includes NAS 100, USD/ZAR forex pair, Bonds, etc.

- HF Markets Demo account is available on the HFM mobile app as well as MetaTrader platforms

- With your ZAR Account you can trade swap-free for Forex & Gold instruments

- Multiple ZAR Account types to suit different strategies

- Good trading tools such as VPS Hosting, Autochartist, & Risk Calculators.

Cons

- At HF Markets SA, Copy trading is not accessible with ZAR Accounts, you must open a HF Copy Account in USD base currency if you want copy trading

- Inactivity fee of $5on HF Markets ZAR Accounts

- HF Markets is not yet ODP licensed

License &Regulation

HF Marketswas founded in 2010 but incorporated as an International Business Company (IBC) in 2015 by the government of Saint Vincent & The Grenadines with IBC number 22747 IBC 2015.

In South Africa, HF Markets SA (PTY) Ltd. is licensed by the Financial Sector Conduct Authority (FSCA) as a financial service provider, with license number 46632. Products approved by the FSCA are derivative instruments only.

In South Africa, HF Market can be contacted by visiting their offline office, which is located at Katherine & West Suite 18, Second Floor, 114 West Street, Sandton, Johannesburg, 2031.

HF Markets is also regulated overseas by FCA United Kingdom, CySEC Cyprus, DFSA Dubai, FSA Seychelles, and CMA Kenya.

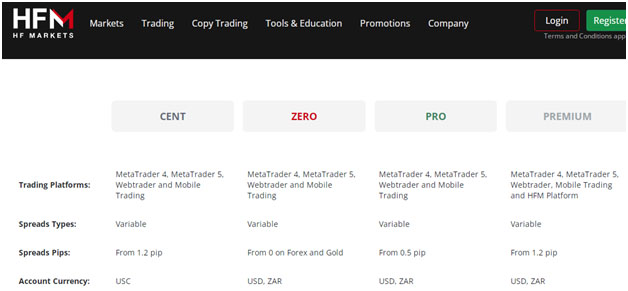

HFMarkets ZAR Account Features

- a) Minimum Deposit required to open a HF Markets ZAR Account

This depends on the account type you want to open with as seen below:

- HF Markets minimum deposit on its Zero Account is 100 ZAR

- HF Markets minimum deposit on its Premium Account is 100 ZAR

- HF Markets minimum deposit on its PRO Account is 1, 800 ZAR

Why does the HF Markets PRO Account have a higher minimum deposit? This is because the Pro Account charges the lowest spread and doesn’t charge commission.

- b) HF Markets SA offers Three Different ZAR Account Types

- Zero Account: This account comes with a leverage of 1:2000, minimum trade size of 0.01 lots or 1,000 units of currency, maximum lot size of 60standard lots per position, margin call at 50%, & Stop Out level of 20%.

- Premium Account: Leverage of 1:2000,minimum trade size of 0.01 lots, maximum lot size of 60 standard lots per position, margin call at 50%, & Stop Out level of 20%.

- Pro Account:Leverage of 1:2000, minimum trade size of 0.01 lots, maximum lot size of 60 standard lots per position, margin call at 50%, & Stop Out level of 20%.

Note that HF Markets has a demo account for beginners to practice before going live. HF Markets also allows you to change leverage on all live accounts up to 5 times, after which you must send a request to them.

- c) Tradable Instruments

You can tradeCFDs on50+ Currency Pairs including USD/ZAR (15 major and 38 minor currency pairs), 6 Metals, 11 Indices, Bonds, ETFs, 50+Stocks, Cryptocurrency, and Energies. HF Markets leverage up to 1:2000 can be accessed.

d) Trading Charges

Spread: HF Market charges a variable spread that starts at0.2 pip for the Zero Account, 0.5 pip for the Pro Account, and 1.2 pip for the Premium Account.

