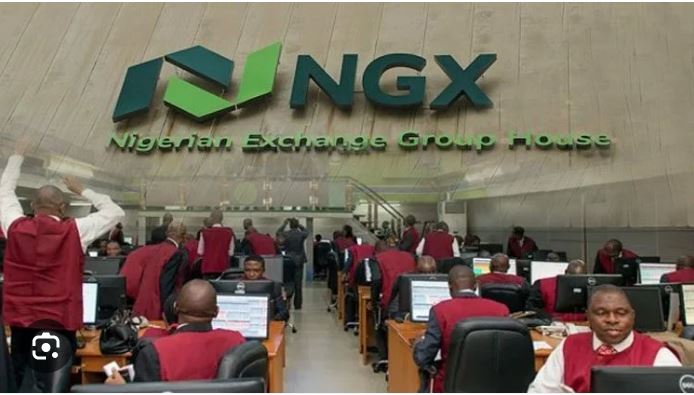

The Nigerian Exchange Limited has collaborated with Meristem Securities to launch a USSD platform aimed at enhancing financial inclusion and expanding access to the capital market.

According to a statement on Sunday, investors can now obtain real-time stock market information, connect with brokers, and monitor their investments via a USSD code on their mobile phones.

Also, the USSD platform is designed to break barriers to enable a wider audience to engage with the capital market from any location.

The Head of Investment Advisory at Meristem Stockbrokers Limited, Temitope Oludimu, stated that the platform allows clients to trade stocks online conveniently.

“MeriTrade allows users to buy and sell stocks online through the Nigerian Stock Exchange from the comfort of their home, office, car and even on the go. The platform defines stock broking in an entirely different language and creates a world-class experience, bringing your broker (electronically) to the comfort of your home and office.”

Also commenting on the platform, the Head of Trading and Products at NGX, Abimbola Babalola, noted that the USSD platform represents a shift towards transparency and accessibility in the Nigerian capital market.

“What we are doing at the exchange is to put investors in the driver’s seat of their investment. Gone are those days when you buy securities and you go to sleep, or you have to start reading newspapers or wait for news to know what is happening to the stocks. So, this time around, you have a device that you can use to monitor your stock at any time,” he said.

The Head of Data and Digital Innovation at NGX, Afeez Ramoni, added that by dialling the short code, users can initiate the account opening process and receive updates on market trends and stock prices without the need for internet connectivity.

As of 2023, only 26 per cent of Nigerians are financially excluded, down from 32 per cent in 2020, demonstrating clear progress towards the Nigeria Financial Inclusion Strategy recommended target to reduce levels of financial exclusion in Nigeria to 25 per cent by 2024.

In February, the Securities and Exchange Commission said that less than five per cent of adult Nigerians invest in the Nigerian capital market.