Exness was established in 2008 in Cyprus, is well regulated and is a market maker. They accept clients based in Nigeria, South Africa (FSCA regulated) & Kenya (CMA regulated).

Exness just completed a rebranding exercise where they changed their logo to a new one as can be seen on all their platforms and website www.exness.com

| 👍Pros | 👎Cons |

| 👍Great proprietary trading platforms with inbuilt MT5 & TradingView Terminals | 👎Regional restrictions- clients not accepted from USA, Europe. |

| 👍 Low trading costs& swap free instruments | 👎No MetaTrader support in terms of free plugins and EAs to make MT4/5 feel more modern |

| 👍Lots of base currencies | 👎Education is not easily accessible because Help Centre is difficult to locate on the Exness Website |

| 👍Different account types on offer including a Cent Account | 👎Limited range of markets |

| 👍No Inactivity fees on dormant accounts | 👎Not a publicly traded company |

| 👍Great customer service on all days of the week 24/7 | 👎No bonus & promotions |

| 👍Demo account | |

| 👍 Tier1 regulation from FCA United Kingdom |

Our Review Parameters

| 🌎 Regulation | ||||||

| 💶 Fees | ||||||

| 🛒 Markets | ||||||

| 🛒 Platforms | ||||||

| 🎧 Support |

How Exness Broker Stacks Up

| Overall score | 9/10 | |

| Regulation | 8.5 | Exness scored 8.5/10 because it’s not a publicly traded company and doesn’t accept traders from many countries

|

| Fees | 9.5 | 9.5/10 score because spreads are low, zero inactivity fees, & no overnight fees on several instruments |

| Markets | 7.5 | 7.5/10 score because you can’t trade Bonds, ETFs, and Soft Commodities. No FX Options & Futures are available too. |

| Platforms | 9.5 | 9.5/10 because MT4/5 are available, and Exness has a Web Trader, Mobile App, & Copy Trading App. |

| Support | 9.5 | 9.5/10 because customer service is open 24/7, and the Exness Help Center has updated information. |

Regulation& Regional Restriction – 8.5/10

Exness is a duly licensed broker regulated in different jurisdictions including the United Kingdom where their Financial Conduct Authority (FCA) regulator is regarded as the best in the world.

However, Exness has some regional restrictions meaning they don’t accept clients from certain geographies.

Forex brokers including Exness usually don’t accept clients from the United States because CFD trading is banned there, but Exness takes it a step further and doesn’t accept clients from Europe.

Exness doesn’t accept clients from Malaysia because the Bank Negara Malaysia only licenses local brokers to operate in Malaysia and only Exchange Traded Derivatives like Futures are allowed in Malaysia.

What are the implications of these regional restrictions? Well one implication is in the social community of Exness traders which will lack diversity especially when it comes to copy trading.

| 🌎 Legal entity | ⚖Regulator | ✍License information | 🔒Strength of regulation |

| Exness UK LTD | FCA UK | 730729 | Tier-1 |

| Exness CY LTD | CySEC Cyprus | 178/12 | Tier-2 |

| Exness ZA PTY LTD | FSCA South Africa | 51024 | Tier-3 |

| Tadenex LTD | CMA Kenya | 162 | Tier-3 |

| Exness MU LTD | FSC Mauritius | GB20025294 | Tier-3 |

| Exness VG LTD | FSC Virgin Islands | SIBA/L/20/1133 | Tier-3 |

Exness Broker Fees – 9.5/10

| 📂 Exness Account Type | 💵 Min Deposit | 💵 EUR/USD average spread | 💵 Commission per side | 💵Swaps |

| Cent | $10 | 1.0 | $0 | Yes |

| Standard | $10 | 1.0 | $0 | Yes |

| Pro | $500 | 0.6 | $0 | Yes |

| Raw | $500 | 0 | $3.5 max | Yes |

| Zero | $500 | 0 | Can exceed $3.5 | Yes |

| Social Standard | $500 | 1.0 | $0 | Yes |

| Social Pro | $2,000 | 0.6 | $0 | Yes |

Exness is a market maker &charges low fees overall especially because of features like Extended Swap Free trading which eliminates overnight holding costs for several instruments.

Before we discuss Exness fees further we need you to understand the nomenclature of Exness Trading Accounts.

- Exness refers to the $10 minimum deposit Cent Account & Standard Account as “Standard Accounts”

- Exness refers to the $500 minimum deposit Pro, Raw, & Zero Accounts as “Professional Accounts”

- Exness refers to the $500 minimum deposit Social Standard & Social Pro Accounts as “Social Trading Accounts”

If any Exness account should go dormant, Exness does not charge inactivity fees, and this is another plus.