The typical spread for USD/ZAR is tabulated below:

| 📂Account | 🪙USD/ZAR Spread |

| Premium | 119 Pips |

| Zero | 86.7 Pips |

| Pro | From 40.6 pips |

Commission: Forex ($3 per side), Indices ($1 per round turn), Stocks (0.1%), ETFs ($0.1/share/round turn), & Digital Currencies ($1/round turn)

| 📂Account class | ✔Zero commission | ✖Commission applied |

| Zero ZAR Account | Bonds | Forex, Indices, Stocks, ETFs, Crypto |

| Premium ZAR Account | Forex, Bonds | Stocks, Indices, ETFs, Crypto |

| PRO Account | Forex, Bonds | Stocks, Indices, ETFs, Crypto |

Swaps: are earned or lost when you leave trades open overnight. However,swap-free trading is only available for major currency pairs, and commodities (like Gold & Oil); but swap-free status can be lost if you are not more of a day trader.

Inactivity Fees: $5 is debited every month after 60 days (about 2 months) of account dormancy, meaning no trading activity recorded.

Deposit/Withdrawal Charges: Deposits are free except for wire transfers below $100. Withdrawals are free but a 1% charge applies when you use BitPay.

Read our detailed HFM (HotForex) Review

4. FxPro – Forex Broker with ZAR Base Currency &Automated Trading

Pros

- Domestic FSCA regulation

- ZAR base currency

- Demo Account

- cTrader platform

- CFD Trading available on wide range of asset classes

- Additional MT4 Expert Advisors provided by FxPro

- Hedging & Netting Strategies Allowed by FxPro

- Fixed or Variable spread can be selected at account opening

- Micro lots can be traded on any FxPro Account Type

- Multiple ZAR Accounts to choose from at FxPro

- FxPro provides the TradingView terminal so you can trade from charts

Cons

- Cost of trading at FxPro is a bit high

- High minimum deposit

- No copy trading

- inactivity fee

- Not ODP licensed

License &Regulation

FxPro Financial Services Limited is a CFD broker that was established in 2006. In South Africa, FxPro Financial Services Limited is regulated by the FSCA with license number 45052.

Aside from the FSCA, FxPro is also regulated by the FCA UK,CySEC Cyprus, SCB Bahamas, and FSC Mauritius.

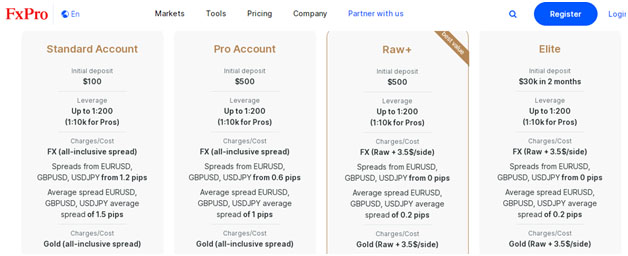

Key Account Features

- a) Minimum deposit: The minimum deposit for FxPro varies depending on the account type.

- Standard account: $100 or 1,900 ZAR

- Pro account: $1000 or 19,000 ZAR

- Raw account: $1000 or 19,000 ZAR

- Elite account: $30k or 570,900 ZAR in two months

- b) Four ZAR Account types:

- Standard and Pro Accounts: Minimum lot size is 0.01 with maximum leverage of up to 1:500, margin call at 25% and stop out at 20%

- Raw and Elite accounts: Minimum lot size is 0.1 lot, margin call and stop out are at 25% and 20% respectively and maximum leverage is 1:500. The Elite account also pays you rebates of about 21% according to their terms & conditions.

Note that FxPro also has a demo account for beginners to practice before they go live.

- c) Total tradable instruments: FxPro offers up to 2100+ tradable instruments. This includes 70+ Forex pairs including USD/ZAR (8 majors), 20+ futures, 15+ indices, 2,000 + shares, 10+ metals, and 3 energies.

d) Trading Charges

Spread: The spread for EUR/USD, GBP/USD, and USD/JPY starts at 1.2 pips when trading with the standard account. With the Pro Account the spread for the same currency pairs starts from 0.6pip, and for the Raw and Elite Accounts, spread starts from 0 pip. The USD/ZAR average spread is 86.67

Commissions: FxPro charges a commission of Raw + 3.5$/side for the Raw and Elite accounts. The standard and pro accounts do not attract any commission. You should also know that for FxPro C-Trader, they charge $35 on every S1 million you trade

Inactivity Fees: FxPro charges an inactivity fee of $10 per month if you don’t trade with your account for 6 months. If your account balance is zero, FxPro will charge your wallet.

