For the safety of your funds, traders based in Nigeria should only trade via forex brokers that are regulated by multiple Tier-1 & Tier-2 regulations.

There are only a few Top-Tier regulated forex brokers that operate in Nigeria, which we consider to be low risk. In our research, Exness stood out on most of the important metrics.

Read our research on brokers& detailed list of the various metrics.

| 📂 Forex Broker | ⚖Regulation(s) | 💰 Starting deposit | 🏦 Naira Account | 🌐 Website |

Exness

|

FCA, CYSEC, FSCA, FSC, FSA, FSC(BV), CBC, CMA | $10 | Yes | www.exness.com

|

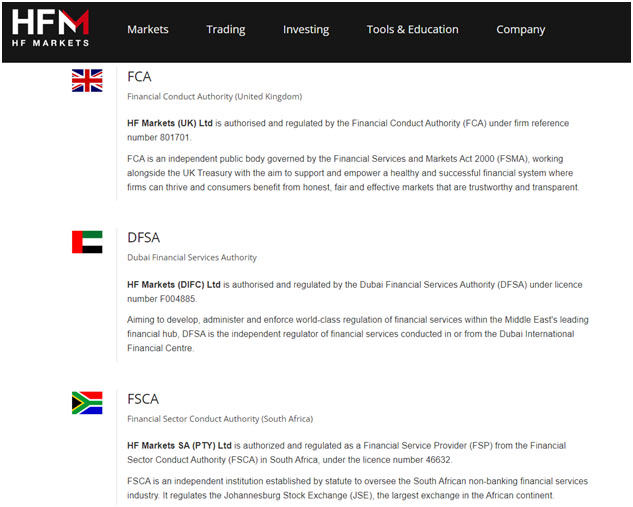

| HFM

|

FCA, DFSA, FSA, CMA, FSCA | $5 | Yes | www.hfm.com/sv/en-ng

|

| FXTM

|

FCA, CYSEC, CMA, FSCA, FSC | N80,000 | Yes | www.forextime.com

|

| XM

|

CYSEC | $5 | No | www.xm.com

|

| AvaTrade

|

CBI, ASIC, CYSEC, FSCA, BVI FSC, FSA Japan, FRSA Abu Dhabi | $100 | No | www.avatrade.ng

|

|

OctaFX

|

MISA, CYSEC, St. Vincent & The Grenadines | N30,000 | No | www.octafx.com

|

| FxPro

|

FCA, FSCA | $100 | No | www.fxpro.com

|

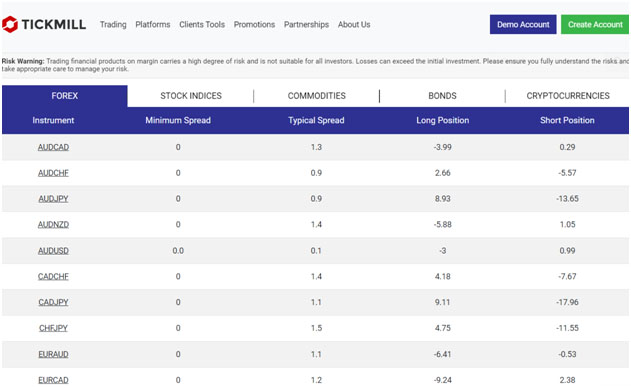

| Tickmill

|

FCA | $100 | No | www.tickmill.com

|

Best Forex Brokers in Nigeria

- Exness – Overall Best Forex Broker in Nigeria

- HotForex (HFM) – Best Forex Broker for Beginners

- FXTM – Best Forex Broker for Naira CFDs on USD/NGN& EUR/NGN

- XM Broker – Best Forex Broker for Spread Only Trading Account

- AvaTrade – Best Forex Broker for Fixed Spreads

- OctaFX – Good Forex Broker with Local Funding Options in Nigeria

- FxPro – Best Forex Broker with Multiple Platforms at Low Cost

- Tickmill – Best Regulated Forex Broker with Pro Accounts

- IC Markets – ASIC Regulated Forex Broker

- PepperStone – Forex Broker with Commissions

We scrutinized these international forex brokers accepting Nigerian clients based on multiple metrics including: Regulation(s), Fees, Platforms, Payment options for Nigerian traders, List of Instruments, Customer support & Promotions/Bonuses.

1. Exness – Overall Best Forex Broker in Nigeria

Pros:

- Tier 1 regulation from FCA UK(Exness is also regulated in 2 African countries: Kenya & South Africa)

- Exness has a Demo Account for practicing with fake cash in a virtual trading world

- Exness has Naira base currency trading accounts

- Exness has a Cent Account which restricts trading to smaller volumes & this is good for beginners who want live trading which the demo account doesn’t provide

- Low spreads when compared to what major competitors offer

- Exness allows swap-free trading(no overnight fees) on several instruments

- Exness has a powerful mobile app with over 10 million downloads on google play store

- Exness does not charge inactivity fee

- Exness 24/7 customer support channels are open even on weekends

- Exness offers VPS hosting to prevent downtime when there’s no network locally

Cons:

- No bonus is available

- Range of tradable asset classes are limited

- Exness is not licensed by SEC in Nigeria

Regulation/Licenses: 5/5

Exness is a retail Forex broker that was founded in 2008 and is regulated by:

- The Financial Conduct Authority (FCA) UK

- Cyprus Securities and Exchange Commission (CySEC)

- Financial Sector Conduct Authority, South Africa

- Financial Services Commission (FSC) Mauritius

- Financial Services Authority (FSA) Seychelles

- Financial Services Commission (FSC) British Virgin Islands

- Central Bank of curacao and Sint Maarten

- Capital Markets Authority Kenya (CMA)

Exness (SC) Ltd. does not have a physical local office in Nigeria.

