Overall, Exness is the highest rated broker in our research on multiple factors.

The risk of trading with a broker that is not locally regulated means that you’re in danger of losing your money.

The CMA issues non-dealing forex broker licenses meaning they cannot engage in market activities. They only act as middlemen between the international forex markets and you.

Comparison of Best Forex Brokers in Kenya

| 💼Broker | ⚖️ CMA Regulated | 💱 Base currency | 💰 Min deposit | 💵 Currency pairs | 💻 Platforms | 🎯 EUR/USD average spread | 💳 Funding methods |

| Exness | Yes | KES, USD, GBP, AUD, US cents, GB pence, Au cents | 10 USD | 100+ | MT4, MT5, Exness trader app | 1pip | MPesa, e-Wallets, Cards, Banks, Crypto |

| HF Markets | Yes | KES, USD, US cents, EUR, NGN, & JPY | 700 KES | 50+ | MT4, MT5, HFM app | 1.6 pips | Mpesa, e-Wallets, cards, banks, crypto. |

| Pepperstone | Yes | USD & GBP | Zero | 60+ | MT4/5, cTrader, TradingView | 1.1 pips | Mpesa, PayPal, Cards, banks, telex |

| FxPro | No | USD | KES 200 | 50+ | MT4/5, cTrader, TradingView | 1.26 pips | Bank Wire, Cards, Skrill |

| FxPesa | Yes | USD | 5 USD | 50+ | MT4, MT5, EquitiTrader. | 1.4 pips | Mpesa, Eazzypay, Airtel money, Vodacom, HaloPesa, TigoPesa, E-Wallet, Mobile money, local banks, cards |

| Scope Markets | Yes | KES, USD | 100 USD | 60+ | MT5, scope trader, scope copy | 1.1 pip | Mpesa, e-Wallets, cards, bank, |

List of Best Forex Brokers in Kenya

- Exness– Overall Best Forex Broker in Kenya

- HF Markets – Best Forex Broker for Beginners in Kenya

- Pepperstone – ECN Broker in Kenya with CMA License

- FxPro – Forex Broker with cTrader Platform

- FxPesa – Local Forex Broker with MPesa

- Scope Markets – Good CMA Regulated Forex Broker in Kenya

We’ve analyzed the best forex brokers in Kenya using these parameters – regulation/safety, number of instruments, Fees, platforms and general trading conditions.

#1. Exness – Overall Best Forex Broker in Kenya

- CMA regulated – Yes

- Physical office in Kenya – Yes

- In the forex business for more than 10 years – Yes

Exness is a global multi-asset broker founded in 2008. It is registered and regulated by the Kenyan Capital Markets Authority (CMA) with license number 162.

It is also licensed to operate by FSA Seychelles, CBC SintMarteen, FSC British Virgin Islands, FSC Mauritius, FSCA South Africa, CySEC Cyprus, & FCA United Kingdom.

In terms of regulation, Exness has an excellent regulatory backup from the CMA Kenya as well as international bodies.

Exness Account types– Exness has the Standard, Standard Cent, Raw Spread, Zero, & Pro Account types. They come in KES, USD, GBP, AUD, USC, GBC, and AUC base currencies.

All Exness accounts come with 1: 400 maximum leverage limits. Exness also offers a Demo Account for practice purposes.

Exness minimum deposit for Standard Accounts is 10 USD and for Raw Spread, Zero, and Pro Accounts is 500 USD

Exness Funding Methods include Bank transfer, Cards, e-Wallets,MPesa& Mobile money, all take 30 minutes to deposit and 24 hours to withdraw. Cryptocurrency takes 24 hours for both deposit and withdrawal to be affected.

Summary

- MPesa accepted? Yes

- e-Wallet payment accepted? Yes

- Card payment accepted? Yes

- Bank transfer accepted? Yes

- Cryptocurrency accepted? Yes

Exness Fees– Spread starts from 0.3 pip on the Standard Accounts, 0.0 pip for the Raw Spread & Zero Accounts, and 0.1 pip on the Pro Account.