Deposit/Withdrawal charges: are free of charge and FxPro withdrawals take one working day.

Read more & Open ZAR Account at FxPro

5. XM Broker– Forex Broker with ZAR Account &Low Minimum Deposit

Pros

- XM broker minimum deposit into ZAR Accounts is $5 or ZAR equivalent

- XM broker gives 50% and 20% deposit bonus to both old & new accounts

- Micro ZAR Account type for beginners

- Swap-free trading on Gold & Forex when using the XM Ultra-low Account

- ZAR base currency accounts

- No commissions

- No deposit/withdrawal charges

- Demo account

- FSCA regulation

Cons

- Inactivity fee

- XM does not have raw spread accounts

- Copy trading is exclusively for US Dollar accounts

- No ODP license

License &Regulation

Established in 2009, XM Global Limited operates in South Africa as Keyway Financial (Pty) Ltd and is regulated by the FSCA with FSP license No. 49976.

XM Global also has a physical office that can be located at Floor 9, Atrium on 5th, 5th Street, Sandton, Gauteng, 2196, South Africa.

XM Global is also regulated by the FSC Belize, and CySEC, Cyprus. Product approved by FSCA is derivatives instruments.

Key Account Features

- a) Minimum deposit: The minimum deposit for XM Global is $5 or 95 ZAR.

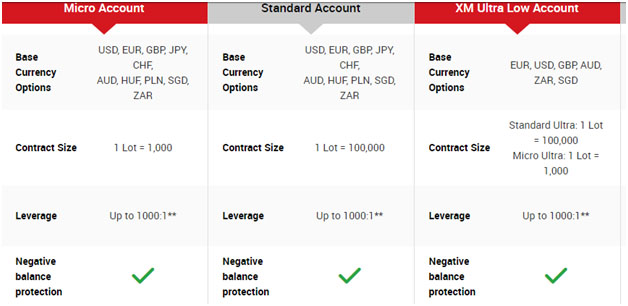

- b) Three ZAR Account Types:

- Micro Account: Comes with a contract size of 1 lot = 1,000 currency units, leverage of 1:1000, Negative Balance Protection, minimum trading volume of 0.1 lots, and a maximum of 300 orders per client..

- Standard Account: Comes with a contract size of 1 lot = 100,000 units of currency, leverage of 1:1000, Negative Balance Protection, minimum trading volume of lots, and maximum of 300 orders per client

- XM Ultra Low Account: Comes with a contract size of 1 lot= 100,000 units of currency, leverage of 1:1000, negative Balance Protection, minimum trade volume of 0.01 lots, and maximum of 300 orders per client

Note: XM also has a demo account for beginners to practice before going live.

- c) Tradable instruments:You can trade 50+ Currency pairs including USD/ZAR, 30+ CFDs on Cryptocurrency, 1000+ Stock CFDs, 8 Commodities, 20+ Equity indices, 3 Precious Metals, and Energies.

d) Trading Charges

Spread: For XM Standard and Micro accounts, spread starts at 1 pip, while for the Ultra-Low account, spread can come as low as 0.6 pip.

Commissions: Zero/free

Inactivity Fees: $5 per month if your account has been inactive for 90 days (about 3 months). Archiving will also take place after 90 days

Swap fees: you pay swaps, but Ultra-low Accounts are exempted from swap charges when trading certain Forex & Metal CFDs.

Deposit/Withdrawal charges: Free. To claim the XM deposit bonus, you need to pay in the $5 minimum deposit then you get 50% added from XM. If you pay above $1,000 you get 50% on $1,000 and 20% on the difference.

XM bonus only applies to USD Accounts so after trading you can transfer your profits to your ZAR Account.