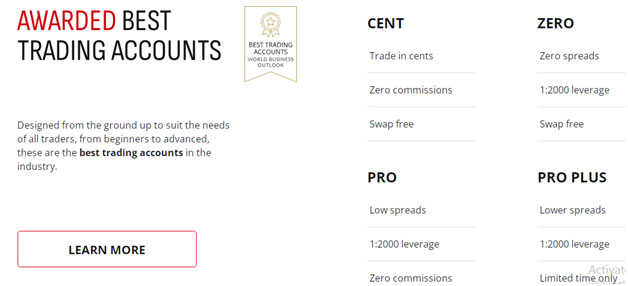

Exness Fees: 5/5

When trading live you are bound to incur: Commissions, Spreads, and Swaps(overnight fees).

However Exness Standard Account users don’t pay commissions, but have to pay spreads from 0.3 pips & above. This implies EUR/USD spread of around 1 pip and GBP/USD around 1.2 pips.

Traders who have more experience are the target of Exness Professional Accounts which require you to pay $3.5 per side commissions which is high as per industry standards; but pay lower spreads starting from 0.0 pips.

Holding a forex CFD position overnight means you earn or pay swap however in many cases you don’t even earn anything. As seen on Exness website, if you bought GBP/USD, you pay $0.18708 every night & if you sold you still pay $$0.11063.

However Exness has enabled swap-free tradingwhich comes with a condition that you trade mostly during the day.

Exness conditional swap-free instruments are: Indices, Crypto, Gold, &Major Forex Pairs.

Warning: Over 80% CFD traders lose money, so you should be careful about ‘trading actively’without a good plan, as you could incur losses.

Exness Payment Channels: 4.7/5

Exness in Nigeria does not charge fees for deposits/withdrawals. Although Exness accepts transactions to/from local Nigerian Banks, they are yet to configure their systems to accept transactions from more indigenous/local mobile money platforms.

Exness allows you the option of choosing your account base currency to be in Naira, thus you don’t have to go around sourcing for Us Dollar or any foreign currency to trade with. You also avoid paying currency conversion fees since you are trading with Naira Currency.

Find below list of accepted payment methods on Exness:

| Method | Minimum amount | Duration |

| Bank/Card | ● Withdrawal: $10

● Deposit: $10 |

● Withdrawal: 24 hours

● Deposit: – |

| Skrill | ● Withdrawal: $10

● Deposit: $10 |

● Withdrawal: 24 hours

● Deposit: 30 minutes |

| Neteller | ● Withdrawal: $4

● Deposit: $10 |

● Withdrawal: 24 hours

● Deposit: 30 minutes |

| Online Bank Transfer | ● Withdrawal: $3

● Deposit: $10 |

● Withdrawal: 24 hours

● Deposit: 30 minutes |

| Perfect Money | ● Withdrawal: $2

● Deposit: $10 |

● Withdrawal: 24 hours

● Deposit: 30 minutes |

| SticPay | ● Withdrawal: $1

● Deposit: $10 |

● Withdrawal: 24 hours

● Deposit: 30 minutes |

Exness Tradable Instruments: 4.5/5

Exness offers Forex trading on 100+ Currency pairs (including major, minor and exotic pairs), 10+ Metals, 90+ Stocks, 10+ Indices and Energies. Leverage ratio offered by Exness is 1:2000

However Exness does not allow you pair the Naira with other currencies to trade. Even when it comes to asset classes like Bonds, and Indices; Exness does not have products based on Nigerian Bonds or Indices.

Exness Platforms: 4.8/5

Exness proprietary platforms(meaning platforms built by Exness) are Exness Web Trader, Exness Trade Mobile App, & Exness Social Trading Mobile App.

Exness MetaTrader Platforms(shared platforms) are MT4 & MT5. However Exness MetaTrader users don’t get any free MT4/5 Expert Advisor plugins.

Useful fact: The Exness Mobile App has an inbuilt MT5 terminal so even if you don’t have the MT5 app on your phone, you can use the one inbuilt into the Exness Trade app. read our Exness Review for more details

Exness Support Service: 4/5

You can engage the Exness LiveChat service while logged into the mobile app & this is convenient. If you trade from a browser or desktop, engage LiveChat on the Exness website.

We like that Exness support stays open 24/7, and other support channels like telephone and email are responded to in English language.

However we do not like that telephone lines are not free and general response time can be long.

Overall: 4.6/5

Exness has the highest no. of regulations, and their costs are also low. The major downside is that their customer support is not the best &tradable instruments offered lack diversity as Bonds, Agro-commodities, &ETFs are not listed on their product menu.

You can get more information about Exness for Nigerian traders here

2. HotForex (HFM) – Best Forex Broker for Beginners

Pros

- Naira denominated trading accounts(aka Naira base currency)

- Strong Regulation: HF Markets is regulated in many jurisdictions including the UK where the FCA has very strong regulations.

- HF Markets has a Demo Account

- HFMarkets has a Cent Account specifically built for beginners to trade very small order sizes

- HF Markets VPS hosting to prevent downtime when there’s no network locally

- Copy Trading: You can choose to be a Strategy Provider (SP) or a Follower. An SP lets followers to copy his trades and earns a fee. Followers also copy the trades of SPs.

- Swap-free trading(no overnight fees)

- Bonus on deposits

Cons:

- HF Markets trading platforms lineup lack a Web Trader which is desirable if you want to trade on desktop (but they have a mobile app)

- HF Markets is not licensed by SEC in Nigeria

- No customer service channels open during weekends, so you will get delayed responses.