Exness EUR/USD average spread is 1.0 pip on Standard Accounts & 0.0 pip on the Zero Account

Exness Standard & Pro Accounts are commission free, but the Raw Spread & Zero Account has a $3.5 per side commission.

Exness does not charge an inactivity fee & does not charge overnight swaps on Forex, Crypto, Stocks, Indices, & Gold CFD instruments.

Summary

- Deposit & withdrawal fees? No

- Swap fees on major currency pairs? No

- Inactivity fee? No

Exness General Trading Conditions– Exness clients in Kenya can trade CFDs on100+ Currency Pairs, Metals, Energies, Shares, & Indices.

Exness CFD instrument offering for Kenyan clients is limited in terms of diversity. Some notable asset classes are not on offer such as ETFs, Crypto, Soft Commodities, &Bonds

Your trades are executed on any of the following platforms. Exness Trade Mobile App, Exness Web Terminal, MT4, or MT5.

| 👍 Pros | 👎 Cons |

| Exness is a CMA regulated broker | High minimum deposit of $500onProfessional Accounts. |

| Exness offers Kenyan Shilling base currencytrading accounts | Some asset classes cannot be traded in Kenya. |

| Exness accepts MPesa deposits & withdrawals | No copy trading for Exness Kenya clients |

| No inactivity fees on Exness | |

| Exness permits swap free CFD trading | |

| Exness does not charge any fees for withdrawals | |

| Exness has Cent Accounts for beginners trading Forex & Metal CFDs | |

| Exness has a Demo Account | |

| 24/7 live support |

Read more information about Exness Kenya on their website

#2. HF Markets – Best Forex Broker for Beginners in Kenya

- CMA regulated: Yes

- Physical office in Kenya: Yes

- In the forex business for more than 10 years: Yes

Formerly known as Hotforex, HF Markets was established in 2010 and operates under the HFM brand name.HF Markets is licensed by the Kenyan Capital Markets Authority (CMA) as a non-dealing forex broker with license number 155.

HFM is also regulated outside Kenya by the FCA United Kingdom, DFSA Dubai, FSCA South Africa, & FSA Seychelles.

HF Markets Account Types

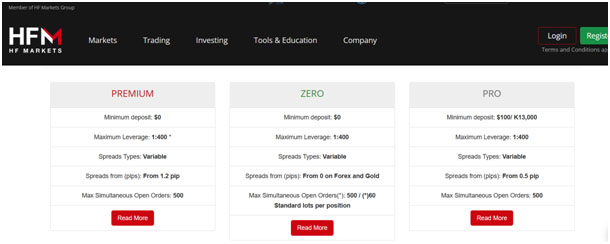

There are four account types on HF Markets. The Cent, Zero, Pro and Premium Accounts. There is also a demo account for practice.

First is theHFM Cent Account which operates with the US cent base currency and is designed for beginners who don’t want to risk much capital. It has a 700 KES minimum deposit, zero commissions and comes with a 1:400 leverage

Second is theHFM Zero Account has KES, USD, EUR, NGN, & JPY base currencies, $3 per side commissions,no minimum deposit, and a 1:400 leverage. It has a 700 KES minimum deposit

Third is the HFM Premium Account which has KES, USD, EUR, NGN, & JPY base currencies, no minimum deposit, zero commissions and leverage of 1:400. It has a 700 KES minimum deposit

Finally,the HFM Pro Account has KES, USD, EUR, NGN, & JPY base currencies, 100 USD or 13,000 KES minimum deposit, zero commissions and leverage of 1:400

Minimum withdrawal on all HF Markets Accounts is 700 KES via local payment methods such as MPesa.

Summary

- Kenyan Shilling base currency? Yes

- Minimum deposit? Yes

- Minimum Withdrawal? Yes

- Demo account? Yes

- Cent Account? Yes

HF Markets Fees

HFM does not offer fixed spreads, so the spreads fluctuate (variable spread). On the Zero Account spreads start from 0.1 pips, the Cent& Premium Account spreads begin from 1.4 pips, while the Pro Account spreads begin at 0.5 pips.

Overnight swaps are waived for Popular Forex Pairs, XAU/USD, &US/UK Oil CFDs

HF Markets does not charge any deposit except for wire transfers below 100 USD. Withdrawal is free

However, it charges an inactivity fee of 5 USD per month for accounts that have been dormant for 6 months or above.