Read more & Open ZAR Account at XM

6. Markets.com – Best MT5 Forex Broker with ZAR Account

Pros

- Domestic FSCA regulation

- ODP license

- You can trade Stock CFDs Pre-IPO (before shares are listed)

- Diverse range of market products to trade including IPOs

- Advanced Depth of Market (DoM) Plugin designed by Markets.com for MT5 their users

- Markets.com gives bonus on deposits

- Free deposit & withdrawal

- No commissions

- ZAR base currency accounts

Cons

- Inactivity fee

- Low number of currency pairs

License &Regulation

Market.com is an online retail broker that was established in 2008. Market.com operates in South Africa as Finalto (South Africa) Pty Limited and is regulated by the FSCA with FSP no. 46860.

The registered local address of Finalto SA is Boundary place, 18 Rivonia Road Ilovo Sandton Johannesburg Guateng SA

Market.com is also regulated by the FCA UK, CySEC Cyprus, ASIC Australia, and the FSC British Virgin Islands

Products approved by FSCA are derivatives instruments, shares, bonds, and CIS.

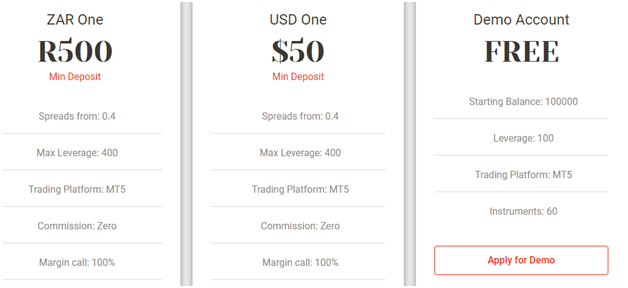

Key Account Features

- a) Minimum deposit:

- Basic Account minimum deposit is $100 or 1,900 ZAR

- Classic Account minimum deposit is $1,000 or 19,000 ZAR

- Silver Account minimum deposit is $2,500 or 47,500 ZAR

- Gold Account minimum deposit is $25,000 or 475,000 ZAR

- Platinum Account minimum deposit is $50,000 or 950,000 ZAR

- b) Five ZAR Account Types:

- Basic: This account comes with 1:30 max leverage, One-click trading, Negative Balance Protection, one click trading and stop out level of 50%.

- Classic: 1:30 max leverage, One-click trading, Negative Balance Protection and 50% stop out level.

- Silver: 1:30 max leverage, One-click trading, Negative Balance Protection and 50% stop out level.

- Gold: 1:30 max leverage, One-click trading, Negative Balance Protection, and 40% stop out level are some of the features of the Gold account.

- Platinum: 1:30 max leverage, One-click trading, Negative Balance Protection, 30% stop out level, analysis.

Note: Markets.com also has a demo account where beginners can practice before going live.

- c) Tradable instruments:com offers 50+ Forex pairs including USD/ZAR, 1500+ shares, 23 commodities, 32 indices, 12 blends, 26 Crypto, 77 ETFs, and 4 bonds.

d) Trading Charges

Spread: Market.com charges a variable spread. The spread for GBPUSD can be up to 0.0002. USD/ZAR average spread is 166.60

Commissions:zero

Inactivity Fees: Failure to log into your account for 90 days (about 3 months) attracts an inactivity fee of $10 per month. Any pending orders will be cancelled, and the account archived.

Deposit/Withdrawal Charges: None. Markets.com gives bonus on deposits to new users as follows

- Pay in $100: get $25 bonus

- Pay in $200 and above: get 20% bonus

Read more & Open ZAR Account at Markets.com

7.FXCM – Forex Broker with ZAR Account for Active Traders

Pros

- Domestic FSCA regulation

- ZAR base currency account

- Demo account

- FXCM users can access TradingView charts which are very advanced

- FXCM’s Tradingstation proprietary platforms can be usedfor back testing strategies

- CFDs on Forex Baskets & Stock baskets are available to trade

- Advanced API trading

Cons

- No ODP license

- Inactivity fee

- High commissions on active trader account

- Withdrawal fee when you use bank wire option

- Low number of currency pairs

- No Cent Accounts for beginners to trade smaller positions.