- $5 Inactivity fee

- Spreads on the HF Markets Cent Account are too high for beginners who are the targets of this account. EUR/USD benchmark spread hovers around 1.6 pips.

Regulation&Licenses: 5/5

When you open an account with HF Markets, your client agreement is between you and HF Markets (SV) Ltd. which is their business unit regulated in Saint Vincent & The Grenadines.

HF Markets also operates in other part of the world, where their operations are monitored and sanctioned by:

- Financial Conduct Authority (FCA), UK. The FCA regulator in the UK is regarded as a tier-1 regulatory body because it sees a lot of the action in the forex market given that the UK is the forex trading hub of the world. The FCA has thus developed strong regulations based on its experience.

- Dubai Financial Services Authority (DFSA)

- Financial Services Authority (FSA) Seychelles

- Capital Markets Authority (CMA) Kenya

- Financial Sector Conduct Authority (FSCA) South Africa

HFM has a physical registered office in Nigeria. But theNigerian clients at HotForex are registered under St. Vincent & the Grenadines regulation which is registered as the company name HF Markets (SV) Ltd.

HF Markets Fees: 5/5

HF Markets Cent Account fees include spreads from 1.2 pips upwards, commission payable on all trades except Forex, Metals, & Commodity trades. HF Markets minimum deposit is $5 for the Cent Account.

HF Markets Premium Account fees are spreads from 1.2 pips, & commission charged on all trades except Forex,Metals, & Commoditytrades. HF Markets minimum deposit for its Premium Account is $5.

HF Markets PRO Account fees are spreads from 0.6 pips & commission is charged on every trade except Forex, Metals, & Commodity trades. HF Markets minimum deposit is N50, 000 on the PRO Account.

HF Markets PRO PLUS Account fees are spreads from 0.2 pips & commission is charged on every trade except Forex, Metals, & Commodity trades. HF Markets minimum deposit is N200, 000 on the PRO PLUS Account.

HF Markets Zero Account fees are spreads from 0.0 pips (on forex trades only) & commissions up to $3 per side per 100,000 units of any instrument traded. The HF Markets minimum deposit on its Zero Account is $5.

HF Markets Top-up Bonus Account fees are 1.4 pip & above spreads, overnight swap fees, and commissions on all trades except forex trades. HF Markets minimum deposit on the Bonus Account is $5.

Important information for readers: HF Markets charges commissions on all their trading account types. There are no spread-only accounts at HF Markets

List of commissions charged by HF Markets:

| Instrument | Commission |

| 💱Forex | $3 per side per 100,000 units traded |

| 📈ETF | $0.05 per side per share |

| 📈Indices | $0.5 per side |

| 📈Stocks | 0.1% |

| 🪙Gold &Metals | $0 |

| 🔥Energies | $0 |

| 🌾Grains | $0 |

| 🏛Bonds | $0 |

For dormant accounts on HF Markets, a $5/month inactivity fee is levied after 6 months.

HF Markets Payment Methods: 4.7/5

HFMarkets accepts over 15 funding methods but we discuss the ones applicable to Nigeria. HFM also offers Naira account currency so deposits/withdrawals in Naira don’t need to be converted to another currency thus lowering cost.

Deposits into HF Markets:

- Nigerian Bank USD deposit takes 2 working days

- Nigerian Bank Naira deposit is instant

- USD Wire Transfer deposit takes between 2 & 7 working days.

- Master & Visa Credit card deposits take 10 minutes and is free

- Other alternative payment channel deposits take around 10 minutes and HF markets does not charge anything. Also note that payment processor fees are not covered by HF markets.

Withdrawals from HF Market:Nigerian Bank USD Withdrawal takes 24 hours and is free.Wire transfer & Visa credit Card Withdrawal takes around 10 working days.

HFM needs to integrate more local Nigerian mobile payment solutions into its payment lineup.

HF Market Tradable Instruments: 4.5/5

HFM CFD offerings lag behind in the currency asset class segment. Only 50+ FX Pairsincluding both major & minor, but no Exotics.

However Metal CFDs paired against USD & EUR such as Gold and Silver are available and you can trade Gold CFDs with spreads from 0.0 pips.

You also get Energy, Indices, Stock, Commodity, Bond, & ETF CFD market exposure. CFDs are leveraged products so HFM allows up to 1:2000 in leverage meaning higher risk to you.

HF Market Platforms: 4/5

The HFM Mobile App(developed by HF Markets) for Android & iOS phones lets you trade on your phone and is user-friendly.

MT4 and MT5shared platforms are also provided by HF Markets and supported with what they call ‘Premium Trader Tools’ which are basically free downloadable Expert Advisors for MT4/5 courtesy of HF Markets.

HF Markets Copy Trading platform can be accessed on the HFM Mobile app as well as the MT4 terminal.

VPS hosting has been newly introduced allowing Expert Advisors (EAS) to be connected to HFM servers always and preventing downtime.

However, the downside of HF Markets platforms is that there is no exclusive HFM Web Trader meaning a proprietary trading software that can be accessed from the HF Markets website without the need to download and install it on your device.

HF Markets Customer Support: 4.5/5

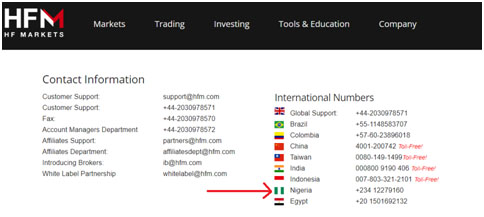

HFM is available 24/5 (Monday to Friday) via Live Chat, emails, and Nigerian phone number.