Summary

- Swap fees? Yes

- Inactivity fees? Yes

- Withdrawal Fees? No

HFM Funding Methods

Local bank, Mpesa, DusuPay, Airtel, Vooma, Equitel, Pesalink, Bonga, Master/Visa, Neteller, &Skrill are all accepted payment methods.

HFM General Trading Conditions

HF Markets traders get exposure to CFDs on 50+ Currency Pairs, Metals, Energies, Indices, Stocks, Commodities, Bonds, ETFs, Crypto.

HF Markets provides a variety of platforms for traders. It has a mobile app that is available on Google Play store and Apple Store. It also has the MetaTrader 4 and 5 trading software.

HF Markets Kenya offers copy trading service, but you need a $25 minimum deposit to start as a follower.

When copy trading on HF Markets you can only trade Forex, Spot Indices, Spot Energies, & Gold CFDs.

HF Markets provides three sections where traders can get information. There is Forex News, HF Analysis and Advanced Insights. These three provide traders with in-depth technical and fundamental analysis of the market.

| 👍 Pros | 👎 Cons |

| CMA regulation | HF Markets Inactivity fee is $5 |

| KES base currency | Live support is unavailable on weekends |

| Demo account | |

| Copy trading | |

| No overnight swaps charged on Forex, Gold, & Oil | |

| Cent Account is available on HF Markets Kenya | |

| HFM Kenya accepts MPesa as a means of deposit & withdrawal |

Read more information about HF Markets Kenya on their website

#3. Pepperstone – ECN Broker in Kenya with Trading View Terminal

- CMA regulated: Yes

- Physical office in Kenya: Yes

- In the forex business for more than 10 years: Yes

Pepperstone limited was established in 2010. Pepperstone Markets Ltd is registered with the Capital Markets Authority (CMA) Kenya and holds CMA license number 128.

They are also licensed by the FCA United Kingdom, & ASIC Australia, DFSA Dubai, SCB Bahamas, BaFin Germany, and CySEC Cyprus.

Pepperstone Account Types

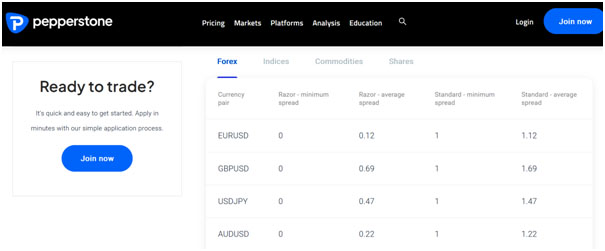

Pepperstone offers you two account types: the Standard Account and the Razor Account. The base currency for both accounts can be either USD or GBP only. Pepperstone Kenya does not have KES base currency accounts.

The Standard Accounts don’t charge commissions, while the Razor Account combines commission charges and low spread charges.

Pepperstone also has a Demo Account for new traders to learn the ropes of forex trading.

The available leverage on both the razor and standard account is 1.400. With Pepperstone, there is no minimum deposit for funding your account.

Summary

- KESbase currency?No

- Minimum deposit? No

- Demo account? Yes

Pepperstone Funding methods: Visa/MasterCard, Bank Transfers, Mpesa, and PayPal are all accepted. For telegraphic transfers, the fees are passed on to the client. Withdrawals by bank transfers can take at least 3 working days

Pepperstone Fees

TheEUR/USD benchmark average spread charged by Pepperstone Kenya is 0.1 pips on the Razor Account and 1.1 pips on the Standard Account.This means this is the lowest spread you can get with the broker.

Commission when trading on MT4/5 or TradingView terminals is $3.5 per side per lot, &when usingcTrader commission is $3 per side per lot,

Swap fee is charged as cost of financing overnight positions.

Deposits and withdrawals are free with pepperstone as there is no charge.Pepperstone does not charge any fee for account inactivity or dormant accounts.