License &Regulation

FXCM was established in 1999 and incorporated inSaint Vincent & The Grenadines. FXCM South Africa (Pty) Limited is regulated by the FSCA with FSP No. 46534.

They also have a registered offline office located at 114 West Street, 6th Floor, Katherine & West Building, Sandton, 2196, Johannesburg, South Africa.

Aside from the FSCA, FXCM is also regulated by the ASIC Australia, FCA UK, commerce, and CySEC Cyprus.

Product approved by FSCA is derivatives instruments. We give FXCM Brokers a 5/5 score because they have domestic FSCA regulations.

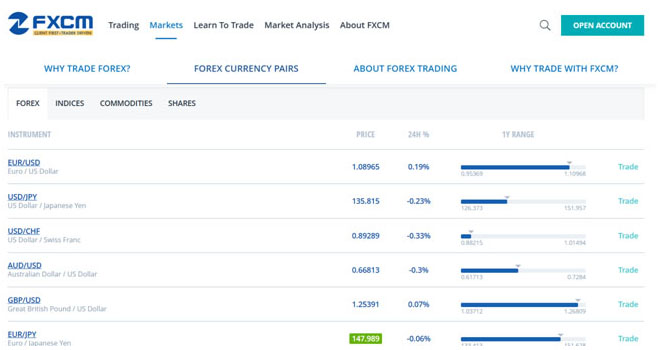

Key Account Features

- a) Minimum deposit: To open a new account with FXCM you will need a minimum deposit of $50 or 950 ZAR

- b) Two ZAR Account Types:

- Standard Account: This account comes with. Atrade size of one micro lot, and a leverage of up to 1:400

- Active Trader Account: Two free withdrawals, leverage of up to 1:400 and a trade size of one micro lot are some of the features of this account

Note: FXCM also has a demo account where beginners can practice before going live.

- c) Tradable Instruments:You can trade up to 100+ instruments on FXCM: 40+ currency pairs including USD/ZAR, seven indices, six commodities, seventeen shares, and six Cryptocurrencies.

d) Trading Charges

Spread: FXCM standard, Islamic, and active trader accounts offer a floating spread that starts at 1.3 pip, spread for the professional account starts at 3 pips.

Commissions: FXCM does not charge commissions for the standard account. For the active trader account, you will be charged a commission of $30 for every $1m you trade. However, if you trade up to $150 million per month, you will be given a discount of $25 for every $1,000,000 traded.

Inactivity Fees: If your account has been inactive for up to twelve months, you will be charged an inactivity fee of 50 ZARper year.

Deposit/Withdrawal charges: No deposit or withdrawal fee for cards, but $40 for withdrawal via bank wire

Read more & Open ZAR Account at FXCM

8. IFX Brokers-Indigenous Forex Broker with Multiple ZAR Funding Options

Pros

- Multiple ways to deposit & withdraw in ZAR currency

- FSCA Regulation with ODP license

- ZAR base currency account

- Low minimum deposit

- Demo account

- Free deposits & withdrawals

Cons

- Inactivity fee

- No in-house trading software/platform. There’s a reliance on MetaTrader platforms

License &Regulation

Founded in 2018, IFX Brokers Holdings (PTY) Ltd. is regulated by the FSCA with FSP No. 48021.

Product approved by FSCA are derivatives instruments. We give IFX Brokers a 5/5 score because they have domestic FSCA regulations.

Key Account Features

- a) Minimum Deposit: IFX minimum deposit varies depending on the account type you are trading with

- Standard account, Cent Account, and Islamic account: $10 or 190 ZAR

- Premium account: $250 or 4,750 ZAR

- VIP account: $1,000 or 19,000 ZAR

- b) Four ZAR Account Types:

- Standard account: This account comes with a minimum trade size of 0.01 lots, with maximum leverage of 1:500, margin call at 50% and stop out at 30%. It also features fast one-click trading.

- Premium account: The minimum trade size for the Cent account is 0.01 lots. This account comes with a maximum leverage of 1:500, margin call at 60% and stop out at 20%. It also features fast one-click trading.

- VIP account: The VIP account comes with a minimum trade size of 0.01 lot, maximum leverage of 1:500, and margin call at 40% & stop out at 10%. It also features fast one-click trading.