HF Markets Bonus/Promotions

- 100% supercharged bonus- You can earn $2 daily cash rebates per lot for every $10 you deposit. The rebates can be withdrawn in cash or used to trade

- 30% Rescue Program: To qualify you need to deposit over N20, 000 or $50 or 40 Euro. For every N20, 000 you deposit you get N6, 000 in rescue. This cash cannot be withdrawn and is to be used for trading only.

- Deposit Bonus: A 100% credit bonus to all new traders at HFM if you sign up for the bonus.This is available only for Islamic, premium & Micro accounts. To qualify make a deposit of 100 Naira or 100 of any currency. You get a bonus on your deposit which can withdraw from your account.

- HFM in Nigeria also pays you Return on Free Margin (ROFM) where you earn interest on unused margin, but terms & conditions apply.

Overall: 4.6/5

If you can afford the N50, 000 or N200, 000 minimum deposit for the PRO & PRO PLUS Accounts respectively, you can access really low spreadsat HF Markets and you get to trade with accounts denominated in the Naira currency. Their support is also good, and they have local deposit & withdrawal options.

Read more information about HotForex for Nigerian traders

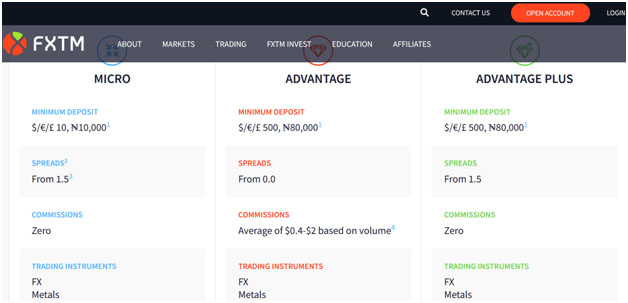

3. FXTM – Best Forex Broker for Naira CFDs: USD/NGN& EUR/NGN

Pros:

- Naira Base Currency Account is available

- Demo Account is available for free

- You can trade USD/NGN & EUR/NGN

- FXTM has swap-free trading on Forex & Gold

- FXTM has no limit & stop levels

- FXTM supports speedy withdrawals in Naira via Nigerian Banks at zero cost

Cons:

- FXTM has a N80,000 minimum starting deposit which is quite high

- Spread-only account (Advantage Plus Account) has high spreads ( the spread plus commission Advantage Account charges lower spreads from 0.0 pips)

- No beginner friendly accounts (The Micro Account has been discontinued)

- FXTM is not licensed by SEC in Nigeria

- No bonus on deposits

- FXTM charges $3 withdrawal fees when you use Visa/Master/Maestro Cards.

- Inactivity fee

FXTM is a global financial service provider that was established in 2011 and they accept clients from Nigeria. They do have a physical branches in Nigeria.

FXTM is licensed by:

- Cyprus Securities and Exchange Commission (CySEC)

- Financial Sector Conduct Authority (FSCA) South Africa

- Capital Markets Authority Kenya CMA (where it operates as Exinity Capita East Africa Ltd)

- Financial Conduct Authority FCA UK (where it operates as Exinity UK Ltd.)

- Financial Services Commission Mauritius (where it operates as Exinity Ltd.)

FXTM Fees: 4/5

- Deposit & Withdrawal charges via Nigerian banks: Free

- Deposit & Withdrawal charges via e-Wallets: Free

- Deposit charges via Visa & Master Credit Cards: Free

- Withdrawal charges via Visa & Master Credit Cards: $3

Note that if you intend to deposit in Naira currency, your best option is to use Nigerian Banks because other payment channels don’t support Naira currency.

Spread: On the FXTM MT5 Advantage Account, spread can be as low as 0 pips but with Micro Accounts, the spreads are high.

On the Micro and Standard Accounts EUR/USD spread can be 1.9 pips but on the MT5advantage account spread is zero.

Commission: is $2 per side and is charged on the Advantage Account only. However commissions on Cryptocurrency CFDs can reach $150.

Swaps: FXTM charges for overnight positions but there is also swap-free terms & conditions on certain instruments

The maximum leverage FXTM offers is 1:1000 fixed on the Micro account, 1:2000 floating on the Advantage & Advantage Plus accounts.

FXTM Payment Options: 5/5

| Methods | Minimum amount | Duration |

| Bank Transfer | Deposit: None

Withdrawal: None |

Deposit: Instant

Withdrawal: Instant |

| MasterCard | Deposit: $5

Withdrawal: None |

Deposit: Instant

Withdrawal: 24hrs |

| Neteller | Deposit: $5

Withdrawal: N1 |

Deposit: instant

Withdrawal: 24hrs |

| Bank wire | Deposit: $10

Withdrawal: None |

Deposit: 3-5 working days

Withdrawal: 24 hrs |

FXTM Tradable Instruments: 4/5

FXTM offers 60+ Forex Pairs (including major, minor and exotic), 5 Spot Metals, 3 Commodities, Stocks, and Indices.

You can trade the USD/NGN& EUR/NGN giving you exposure to the Nigerian market, but these FX pairsare very volatile and should be traded by professionals only.

FXTM Platforms: 4.5/5

FXTM offers MT4 and MT5 trading platforms that are available on PC, Mac, Mobile and iOS. They also offer the FXTM Trader mobile app that is available on both android and iOS.

FXTM platform lets you open account in Naira (NGN), US Dollar (USD), Euro (EUR), & British Pound (GBP) base currencies

FXTM has a Demo Account where you can learn how to trade, or perfect strategies before going live.