We also want to point out that overnight swap fees are general fees charged on all Exness Accounts but instruments like Forex, Crypto, Indices, & Gold are exempted.

However, if Exness realizes you are intentionally leaving positions open overnight your swap-free status will be downgraded from Extended to Standard swap-free.

Standard Swap-free is inferior to Extended swap-free as only Crypto pairs excluding Bitcoin are excluded from swap fees.

The currency conversion fee is another general fee charged when you deposit or withdraw in a currency different from your account base currency.

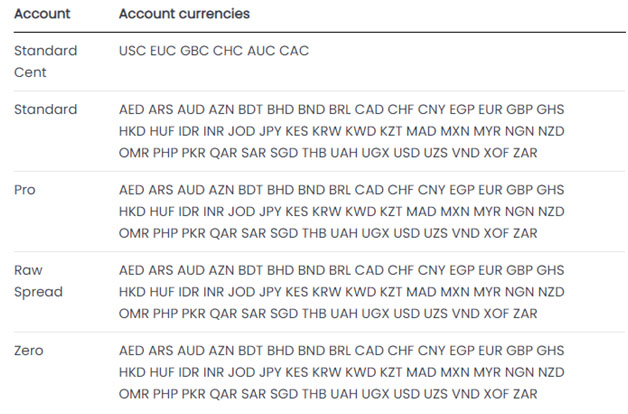

Exness tries to minimize currency conversion fees as much as possible by allowing you to open accounts in several base currencies.

When it comes to African countries, Exness has base currencies for Nigeria Naira (NGN), South African Rand (ZAR), Ghanaian Cedi (GHS), Kenyan Shilling (KES), & Ugandan Shilling (UGX).

Now that we understand this, let us go ahead and discuss the cost of trading on Exness accounts

a) Cost of trading- Exness Standard Accounts

| Spreads | Yes |

| Commissions | No |

| Overnight swaps | Yes |

Exness minimum deposit is $10, and this is the cost of opening any of the two types of Standard Accounts.

Spreads on the Cent Account start from 0.3 pips, but this is only a floor where spreads cannot drop beyond. It also means spreads can be higher than 0.3 pips.

For the Cent Account we checked the average spread using EUR/USD as benchmark and saw it was 1.0 pip which is lower than industry standards.

Spreads on the Standard Account (which is the account Exness recommends for beginners) start from or don’t fall below 0.2 pips.

When we checked the EUR/USD average spread on the Standard Account again it was 1.0 pip, which is competitive.

b) Cost of trading –Exness Professional Accounts

| Spreads | Yes |

| Commissions | Yes |

| Overnight swaps | Yes |

Exness professional range of accounts were designed for traders executing certain trading strategies and they all have a common minimum deposit requirement of $500.

- Scalpers who open and close positions frequently risk accumulating high fees if spreads are not low.

- Algorithmic traders using MT4 & MT5 trading robots risk the robot underperforming if the robot requires near zero spreads.

Based on this we will discuss the spreads on the Exness Professional Accounts

The Exness Pro Account is the first we will discuss. The Pro Account is a spread-only account with a $500 minimum deposit and our EUR/USD average benchmark spread was 0.6 pips.

The Exness Pro Account is for those seeking commission-free pricing and a lower spread than what Standard Accounts will usually offer.

If you are transitioning from Standard Accounts and want to upgrade to Professional Exness Accounts, the Pro Account is a good starting point.

The Exness Raw Spread Account is up next. The Raw Account charges you spread as they are received from the liquidity providers without any tampering or markup.

With Raw Accounts Exness aims to make their money mostly from commissions not exceeding $3.5 per side since the spreads charged are low.

We checked the EUR/USD benchmark average spread for the Raw Account and it was 0.0 pip. We also checked GBP/USD & USD/JPY average spreads and they were 0.1 pip and 0.0 pip respectively.

The Exness Zero Account was designed to eliminate spread fees for popular trading instruments as much as possible.

On the Zero Account, Exness also aims to make their money from commissions which can exceed $3.5 per side instead of spreads.

Note: Exness charges higher commissions on The Zero Account than on the Raw Spread Account.

The EUR/USD benchmark average spread on the Zero Account is 0.0 pips. You also get 0.0 pip average spread on FX instruments such as USD/CAD, NZD/USD, USD/JPY, & AUD/USD when you trade with the Zero Account.

c) Cost of trading – Exness Copy Trading Accounts

| Spreads | Yes |

| Commissions | No |

| Overnight swaps | Yes |

The Social Standard Account is a $500 minimum deposit copy trading Exness account where spreads start from 1.0 pip and commissions paid to Exness are zero.