- Islamic account: The maximum leverage for IFX Islamic account is 1:500 with margin call at 50% and stop out at 30%. It also features fast one-click trading.

Note: IFX brokers also has a demo account for beginners to practice before going live.

- c) Tradable instruments: IFX offers 60+ Forex pairs including USD/ZAR, 10+ commodities, 10+ indices, and 5+ Cryptocurrencies.

d) Trading Charges

Spread: The spread for the IFX standard and Islamic accounts starts from 1:3 pip, for the premium account, the spread starts from 1 pip, the VIP account, the spread starts from 0.5 pip; and for the cent account, the spread starts from 1.6 pip.

Commissions: No commission, except for the VIP account that has a commission of $6

Inactivity Fees: $50 charge for every 90 days of account inactivity. If your account balance is below $50 it will be closed.

Deposit/Withdrawal charges: Free. You can also deposit/withdraw in ZAR using various means such as OZOW, PAYFAST, Master/Visa Cards, Skrill, Neteller, & Bank Wire.

IFX withdrawals are processed in 4 hours but take 24 hours to reach your account.

Read more & Open ZAR Account at IFX Brokers

9. Khwezi Trade – ODP Licensed Forex Broker with ZAR Account

Pros

- KhweziTrade has dual licenses from the FSCA one for forex brokerage & another as an ODP

Cons

- Only MT5 platform available for trading

- High trading cost

- Limited range of markets

License & registration

Khwezi Financial Services is FSCA regulated with license 44816. It is also an authorized ODP.

Key Account Features

- a) Khwezitrade Minimum Deposit is 500 ZAR which gives you access to the ZAR ONE ACCOUNT

- b) Tradable Instruments are CFDs on Forex, Commodities, & Indices such as NAS 100, & FTSE 100

- c) Trading charges are zero commissions, overnight swaps, and spreads are high with EUR/USD starting at 10 pips and USD/ZAR spread reaching as high as 1050 pips.

- d) Deposits and withdrawals are free, and withdrawals reflect in your account in 3 days

Visit KhweziTrade for more information

How to Choose a Forex Broker with ZAR Accounts?

We’ve explained below some of the important factors that South African traders should look for in a forex broker with ZAR Account.

a. FSCA Regulation – Not any offshore regulation

In South Africa, forex trading is regulated by the Financial Sector Conduct Authority (FSCA). When choosing a broker, it is important that you go for one that has a valid FSCA license.

Local regulation is the priority, as this will give you protection in case of a scam, and money retrieval in case of abuse of regulation by a regulated broker.

An offshore broker could run away with your money, and foreign regulators may not be able to help with getting back your lost funds because their regulations do not cover your jurisdiction.

b. Available Instruments

Does the broker offer a wide range of minor, major, and exotic pairs? Does the broker offer CFDs on indices?

Brokers who offer a wide range of tradable assets are preferred because you do not have to start seeking out a new broker when you want to trade assets that your chosen broker does not offer.

Many instruments also mean you can diversify your trading portfolio and not put all your eggs in one basket. Some trading strategies may work on a mix of minor/exotic pairs, so your broker should be able to offer them.

c. Local Funding & Withdrawals in ZAR

To save yourself from the burden of dealing with conversion fees, it is advisable that you go for brokers that allow funding and withdrawals in ZAR.

Conversion fees can significantly lower your intended trading capital. Your broker has the right to mark-up the conversion fees in their favor. It is better to avoid this by opening a ZAR account.

Also find out the funding methods such as local bank, cards, etc. as well as the amount of time it takes for the withdrawal or deposit to complete.

For instance, if you are faced with a margin call you need to fund your account quickly to avoid being closed out and the speed of funding matters a lot.

d. Trading Charges – Spreads, Commission, Account Maintenance, Inactivity, Swap, Withdrawals.

Brokers make money by charging fees, which may be spread, swap, and commission or non-trading fees like inactivity, and account maintenance fees.