FXTM platforms also support copy trading where you can copy the trades of other experienced traders and vice versa.

FXTM Support Channels: 5/5

Live Chat, Nigerian Phone Numbers, email address. Help lines are also open on weekends

Read more information about FXTM for Nigerian traders

4. XM – Best Forex Broker for Spread Only Trading Account

XM Pros:

- XM has a Micro Account for traders who have practiced on Demo Accounts & are going live for the first time

- Zero Commissions means beginners will find it easy to estimate profit & loss when making calculations

- XM has a $5 starting minimum deposit which is affordable

- Demo Account is free

- Swap-free trading with Ultra Low Account

- XM has copy trading

- XM has good research & education

- Live price feed

- XM has a good mobile app with over 5 million android downloads recorded

- Bonus offerings

XM Cons:

- No Naira Account

- High risk- No Tier-1 regulation

- XM broker is not licensed by SEC in Nigeria

- No raw spreads. XM spreads can be high with EUR/USD spreads reaching 2.0 pips

- No CFD Markets for ETFs & Bonds

- Inactivity fee

Regulation&Licenses: 3.5/5

XM Global ltd. is a financial service provider that was founded in 2009. They are regulated by the Financial Services Commission (FSC), Cyprus Securities and Exchange Commission (CySEC).

XM has no registered physical office in Nigeria.

XM Fees: 4/5

XM brokers takes zero commission on forex trading, but their average spread is high.

XM EUR/USD average spread on standard accounts is 1.7 pips but on ultra-low accounts EUR/USD spread can be as low as 0.0016 pips

Although XM charges overnight swap fees, the Ultra-low Account provides swap-free trading on specific instruments

XM Payment Channels: 4/5

You can deposit and withdraw money with XM broker using mastery, visa card, e-wallet like Skrill. There is no option to fund via bank transfer in Naira.

XM Tradable Instruments: 5/5

You can trade up to 1000 instruments on XM. This includes 50+ Forex Pairs, 1000+ Stocks, 8 Commodities, 20+ Equity Indices, 3 Metals, Energies and Cryptocurrency. XM leverage is 1:1000 maximum.

XM Platforms: 5/5

XM has the MT4 for windows, MAC PCs, web, iOS & Android devices. It also has MT5 for Windows & MAC PCs, web and Android devices.

There is also the XM proprietary trading app for Android & iOS devices

XM only supports account opening in USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, SGD, ZAR base currencies as there is no Naira account

XM has a Demo Account where you can learn how to trade, or perfect strategies before going live.

XM Security: 4/5

XM brokers offers users the ability to enable two factor authentication. It is advised you enable two factor authentication as it gives your account protection from hackers.

Negative Balance Protection is also in place to prevent you from losing more than your initial deposit. If due to volatility your account goes into negative, XM will adjust it back to zero.

XM Support Service: 4.5/5

XM broker customer support is available 24/7 via call, email, and live chat.

XM Bonus/Promotion

XM has a ‘50% + 20% bonus program’ for deposits over $5 into your account. For 50% the bonus cannot exceed $500 and for 20% the bonus cannot exceed $4500

For example you deposit $5000 so your bonus will be (50% of $1000) + (20% of $4,000) = $1300

Overall: 4.2/5

XM is not regulated by any Tier-1 regulation, but they are a reputed broker. Their fees is low with Ultra Low account (no commission per lot) & their support is good.

You can read about the trading conditions on your signup with XM

5. AvaTrade – Best Forex Broker for Fixed Spreads

Pros:

- Strong Tier-1 regulation from ASIC

- AvaTrade offers multiple high-tech trading software/platforms such as a Mobile App, a Web Trader, and another mobile app for trading FX Option contracts.

- Copy trading is availablevia collaboration with 3rd party copy trading platforms like DupliTrade& ZuluTrade

- Beginners using the AvaTrade MT4 platform can download their Guardian Angel Expert Advisor to be their companion while they trade. It acts as a risk management tool/companion for beginners.

- Deposit bonus

- AvaTrade spreads are fixed (they don’t fluctuate)

- AvaTrade can reimburse you for losses while trading when you subscribe to the AvaProtect feature

- List of products you can trade is extensive

- AvaTrade has a dedicated website for Nigeria& great customer support

Cons:

- AvaTrade has only one account type. AvaTrade has no Cent Accounts for beginners

- No support services on weekends

- AvaTrade does not support Naira base currency denominated accounts. The implication is you pay for currency conversion if you deposit/withdraw in Naira

- High minimum deposit

- AvaTrade charges $50 inactivity fee

- AvaTrade does not provide for swap-free trading(meaning you pay overnight fees on trades left active overnight)

- AvaTrade is not licensed by SEC in Nigeria

Regulation: 4/5

Avatrade is an online CFD broker that was founded in 2006. This broker accepts traders from Nigeria, but does not have an offline branch office in the country. Avatrade is regulated by:

- The Central Bank of Ireland (CBI)

- Cyprus Securities and Exchange Commission (CySEC)

- Australian Securities & Investments Commission (ASIC)

- British Virgin Islands Financial Services Commission

- Financial Sector Conduct Authority (FSCA) South Africa

- Financial Services Agency (FSA) Japan

- Financial Regulatory Services Authority (FRSA) Abu Dhabi

- Israel Securities Authority (ISA)

Fees: 4.5/5

AvaTrade does not charge commission, however they charge fixed spreads. The average spread for some Forex pairs like EURUSD is 0.9.

For Nigerian users, AvaTrade has a maximum leverage of 1:400. Avatrade charges inactivity fees and swap fees.

