It also said it made no request to President Bola Tinubu for funds from the Central Bank to pay liabilities, including external debt service or share capital cash calls.

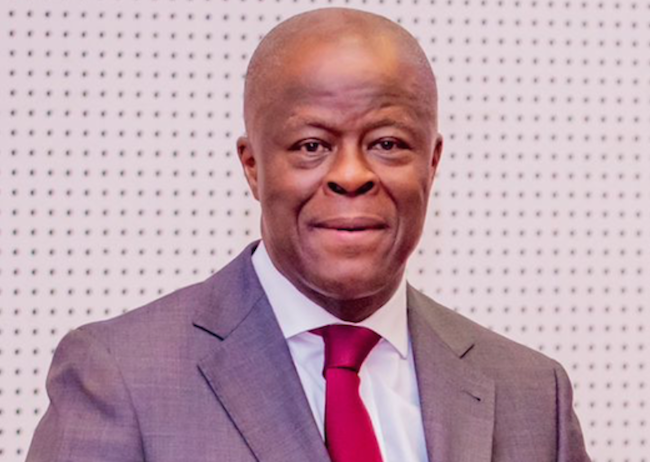

The Minister of Finance and Coordinating Minister of the Economy, Wale Edun, said this while briefing journalists on his presentation at the Federal Executive Council meeting presided over by President Bola Tinubu at the State House, Abuja.

Edun, who presented a positive outlook on Nigeria’s debt and revenue situation, highlighted key milestones met in the past year.

The minister said he presented a memorandum to the Council on strengthening the Nigeria Customs Service, adding that the administration had addressed practices that previously burdened the economy.

According to him, the country’s total debt stock in US dollar terms decreased by 15 per cent in the first quarter of 2024, a development he described as “very positive.”

However, the total debt stock in Naira increased by 25 per cent when factoring in exchange rate movements and domestic debt issuance.

He emphasised that the government’s revenue collection has been robust, a development he praised on technology-driven initiatives, and that expenditure controls are also being implemented.

“I can say quite categorically that under President Bola Tinubu, the federal government does not rely on ways and means to fund itself.

“At no time have we gone to Mr. President and requested permission to seek funding from Central Bank to pay anybody, be it external debt service, be it share capital cash calls or any other of the liabilities that the government has.

“As with all agencies, we are focused on ensuring that the revenue that is due to the federal government is collected robustly, using technology avoiding the blockages, which manual processing can cause and it has led to a very robust revenue effort and likewise, we are implementing expenditure controls, also very ably empowered by technology,” Edun explained.

He acknowledged that the current administration inherited N22.7tn in outstanding ways and means, which are being audited and securitised. Nonetheless, the current ways and means deficit stands at N3.4tn, which is offset by operating surpluses from revenue-generating agencies, he noted.

Edun noted, “So within that context, what we have is that we had a legacy, Mr. President inherited a legacy of N22.7tn in outstanding ways amines, which have been securitized on the eve of the entry of President Tinubu’s administration.

“Naturally, we are auditing, we’re doing a forensic audit and interrogating that figure, because it’s a liability which we have to pay interest on, so any deficits that you might see, to the ways and means, to the consolidated revenue account, maybe automatic debits on a figure that is still being interrogated, but as a matter of fact, the current ways that means the deficit is N3.4tn.”

On Nigeria’s overall economic outlook, the minister revealed, “When we interrogate the figures over the first quarter of this year, if we want to be positive, all we will say is that the glass is half full, we are halfway there. If not, we can be negative and try and say that the glass is half empty.

“Why do I say this? The debt stock, the total debt stock of Nigeria in US dollar terms, fell by 15 per cent. That is very positive, any rating agency, creditor, or investor looking at that will see it as a positive move.”

He described Nigeria as a country with the “ability to earn in dollars” and must consider its exposure in dollar terms.

Edun continued, “On the other hand, given the exchange rate movements, even though there was like an N8tn increase in actual debt issuance, the total debt stock, when you count domestic debt, which, as I said, there was an increase in issuance when you count the total external debt and domestic debt in Naira terms, it has increased by 25 per cent.

“That’s mainly due to the foreign exchange movement, which can change tomorrow, as we know.

“Linked to that is the all-important question of the government’s capacity to pay its way, debt, credit is all about the revenue to service and, of course, to use those funds properly, judiciously, accountably and in a way that gives positive returns.”

Edun noted that, by comparing the operating surpluses of revenue-generating agencies by law under the Fiscal Responsibility Act and other legal guidelines and how much is outstanding and owed, “we are actually positive.”

“The amount that is owed and that we are claiming far out exceeds the N3.4tn in Ways and Means and as I’ve said before, we do not rely on ways and means to pay salaries, we don’t rely on it to pay external debt servicing or other obligations. That is the situation, the finances of Nigeria have been revamped,” Edun said.

Meanwhile, the federal government said it had completed 80 per cent of the 330 emergency road and bridge repairs projects nationwide, valued at over N500bn.

The Minister of Works, Dave Umahi, also disclosed this to journalists at the State House after Tuesday’s FEC meeting.

Umahi also announced that the Ministry of Finance has fully released N300bn for the projects, with the remaining work expected to be completed soon.

“Let me announce that the 330 emergency repairs of roads and bridges across the country, valued at over N500bn, is about 80 per cent completed, and the Ministry of Finance has fully released N300bn for the projects, and we are going to publish by next week the full details and the level of completion.

“Also, the PIDF (Presidential Infrastructure Development Fund) projects the Abuja to Kano, the Lagos to Ibadan and the Second Niger Bridge. The Abuja to Kano has been dismembered into three, with two for tax credit by Dangote and BUA and the other by Julius Berger. Berger has moved back to site and the other tax credit contractors will be mobilized by next week,” he said.

The Minister said he submitted three memoranda to the Council and secured approvals for contract reviews for several ongoing projects, including the construction of Umulungbe–Umuoka Road in Enugu State, the repair of Iganmu Bridge in Lagos State, and the dualization of Calabar–Odupkani–Itu Road in Cross River State.

Additionally, the Council approved contracts for the rehabilitation of Katsina-Dutsin-Ma-Maraban Road in Katsina State.

“Today in FEC, we have three approvals for review of ongoing projects; the first one was the review for the construction of Umulungbe–Umuoka Road in Enugu state. It was approved for review from N6.25bn to N8.85bn, about N2.6bn addition.

“We had the review of the repair of the Iganmu Bridge in Lagos State, it’s reviewed from N1.16bn to N2.23bn. The last one was approval for the dualisation of the Calabar to Odupkani to Itu Road in Cross River State. It was changed from flexible to rigid pavement, dualized with improved soft structure engagement. It is reviewed from N79.65bn to N118.41bn.

“There is also approval for the immediate procurement of full rehabilitation of the road in Katsina State, that is, the road on the Katsina–Dutsin-Ma–Maraban Road in Katsina State, and it is approved for immediate selective procurement,” he said.