- Mpesa accepted? Yes

- PayPal accepted? Yes

- Card payment accepted? Yes

- Bank transfer accepted? Yes

- Cryptocurrency accepted? No

- Swap fee? yes

- Deposit & withdrawal fees? No

Pepperstone General Trading Conditions– Pepperstone offers 60+ currency pairs, indices, commodities, cryptocurrency, shares CFDs, & ETFs

For trading platforms, Pepperstone does not have their own proprietary mobile app for Kenyans, but MT4/5, cTrader, &TradingView platforms are available as 3rd party mobile apps.

cTrader is modern and a competitor to MT5, while TradingView is a platform that specializes in trading from advanced & interactive charts.

Copy trading on Pepperstone is known as social trading and traders can deploy the trading strategies of the more experienced traders.

Pepperstone partners with different social trading platforms to bring this initiative to its clients. They have MyFxbook, MetaTrader signals and DupliTrade.

| 👍 Pros | 👎 Cons |

| CMA regulated | KES base currency not available on Pepperstone |

| Pepperstone has 90+ forex pairs available for CFD trading | Pepperstone does not allow swap-free trading in Kenya |

| C-Trader &TradingView platforms are available on Pepperstone | No proprietary trading app |

| No deposit & withdrawal fees | No beginner type accounts such as Cent Account |

| No inactivity fees | Live support response can be slow & is not available 24/7 |

| Pepperstone spreads are low because EUR/USD 1.1 pip spread is below what most brokers charge on Standard Accounts | |

| Lots of tutorial videos & free trading tools for MetaTrader |

Read more information about Pepperstone Kenya on their website

4. FxPro – Forex Broker with cTrader Platform

CMA regulation? No

Physical office in Kenya? No

In the forex business for more than 10 years? Yes

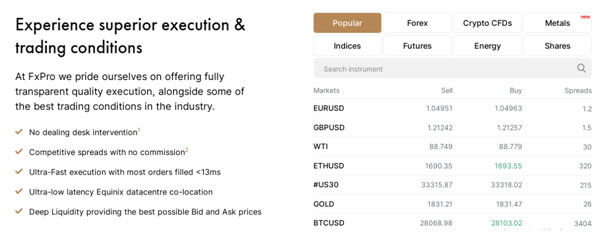

Although FxPro accepts Kenyan traders, they remain unregulated by the CMA & you trade without protection from Kenyan laws.

FxPro is regulated overseas by the Securities Commission of Bahamas, & your account is also opened under Bahamas business laws. This makes them riskier compared to other forex brokers in this list.

The parent company of FxPro broker is also licensed with FCA, which makes them tier-1 regulated. But for Kenyan traders, they are not locally licensed.

Account Types & Fees:FxPro has a high minimum deposit of $20 (KES 200 when you are using MPesa). The default leverage with accounts is 1:200; they offer 4 different account types, which depend on your platform.

Note: even a 1:200 leverage is still highly risky, and you should select lesser leverage when prompted.

If you like to trade without paying commissions, the FxPro Standard & Pro Accounts exclude commissions, but you pay an average EUR/USD spread of 1 to 1.5 pips.

For those who would rather pay commissions to get tighter spreads, the Raw+ & Elite Accounts were designed for that purpose; with $3.5 per side commissions and EUR/USD average spreads of 0.2 pip.

- Kenyan Shilling (KES) base currency accounts? No

- Minimum deposit? KES 200

- Demo account? Yes

Funding Methods:FxPro accepts deposits & withdrawals at no cost from Local Kenyan Banks, MPesa, Broker to Broker, Visa/Master/Maestro Cards, Skrill, &Neteller. However, withdrawal without trading will attract a penalty/fee.

Trading Conditions: Tou trade the markets through CFDs on: Forex, Indices, Shares, & Commodities. FxPro has several platforms such as MT4 which is popular amongst forex/algorithmic traders, MT5, cTrader, as well as their own FxPro platform on mobile devices & browsers.