Payment Channels: 3.5/5

Deposits: You can deposit money into Avatrade via e-Wallets, Wire Transfer, Credit/Debit Card. For credit card deposits it is instant, for e-wallet it take 24 hours and for wire transfer it takes about 7 working days.

Withdrawals: You must withdraw via the same channels which you deposited which could be e-Wallet, Wire Transfer, Credit/Debit cards.

However deposits or withdrawals from Nigerian banks are not supported. Credit cards from Nigeria are also not accepted by Avatrade.

Tradable Instruments: 4/5

Avatrade offers Forex trade with 50+ currency pairs (including exotic, major, and minor). They also offer CFD trading on stocks, commodities, ETFs, bonds, and indices.

Platforms: 4.5/5

Avatrade offers MT4, & MT5 platforms which are ideal for automated trading. Although MT4 users can build their own Expert Advisors (EA), AvaTrade has built the Guardian Angel EA for risk management and offers it for free.

AvaTrade Proprietary platforms such as AvaTradeGO & AvaOptions mobile apps are built by them and offer advanced features.

The AvaTradeGO app is for CFD trading on mobile phone while the AvaOptions mobile app is for FXOption trading on mobile phones.

AvaTrade offers copy trading via ZuluTrade & DupliTrade platforms (these are external platforms not owned by AvaTrade) where you can mirror the trades of other experienced traders and vice versa.

AvaTrade also has a demo account for beginners to learn how to trade.

Support: 4/5

Avatrade customer service is available 24/5 via email, live chat or call and doesn’t work on weekends and holidays.

AvaTrade Bonus & Promotions

AvaTrade offers deposit bonus. For deposits over $200 you get 20% back as bonus.

You can read about the trading conditions on your signup with AvaTrade

6.OctaFX -Good Forex Broker with Local Funding Options in Nigeria

Octafx Pros:

- Low spreads

- No withdrawal fees

- Spread-only accounts (commissions are not charged on Octafx Accounts)

- Octafx does not charge overnight swap fees

- Octafx has a Demo Account

- Octafx does not charge inactivity fees on dormant accounts

- Multiple trading platforms

- Copy trading is available at Octafx

- Deposit bonus (new & existing clients)

Octafx Cons:

- Octafx is not licensed by SEC in Nigeria

- High risk- No strong Tier-1 regulation from the FCA UK. They are still popular in Nigeria.

- High N30,000minimum account opening balance

- No Naira base currency

- Limited products to trade

Regulation: 2/5

Octafx was launched in 2011 and is regulated by The Mwali International Services Authority (MISA) located on the Comoros Island off the coast of Madagascar. This is not exactly top-tier regulation, as Mwali is not an advanced economy.

Octafx Fees: 4.5/5

OctaFX does not charge commission, they charge variable spread that starts from 0.8 for a currency pair like EUR/USD. This broker offers investor protection and has maximum leverage of 1:500.

Octafx Payment Channels: 4/5

Deposit & Withdrawal is free of charge as Octafx does not charge any commission for the service.They have also provided several methods of deposit and withdrawal.

| Method | Minimum amount | Duration |

| Bank Transfer | Deposit: 15000.00 NGN or $50

Withdrawal: 3000.00 NGN |

Deposit:

Withdrawal: 1-3 hrs |

| Bitcoin | Deposit: 0.00037000 BTC

Withdrawal:0.00009000 BTC |

Deposit: 3-30 minutes

Withdrawal: 3-30 minutes |

| Ethereum | Deposit: 0.02000000 ETH

Withdrawal: 0.00500000 ETH |

Deposit: 3-30 minutes

Withdrawal: 3-30 minutes |

| Master Card | Deposit: 50 EUR | Deposit: Instant |

Octafx Tradable Instruments: 3.5/5

Octafx offers CFDs on 35 Currency Pairs, 150 Stocks, 10 indices, 30 Cryptocurrencies, Gold &Silver. The Octafx CFD catalogue is not very rich as ETFs, Soft Commodities, Zinc, &Bonds are missing.

Octafx Platforms: 4/5

Octafx offers the MT4 and MT5 trading platforms that run on Web,Android,Windows, and Mac operating systems.

Octafx also offers their own proprietary mobile app called ‘OctaTrader’ which runs on web, Android, and iOS devices.

OctaFX only supports USD and EUR account base currencies and there is no Naira account.

OctaFX has a Demo Account where you can learn how to trade, or perfect strategies before going live.

OctaFX platforms also support copy trading where you can copy the trades of other experienced traders and vice versa.

Octafx Security: 3/5

Every withdrawal from your account must be confirmed by you via email to prevent fraudulent withdrawals.

Negative Balance Protection is also in place to prevent you from losing more than your initial deposit. If due to volatility your account goes into negative, Octafx will adjust it back to zero.

Octafx Support Service: 4/5

Customer support is available 24/7 via live chat, email, and enquiry form.

Octafx Bonus

Octafx offers both new & existing traders 50% deposit bonus on any deposits above $50.

Overall: 3.8/5

OctaFX is a higher risk forex broker than others in this list. But they are regulated with CySEC, and they have low spreads on major currency pairs.

You can read about the trading conditions on your signup with Octafx

7.FxPro – Best Forex Broker with Multiple Platforms at Low Cost

FxPro Pros:

- FxPro is regulated by FSCA, FCA; both are Top-tier regulators.

- FxPro has a good android mobile app with over 5 million downloads on play store.