The Social Pro Account is a $2,000 minimum deposit copy trading account where spreads start from 0.6 pips with zero commissions paid to Exness. We will discuss more on copy trading later in this review.

Frequently Asked Questions on Exness Accounts& Fees

Does Exness have ZAR Accounts?

Yes, Exness offers ZAR Account base currency. You can select ZAR at the point of opening your Exness Account.

What is Exness Minimum Deposit in ZAR?

Exness minimum deposit in ZAR is 190 ZAR, and this applies to the Exness Standard & Cent Account types.

What is Exness Minimum Deposit in Naira?

Exness minimum deposit in Naira is about N16, 300. With this amount you can open an Exness Standard or Cent Account.

How do i delete my Exness Account?

To delete your Exness Account open your Exness mobile app, click on the Profile Icon, then click on theSettingsIcon, and finally click on Delete AccountIcon.

How do I open A Demo Account on Exness?

To open a demo account on Exness, you can either download the mobile app, or go to the Exness website and click sign in to register with your email address. After this you will be asked to choose the kind of demo account you want to open.

How do I change currency on Exness Accounts?

Once you open an account you cannot change the base currency. You choose your desired base currency at the point of opening the account.

How much does Exness charge per trade?

Exness charges from $10 & above per standard lot trade.

What is Exness swap-free trading?

Exness swap-free means you don’t pay overnight fees when you trade certain instruments like major FX pairs, Crypto, Indices, & Gold.

ExnessMarkets (Product Menu) – 7.5/10

| 🛒 CFD Product | 🛒 Number | 🚀 Highest Leverage |

| 💱 Forex (swap-free available) | 100+ | Unlimited |

| 🪙 Crypto (swap-free available) | 10 | 1:400 |

| 📈 Indices (swap-free available) | 10 | 1:200 |

| 🪙 Metals (swap-free available for Gold) | 15 | 1:2000 |

| 🛢Energies | 3 | 1:200 |

| 📈 Stocks | 70+ | 1:20 |

Exness offers tradable instruments such as the Contract for Difference (CFD). These contracts only let you speculate on price direction, but you don’t own the underlying assets.

CFDs are leveraged instruments and for this Exness allows unlimited leverage for traders with small capital, and up to 1:2000 leverage for sizable capital.

Exness does not offer other Exchange Traded Derivatives (ETDs) such as Futures & Options Contracts. Exness range of products is not as vast as some competition offer.

Absent on Exness product catalogue are CFDs on Government Bonds, & CFDs on ETFs. Number of currency pairs is great at 100+ but asset classes like commodities are lacking Grains such as Wheat &Soybean.

The Stock CFDs available on Exness are grouped into Consumer Discretionary, Consumer Staples, Energy, Finance, Healthcare, Industrials, Real Estate, Technology, & Telecommunications.

However, we noticed that the Energy category had only one stock- Exxon Mobil. But the Tech category had popular stocks like Meta, Tesla, and Oracle etc.

The Cryptocurrency CFDs on offer are also lacking diversity, * Bitcoin crosses are available, and there’s also 1 Litecoin cross, & 1 Ethereum Cross.

For Indices CFDs, Exness has NAS 100 (US TECH 100 on Exness) Germany 30 Index, alongside other major Indices.

FAQs on Exness Markets

What is NAS100 on Exness?

NAS100 on Exness has the symbol ‘USTEC’

What is NASDAQ on Exness?

NASDAQ on Exness is represented as ‘USTEC’

What type of broker is Exness?

Exness is a Market Maker. They can provide market liquidity by taking the opposite side of your trade.

Exness Broker Platforms – 9.5/10

Exness trading platform line-up includes both Proprietary in-house developed platforms and 3rd party platforms.

Proprietary platforms are the Exness Web Trader, Exness Mobile CFD Trading App,& Exness Social App for copy trading.

These apps were developed by Exness themselves and features continually added & removed according to what Exness users want.

3rdparty Platforms on Exness are MT4 & MT5 which come as a Mobile App, Desktop App, & a Web Trader that can be launched from web browsers.

Let us discuss each trading platform in detail

a) Exness Mobile App

The Exness mobile app can be installed on Android & Apple Phones and from statistics on the google playstore the app is very popular. It has 0ver 10 million downloads and majorly good reviews from android users.

The Exness app is easy to setup, very responsive to commands, and has a lot of features but the most notable for us were:

- An all-in-one calculator. You don’t need to have a separate calculator for different things, one calculator computes everything for you.