| 👍 Pros | 👎 Cons |

| Accounts were designed with different types of traders in mind | FxPro is not regulated by CMA Kenya. This makes them a higher risk broker for local traders. |

| Accepts MPesa with minimum deposit of KES 200 | No KES base currency account |

| FxPro spreads are competitive. EUR/USD benchmark spread is 1.26 pips on their Standard Account which is at par with industry standards | $10 inactivity fee |

| FxPro has multiple trading platforms including cTrader&TradingView | FxPro Raw spread Account minimum deposit of $500 is high |

| 1:200 leverage which can be set to lower | FxPro does not provide for swap-free trading, so you pay for leaving positions open overnight |

| FxPro lets you trade micro lots on the Standard Account which is good for beginners | |

| FxPro offers you excellent trading tools to manage risk with | |

| Education for beginners |

Read more information about FxPro Kenya on their website

5. FxPesa – Local Forex Broker with MPesa

- CMA regulated: Yes

- Physical office in Kenya: Yes

- In the forex business for more than 10 years: Parent Equiti Group is reputed

FxPesa operates under the company group EGM Securities Ltd. It is a registered company in Kenya and was established in the year 2012.

FxPesa is regulated by the Capital Markets Authority in Kenya as a non-dealing online foreign exchange broker with license number 107.

FxPesa Account Types

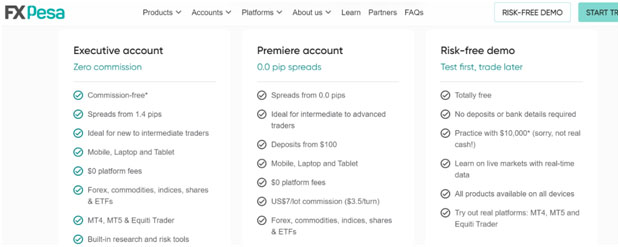

FxPesa has two live trading account types- the Executive and Premier accounts. There is also a demo account for practice.

For the Executive Account, the base currency is USD. The minimum deposit allowed is 5 USD, there is zero commission on trades, and the spread starts from 1.4pips.

The maximum leverage is 1:400. The Executive account is available on MT4, MT5 and Equiti trader on all platforms.

The Premier Account has a spread from 0.0pips, a minimum deposit of 100 USD and commission of $3.5 per side. Its maximum leverage is 1:400. The only available base currency on FxPesais USD.

Summary

- Kenyan Shilling base currency? No

- Minimum deposit? Yes

- Demo account? Yes

FxPesa Funding Methods

FxPesa accepts M-Pesa, EazzyPay, Airtel Money, Mobile money payments from Uganda (MTN & Airtel) are also accepted; as well as from Tanzania (Vodacom, Airtel TZ, HaloPesa, TigoPesa).

There is also the option of a credit card- here you can deposit or withdraw funds using MasterCard, & VISA in the local KES.

Bank transfers are also another method of making deposits. Both local and international bank transfers are allowed using KES or USD.

All deposit methods are instant however withdrawals take 1-2 working days.

Summary

- MPesa accepted? Yes

- e-Wallet payment accepted? Yes

- Card payment accepted? Yes

- Bank transfer accepted? Yes

FxPesa Fees

FxPesa spread is variable and for the major currency pairs like EUR/USD, spread is 1.4 pips on Executive Account, and 0.0 pip on the Premiere Account.

There is no commission on trading for the Executive Account. However, the Premiere Account has a commission of $3.5 per side.

Apart from international bank transfers which have a fee of 15 USD, there is no fee on all other deposit and withdrawal methods.

FxPesa charges a swap fee as the cost of financing when you leave positions open overnight. For EUR/USD the swap fee is -8.335 for a long position, and 4.014 for a short position

An inactivity fee equivalent to three basis points plus the SOFR 30-day rate published for the calendar month is charged after 180 days (about 6 months) of inactivity.

Overall, the Fees on FxPesaare good. It doesn’t overcharge its traders on the platform.

Summary

- Deposit fees on all methods? No

- Withdrawal fees on e-Wallets & mobile money? No

- Withdrawal fees on Cards? No

- Withdrawal fees on local bank transfers? No

- Withdrawal fees on international bank transfers? Yes

- Swap fees? Yes

- Inactivity fee? Yes

FxPesa General Trading Conditions

FxPesa offers CFD trading on 50+ Currency Pairs across Major, Minor & Exotic forex categories. This broker also facilitates CFD trade in Commodities, Indices, Shares and ETFs.