- Excellent platform lineup including MT4/5 & cTrader

- Four Professional Account types out of which 2 offer raw spreads

- FxPro 1:200 leverage helps reduce tendency for heavy losses

- Low commission & spreads with cTrader terminal

- Fixed spreads or variable spreads can be selected on FxPro MT4

- You can trade CFDs on Futures contracts that have commodities as underlying assets

FxPro Cons:

- No Naira account available for traders

- FxPro does not permit trading CFDs on Bonds, ETFs, & Soft Commodities

- FxPro minimum deposit is $100 which is high for the average Nigerian

- No Cent Account for beginners who are done with the Demo Account and want to go live while risking little capital

- No swap-free conditions

- No deposit bonus

- Inactivity fee

- FxPro is not licensed by SEC in Nigeria

Overall: 4.3/5

FxPro is regulated with FCA, which makes them low risk for traders. The fees is low with cTrader account, and they have good customer support. But they don’t have Naira account.

Click here to get more details on FxPro’s website

8. Tickmill – Best Regulated Forex Broker with Pro Accounts

Tickmill Pros:

- Tickmill has Tier-1 regulation with FCA

- Tickmill has no inactivity fee

- Great education

- Tickmill gives a no deposit bonus of $30 to new traders

- Demo account

- Good customer support

- Copy trading

- Free EAs for MT4

- Low commission of $2 per side

- Low spreads when you use the Pro Account. EUR/USD is 0.1 pips

Tickmill Cons:

- No NGN account currency

- Tickmill is not licensed by SEC in Nigeria

- Tickmill minimum deposit is $100 which is still high

- No beginner-oriented trading accounts

- Overdependence on MetaTrader platforms. Tickmill does not have a powerful trading platform of their own.

Regulation: 5/5

Tickmill is a CFD broker that accepts traders based in Nigeria. The Tickmill Group was founded in 2014, and they are a multi-regulated forex broker. They don’t have any local office or phone number in Nigeria, but they are regulated with following regulators:

- Financial Conduct Authority (FCA)

- FCA Cyprus Securities and Exchange Commission (CySEC)

- Financial Sector Conduct Authority (FSCA) South Africa

- DFSA UAE

- Seychelles Financial Services Authority (FSA)

Note that Nigerian clients are registered under FSA in Seychelles.

Fees: 4.5/5

AvaTrade has 2 account types for forex traders. One is commission based & other is spread only. The minimum deposit at Tickmill Nigeria is$100.

Depending on your account type, the spreads are as low as 0 pips. But there is a commission with the Pro Account of $0.2 per side for mini lots.

There are no extra charges for deposits or withdrawals.

Payment Channels: 3.5/5

Tickmill only accepts payments via Cards & Crypto from clients in Nigeria. Tickmill minimum withdrawal is USD 25 (depends on your account currency).

There are no extra charges for withdrawing of your funds. But there is no local bank account option for Naira deposits &withdrawals.

Tradable Instruments: 4.5/5

Tickmill has 6 asset classes for CFD trading. These include 62 Forex pairs, 100+ Stock Indices (like NASDAQ, DAX, Nikkei225& S&P500), Crypto, Commodities (including Gold), Bond & Stocks.

Platforms: 3.5/5

Tickmill relies on the MT4 & MT5 platforms for trading. They have also built free Expert Advisors for MT4 users (Advanced Trading Toolkit) which they offer for free.

As for proprietary trading platforms, Tickmill is lagging behind.

Support: 4/5

There is no local phone number in Nigeria. But they have live chat & email support on their website. Their live chat is responsive & were quick in answering our queries.

Tickmill Bonus & Promotions

Tickmill has a $30 Welcome Account Bonus available for new traders. Nigerian clients can register for this bonus, and withdraw any profits made. But make sure to read the terms.

Overall Score: 4/5

Tickmill is a well regulated broker with low spreads and no inactivity fees. Tickmill range of instruments for trading is also good and Tickmill offers a no deposit bonus of $30.

Tickmill MT4/5 users also have adequate support through Smart Trader Tools but their platforms for trading lack a Proprietary Web Trader &Mobile App.

You can read about the trading conditions on your signup with Tickmill

Runner Ups – Best Forex Broker Nigeria

How should you choose a Forex Broker in Nigeria?

Here are metrics we considered when choosing the listed Forex brokersfortraders in Nigeria.

a. Tier 1 Regulation and Reputation

We pay the highest attention to regulation because of the prevalence of forex scams, and the fact that recovery of funds can be nearly impossible.

Tier-1 regulators are those from developed economies like UK and Australia. For example the Financial Conduct Authority of the UK is a Tier-1 regulator and any brokers under their regulation are deemed safer than those not under Tier-1 regulation.

Sinceforex trading is not regulated in Nigeria (but it is not illegal to trade forex), when choosing a broker in Nigeria, you may want to consider brokers that are regulated by top tier regulatory bodies like the Financial Conduct Authority (FCA) and the ASIC.

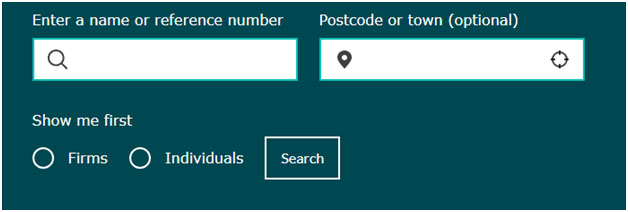

You must check the website of the broker & find out the regulatory licenses with they hold. HF Markets Group for example has licenses issued by multiple regulators.

You then verify if the licenses are valid or notby visiting the website of the regulator (license issuer), and searching its register of licensed entities.