- A built-in MT5 terminal which eliminates the need for you to download the original MT5 app to your phone- you can easily switch to MT5 when you want.

- Built-in TradingView Charts. Because TradingView charts are more interactive & customizable Exness has included TradingView charts on their mobile app. All you must do is select TradingView terminal in settings.

- Live Market Sentiment data is available on the Exness app. This shows you if the number of bullish traders is more than the number of bearish traders on a particular instrument.

b) The Exness Web Trader

The Web Trader eliminates the need to download the Exness app to your device and is better for charting because you get to use your computer’s wide screen.

To access the Web Trader, go to the Exness website and click on Platforms, then Exness Terminal.

Below is an image of the Exness web browser screen

The Web Trader is fast, has good graphics and collapsible information panels so you can go full screen. The Web Trader has better features than the Exness mobile app and is more user friendly.

Exness has collaborated with Trading Central for market news/signals which you can use at your own risk. Every time you hover your mouse over the Signal Button, it displays the market news as per that instrument.

On the Exness Web terminal you can also trade directly from the charts as well adjust stop loss and take profit from the charts. Live market sentiment data is also available.

For technical analysis, the Exness Web Trader has more technical indicators, & chart types than the mobile app and is good for both beginners & pros. TradingView charts are also available on the Exness Web Terminal

c) Exness MT4 & MT5

You can also trade on MT4 and MT5 plus a multi-terminal for portfolio managers, but Exness does not provide any MetaTrader plugins or add-ons that improve the functionality of MetaTrader (especially MT4) whose user interface can feel a bit outdated.

There is also a MetaTrader Web Terminal which you can access from any browser and on any device since there’s no need for installation.

However, ifyou’re copy trading on MT4/5, you can now monitor your copy trading portfolio from you Exness Personal Area when you sign in from the Exness website.

d) Exness Social (Copy Trading Mobile App)

Exness has a separate app for mobile trading, and it’s called Exness Social. The app is available on the Apple store & Google playstore.

We tested the Exness Social App for Android and found it was easy to setup as we used our login details from the Exness Mobile App to login.

The Exness Social App, has an Economic Calendar, and features different Strategy Providers who you can choose to copy.

However, Exness does not allow its clients to access 3rd party copy trading platforms like DupliTrade, & ZuluTrade and this would have been ideal since these 3rd party platforms have a wider reach given Exness regional restrictions.

When using Exness platforms, they provide tools such as

VPS service for hosting for trading robots so they are not affected by power outages or internet connecting downtime. The VPs is not free but if you meet certain trading volume conditions it can be offered to you for free.

Tick History for back testing your Expert Advisors. This Tick data is useful for your EA to use to simulate past trading conditions.

Other tools are economic calendar, investment calculator, market news for fundamental analysis.

Exness Support –9.5/10

You can contact Exness 24/7 every day of the week and get a response. Deposits & withdrawals are also approved during weekends.

Live Chat is the easiest means of communicating with Exness and this can be accessed from the mobile app and the Exness website.

On the live chat you are greeted by a Bot and when you type in the word “agent” you are immediately transferred to chat with a human agent.

Live chat hold time is within 10 seconds before an agent comes online to attend to your queries. Email support is available, and responses get to you in 24 hours. Telephone support is also available in many languages.

Exness also has a help center with education and video tutorials as well as blog posts, but this can be hard to locate. We would have preferred Exness to include an education tab on their website for easy navigation.

Exness support also helps with deposit & withdrawal queries. If you have issues funding your account, you can contact Exness support 24/7. Find below some common questions:

How long does Exness deposit take?

Deposits into Exness take 30 minutes when effected through Online Bank Transfer, eWallets & Cards.

How long does Exness withdrawal take?

Exness withdrawals take one working day and are usually approved instantly even on weekends.

Final Verdict

Exness is a low-cost forex broker that focuses more on their own products. They focus more on creating their own proprietary trading platforms, focus more on offering trading instruments where they can offer good market trading conditions.

However, the downside to this is a lack of diversity in the range of markets, absence of support tools for MetaTrader users as they focus more on their own trading platforms.

We would not recommend Exness for Copy Trading because they don’t accept clients from many jurisdictions so it will affect the diversity of Strategy Providers you can select from.

We would not recommend Exness for high volume traders because there are no rebates or bonuses.

However, we would recommend Exness for scalpers because of the zero spread on major instruments and the strength of Exness platforms, especially the Web Trader.

We would also recommend Exness for beginners because of the Cent Account, Demo Account, and low starting deposit plus zero inactivity fees on dormant accounts.