FxPesa has the MT4, MT5 and Equiti Trader mobile app for you to trade on using any trading account. These apps are available on the Google Play store and Apple Store.

FxPesa does not offer copy-trading services. However, it organizes financial literacy events. Aside from these, it also provides free e-resources such as videos on YouTube.

| 👍 Pros | 👎 Cons |

| Demo account | Swap fees |

| CMA regulation | Inactivity fees |

| Multiple local deposit and withdrawal options | The FXPesaEquiti Trader Mobile App lacks sophistication. Many traders may prefer using the MT4/5 app offering |

| Low spreads | FxPesa does not offer KES base currency |

Read more information about FxPesa on their website

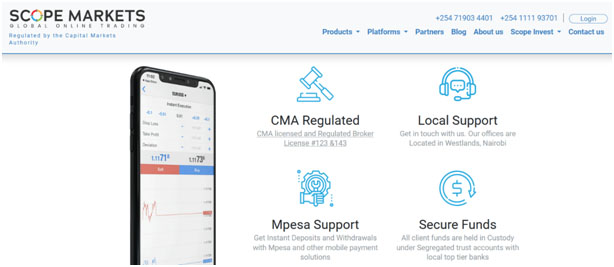

#6. Scope Markets – Good CMA Regulated Forex Broker in Kenya

- CMA regulated: Yes

- In the forex business for more than 10 years: Yes

SCFM Limited with its trading name Scope Markets is a non-dealing online forex broker. It was established in 1997. It is regulated and licensed by the Capital Markets Authority (CMA) with license number 123.

Scope Markets Account Types– the Silver Account is a commission free account with KES & USD base currencies and a 100 USD minimum deposit.

The Gold Account: Comes in KES & USD base currencies and a 100 USD minimum deposit. Demo Account: For beginners to learn how to trade using virtual money.

Scope Markets Funding methods– Cards, e-Wallets, Mobile money channels like M-Pesa, Airtel, Equitel&PesaLink.

- MPesa accepted? Yes

- e-Wallet payment accepted? Yes

- Card payment accepted? Yes

- Bank transfer accepted? Yes

- Cryptocurrency accepted? No

Scope Markets Fees– Scope Markets spreads are competitive. EUR/USD average spread is 1.1 pip on the Silver Account & 0.2 pip on the Raw spread Gold Account which corresponds to industry trends

Scope Markets does not charge a fee for deposits or withdrawals but after one free withdrawal per day, you will be charged 35 USD/ 35 EUR/ 35 GBP to make any additional withdrawals.

There is an inactivity fee of 10 USD after 6 months of account dormancy.Scope Markets don’t charge swap fees on major currency pairs.

- Deposit fees? No

- Withdrawal fees? Yes

- Swap fees on major currency pairs? No

- Swap fees on minor currency pairs? Yes

- Inactivity fee? Yes

General Trading Conditions– Scope Markets lets you trade CFDs on60+ Currency pairs, Shares, Indices, Commodities and Nairobi Stock Exchange (NSE) Derivatives.Scope market platforms are the MT5, Scope copy, and Scope mobile trader.

| 👍 Pros | 👎 Cons |

| CMA regulated | High minimum deposit of 100 USD |

| No swap fees on major currency pairs | Withdrawal fees |

| Competitive spreads when compared to industry averages | CFD instrument menu contains fewer asset classes than competitors have |

| Nairobi Stock Exchange Derivatives can be traded on Scope Markets Kenya | No MT4 platform |

| Demo Account | Inactivity fees |

| Scope Markets has KES base currency | Live chat support is not available 24/7 |

| Scope Markets accepts MPesa transactions |

Read more information about Scope Markets Kenya on their website

How to Spot a Good Forex Broker in Kenya?

There are several factors that traders in Kenya should consider in a forex broker. We’ve listed some important points we checked during our research below:

- CMA Regulation – Any forex broker you decide to trade with must be properly regulated.

Most countries have financial regulatory agencies that provide licenses for brokers to operate. For forex brokers to gain this license, they’ll have to meet certain requirements that guarantee their trustworthiness.

Regulators also ensure forex brokers’ activities are in line with accepted best practices in the industry as they deal with traders.