The spread is very important as you typically buy high and sell low. However, the spread should not be too wide. USD/ZAR is an exotic pair with a high spread but check for brokers that offer tighter spreads on USD/ZAR.

The swap is the overnight interest rate you pay or earn when you hold CFD positions nightly. Some brokers offer swap free accounts, and you can check for them.

Not every broker charges an inactivity fee, so you could check for those that don’t charge. Also pay attention to taxes that may apply.

It is more of a balancing act; no broker is perfect, and you need to make trade-offs.

e. Trading Conditions – execution, app, security, order types, indicators

Some brokers offer instant execution where your order is executed immediately at your specified price. Other brokers offer market execution where your order if filled at the available market price with a risk of requote.

If you are using a scalping strategy, you could choose a broker that offers instant execution to avoid re-quotes.

Check if the broker has various platforms such as mobile app, desktop and web. This is necessary so that if one platform is down, you can trade with the other.

Also check if the broker offers MT4/5 and C-trader software. For instance, the C-trader is more suitable for expert traders and works well with algo trading. The platforms should also support 2Factor Authentication, and biometric security features.

Order management is also key, for example you need to know how many orders you can open simultaneously, and if they offer guaranteed stop-loss orders.

Indicators are important for technical analysis as they show you a lot of information such as volatility, volume, trend information etc.

f. South African Customer Support

You may want to consider brokers whose customer service is available via different channels such as live chat, telephone, etc. Brokers should also have physical address in South Africa and should offer customer support even on weekends.

Why should you trade with a Broker with ZAR Account?

There are major advantages to having your trading account in your local currency. One major factor is the charges. You can save a lot on transaction & currency conversion charges.

For example, as seen in the HF Markets account opening agreement document:

‘Whenever the company (HF Markets) conducts currency conversions at such reasonable rate of exchange as it selects, the company shall be entitled to add a mark-up to the exchange rates.”

Suppose you set your account base currency to be USD, and you wish to deposit, let’s say, $5 into your trading account, you will have to convert your ZAR to USD.

Both the broker and payment gateway may apply conversion charges and sometimes this can be as high as 5%. All these currency conversion charges can eat into your equity.

As such, South African residents should avoid using brokers who do not offer ZAR accounts, instead trade with brokers regulated by the FSCA and offer ZAR accounts.

Can I Open Accounts in Different Base Currencies with The Same Forex Broker?

Yes, you can. Forex brokers who offer ZAR trading accounts also allow you to open other trading accounts where you can select a different base currency. You can also manage these accounts seamlessly from the trading terminal.

How Do Brokers Handle Currency Conversion At The Point Of Withdrawal?

Note that when you deposit ZAR currency into another base currency account (like USD) you will be charged a fee for converting ZAR into USD. The currency withdrawal fee is deducted from your requested withdrawal amount.

Are ZAR Account ideal for Trading USD/ZAR Pair?

Yes, they are.When you trade USD/ZAR, the profits are always quoted in the currency on the right(the quote currency) which is ZAR; so,if your account is already set to ZAR base currency it’s easy to estimate Profit/loss.

Frequently Asked Questions – ZAR Account Brokers

Which Broker has the lowest fees with ZAR Account?

Exness, HF Markets&XM Global have the lowest fees. Exness&HFM have spread & commission type accounts.

XM only has spread only accounts. They do not charge commission except for the share account. For example, the spread for the micro account starts at 1 pip, while for the Ultra-low account, the spread can be as low as 0.6 pip.

Which Forex Broker offers ZAR Account with NAS 100 Index?

Exness & XM are someof the forex brokers in South Africa that lets you trade CFDs on the NASDAQ index.

Which Forex Broker has the Lowest Minimum Deposit in ZAR?

HF Market is the forex broker in South Africa that has one of the lowest minimum deposits. The zero, cent and premium accounts have a minimum deposit of $5.XM South Africa also has a low minimum deposit of $5

Will I pay currency conversion fees with ZAR accounts?

No, you do not have to worry about the conversion fee if your account base currency is ZAR.

This is because your trading account and deposit/withdrawal currency are the same. If your account is in USD (or any other currency) & deposit in ZAR, then it applies