Example to verify HF Markets FCA license visit www.fca.org.uk, click on ‘firms’, then click on ‘check if a firm is authorized’.

b. Local Presence and Support

Some forex brokers have study centers in Nigeria, and hold seminars and trainings periodically. This establishes a footprint as they have a physical presence of some sort enabling you to put a face to the voice.

Whether a broker has a local office branch or not, they should have good customer service that is easy to reach.

Like HFM give their Nigerian phone number on their contact page.

Try to call the number for your questions, not just related to sales, but actual account related queries. See if the responses are satisfactory.

c. Availability across platforms and Ease of Use

Before choosing a broker, you should ensure that the trading platforms they offer are compatible with your device.

Check if the platforms are available on Android, iOS, Linux and Windows. The broker should also offer demo accounts that enable you to test it before you start live trading.

d. Overall Fees

Brokers make money by charging a fee. Some charge more competitive fees than others.

Before trading with a broker, do your due diligence to know how much they charge for Spread, Commission, overnight holding costs, and non-Trading Account charges.

You may want to consider brokers that charge the most competitive fees.

e. Minimum Deposit

Another thing to consider before choosing a broker is the required minimum deposit for account opening & for subsequent deposits.

If you are someone who prefers to trade with small amounts, you may want to consider brokers with low minimum deposit as such brokers do not match your trading styles.

f. Local Payment Options

Depositing and Withdrawing funds should not be a difficult process. You should consider brokers who offer a wide variety of deposit and Withdrawal methods.

Forex brokers that accept payments in Naira via bank account are considered better (only if they are Tier-1 regulated).

You also want to check the terms and conditions for deposit and withdrawal as some brokers charge fees. The duration it takes to deposit and withdraw funds is something you may want to put into consideration as well.

g. Mobile App and MT4

MT4 is one of the most popular trading platforms around the world, and if you wish to hop into the band wagon of people using this platform then your preferred broker should offer it.

Remember MT4 is a shared platform so a good broker should also develop their own proprietary/unique platform. This shows commitment to technology and makes the broker more reliable.

Proprietary platforms offer better functionality than MetaTrader because the broker can keep adding new features at their pace and budget. Brokers can also delete features users don’t find useful.

For example you can access LiveChat from inside a broker’s proprietary platform, which is something you cannot do on MetaTrader platforms.

h. Number of Instruments and access to number of global markets

The number of instruments a broker offers and its access to the global market is one of the important factors to consider when choosing a broker.

A broker’s access to the global market goes a long way to tell the level of liquidity they have.

You may want to consider brokers who offer a wide variety of instruments, as such brokers have more tendency to offer products that you have Interest in trading or investing into.

i. Security of App/Platform

The importance of having a secured app or platform cannot be overstated. You may want to consider brokers who offer two factor authentication during login, and withdrawals.

Two factor authentication makes it difficult for hackers to gain access into your trading platform.

What is the minimum Deposit at Forex Brokers in Nigeria?

There are forex brokers who have N0 minimum deposit required to open your‘trading account’ with them. Note that under this, you are only opening your trading account with that broker, but if you want to trade from that account, then you also need to fund it as well.

For example, HFM has a minimum deposit of N0 (N50,000 for Pro Account which has a lower spread). Exness has as minimum deposit that depends on your choice of deposit. But for Pro accounts (their lowest spread accounts), the minimum funding required is $500.

If any forex broker says zero deposit for any account type, what it ususally means is that lowest amount you can fund, depends on their minimum deposit amount on payment method you are selecting.

If you are selecting Bank Deposit, to take an example, then check what the lowest deposit is for their bank deposit method.

Information of Forex Brokers in Nigeria

| 🔎 Best Forex Broker Name | Exness |

| ☑️ Licenses of Forex Brokers in Nigeria | FCA, DFSA, FSA, CMA, FSCA, ASIC |

| 🏦 Lowest Minimum Deposit | N7,500 at HFMarkets |

| 💰 Lowest EUR/USD spreads | 0.0 pips at Exness |

| 🏢 Brokers with Local Bank Deposits | HFMarkets, Exness, FxPro, OctaFX |

Frequently Asked Questions (FAQs)

Is Forex Trading Legal in Nigeria?

Yes, forex trading is legal in Nigeria but there are no locally regulated forex brokers in Nigeria, so you are trading at your own risk.

Traders should only trade via Tier-1 regulated forex brokers like HotForex for example to ensure that their funds are safe.

How does Forex Trading work in Nigeria?

You have to register and download the app of a foreign licensed forex broker that is regulated in their jurisdiction. Only the forex brokers regulated by Tier-1 regulations should be trusted.

You then fund your account with the minimum deposit which your forex broker will specify.

After that you choose the contract for trading, which could be Contract for Difference, Options, or Futures contracts.

You choose the currency pairs to trade example use US Dollar to buy Euro (EUR/USD) then wait for the Euro to increase in price before closing your position and making a profit.

What currency pairs should beginners trade?

The major currency pairs which contain the US Dollar and another currency of a developed country are the best to trade.

For example the EUR/USD is the most traded pair in the world and is a major currency pair. You will not find it hard to get someone willing to trade with you online.

How to open account with a Forex Broker in Nigeria?

This involves three to four steps.

- Choose a Forex Broker – You should choose a Forex Broker that is regulated by Tier-1 & Tier-2 regulations.

- Signup with the Broker – You would be required to submit your KYC documents, and complete the account opening form. For example, you can follow this link & click the ‘Open Live Account’ green button on HFM’s website (or any other broker).

- Fund your Trading Account – You can fund via available payment methods for the minimum deposit or higher.

- Download App & Start Trading – This step involves downloading the platform or app of your broker from their website. It should be preferred that you use a desktop application for charting & managing your orders.