Trading with a licensed broker protects your investment if the broker fails to meet its obligation. Your country’s regulatory agency can hold them responsible and ensure you don’t lose out.

It also protects you from being scammed by fraudulent forex brokers as they will not be able to meet the requirements needed for licensing.

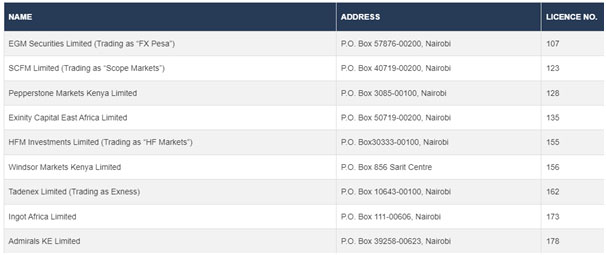

Visit the Capital Markets Authority (CMA) website and download the list of licensees.

This list is updated whenever any licensed broker changes, whether addition of new license or suspension of license.

2.Account Base Currency– In forex trading, your base currency is the currency that is allowed for use in your account. Simply put, it is the legal tender of your account, & all transactions are carried out through it.

Once you open an account and select a base currency you cannot change it. The only option is to open another trading account with a different base currency.

The base currency is very important as it determines your margin requirements and cash accounts, hence, you must ensure your forex account’s base currency is in your home country’s currency.

For example, if you’re from Kenya and the base currency of your forex account is the USD, what happens is when you make a KES deposit, it will be converted to USD, and you’ll have to pay currency conversion fees.

This scenario will also play out when you want to make withdrawals, you’ll have to convert from USD to KES before you withdraw. The deposit and withdrawal fees can eat deeply into your trading funds and contribute to your loss.

However, if your base currency is in KES, you won’t bother about conversion fees thereby saving the funds & using that amount to trade.

Base currency is determined when opening your account.

Make sure you check if the broker has base currency in your home country’s currency. Most brokers have their base currency in USD, EUR, AUD, CAD, JPY, CHF etc. Ensure they have KES if you want to save some funds.

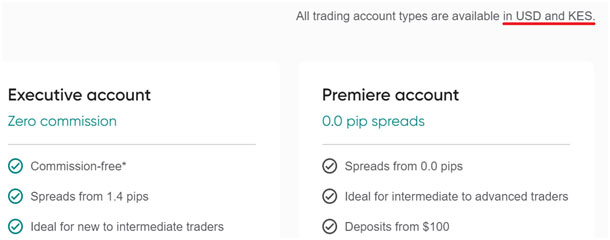

You can find the account currency normally under the account types listed by the forex broker. For example, FxPesa lists three account types, and they mention that all these accounts can be opened in USD or KES.

If you select KES during account opening, then KES will become the base currency for your trading account.

Note that ‘trading account’ is different from your broker account. In most cases, forex brokers allow you to have multiple trading accounts under your broker account.

- The number of Currency Pairs– A currency pair is a comparison of the value of two different national currencies compared against each other.

This is done during forex trading to speculate which will rise in value against the other. Currencies are expressed using currency codes e.g. USD for United States Dollar. Currency pairs are expressed this way: GBP/USD, EUR/USD, JPY/CHF, KES/USD etc.

There are major, minor and exotic currency pairs. When choosing a forex broker, choose the one that has a high number of currency pairs on offer.

A high number of currency pairs gives you the liberty to choose among varieties of currency pairs to trade. It can also help in diversifying your trading portfolio, as you get to trade different currencies across different countries and continents.

A broker with many currency pairs on offer also gives you the benefit of hedging against risk. Since some currencies are more volatile than others, you can trade the volatile pairs with high risk and hedge them with the more stable pairs.

The EUR/USD is the most liquid and highly traded currency pair in the world and has many people ready to trade it. However, pairs like the USD/KES (US dollar vs Kenyan shilling) are less liquid and highly volatile as not many people are on board to trade it.

Some other currencies like the New Zealand dollar (NZD), Australian dollar (AUD), and Canadian dollar (CAD) are called the commodity dollars, because their value depends on how much of commodities their countries can export. New Zealand exports milk, Canada exports oil, and Australia Gold.

Commodity currencies can be useful for hedging risk and navigating volatility in the forex market and are a must have before you sign with a broker.

- Platforms– a good broker should have multiple trading platforms that are compatible with different devices. Trading platforms such as MT4 and MT5 should be available.

Choosing a broker without finding out if they have a good mobile app could mean you are limited to trading on desktop platforms which is inconvenient when you need to trade on the run.

Most proprietary apps developed by forex brokers are extensions of the MT5 platform, but they are modified to have a more user-friendly interface than MT5. For example,HFM broker has the HFM proprietary app which is easier to use than MT5.

Trading with a broker with multiple trading platforms will enable you to monitor your trades better, because you’ll be logged in on multiple platforms. You could also use your mobile device, web and PC to monitor trades.

Also, different trading platforms have specific tools and features unique to them, by having them all you get access to these features which provides a seamless trading process.

- Fees– Forex brokers charge different types of fees ranging from trading commissions, deposit and withdrawal fees, spreads, overnight swap fees etc. These fees eat into your trading capital and even profits.

For example, spread- the difference between ask and bid of a currency pair, is one-way brokers make money.

The bid price is the price the general market is willing to pay for a currency pair, while the asking price is the price the broker is selling the currency pair to you for.

Whenever you open a trading order you notice your account is in a negative, and that is because the asking price you paid your broker is always lower than the bid price the market is willing to pay. By the time you close your trade at a profit, the negative balance will clear.

The spread is the broker’s profit. For example, the bid price for EURJPY is 1.4860 and the ask price is 1.4865. The spread of 5pips is the broker’s profit which he makes for every trade you execute. When choosing a broker, choose those with tight spreads or zero spreads on the currency pairs you wish to trade the most.

Some brokers charge commissions when you trade with them. The commission is a fixed rate or percentage brokers take for their services. Check the commission a broker charges for deciding to trade with them.

Swap fees or rollover rate applies when a currency CFD trading position is held overnight. It is a result of the interest rate difference between the two paired currencies.

When you ‘go long’ or buy a currency pair where the quote currency has a lower interest rate than the base currency, you are credited with the interest rate difference every night.

When you go short or ‘sell’ a currency pair where the quote currency has a lower interest rate than the base currency, you will be debited every night with the interest rate differential for as long as you hold the position open.

The brokers typically add their own markup to the interest rate differential and debit or credit you accordingly. Always look up the broker’s swap rate or if they charge or not. Some brokers offer swap free accounts. Also keep an eye on central bank announcements so you know when interest rates change or are about to change.

- Funding Method: Any good broker should have multiple payment methods- deposits and withdrawals. Multiple deposit and withdrawal methods have their benefits.

Multiple payment options give you the freedom to choose the best and most seamless way to deposit and receive funds from your broker.

Local & indigenous payment channels like MPesa should be provided by your broker because they are usually cheaper and faster than international payment methods.

Frequently Asked Questions – Best Forex Brokers in Kenya

Who is a retail forex broker?

A forex broker is an intermediary that facilitates trade in currencies for individuals. A retail forex broker can be an individual or organization that provides a platform for forex trading.

Who is the best forex broker in Kenya?

There is no single best forex broker, but Exness, HF Markets &FxPesaaregood forex brokers in Kenya.

All three brokers have been in the business for more than 10 years, accept deposits and withdrawals in Kenyan shillings, and allow payments local currencies.

Also, these brokers have commission and spread free account options to suit your needs. They also have a demo account for practice.

Which are the forex brokers with MPesa?

The forex brokers with MPesa are: FXPesa, Pepperstone, HF Markets, Exness, Scope Markets Kenya, and XM brokers.

How do I know if a Forex broker is licensed or legit?

To know if a forex broker is legit or licensed, go to the website of the CMA, and download the list of licensees. Any forex broker that is not listed in their list of licensees, but still accepts clients from Kenya is a high-risk broker.

Are there forex broker scams in Kenya?

Yes, there are forex broker-related scams in Kenya. There have been many reported cases of brokers scamming through phishing.

Avoid any unlicensed broker to avoid scams.