DESPITE promises by President Bola Tinubu to recalibrate Nigeria’s fiscal planning practices, the 2024 budget proposals he presented to the National Assembly last week contained nothing remarkably different from the uninspiring budgeting of the past two decades. Instead, the N27.5 trillion plan offers the familiar bouquet of “envelope” budgeting, shaky funding assumptions, high recurrent provision, low capital outlay, high deficit, more debt, and servicing costs, and a narrow revenue funnel. To optimists hoping for an economy-reflating and poverty-alleviating spending plan, the budget is a whimper, not a bang.

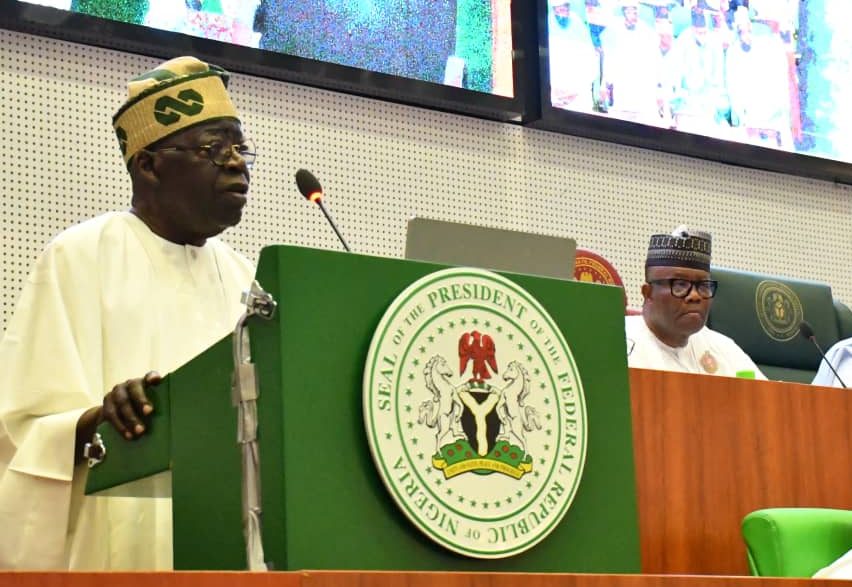

In his speech at the NASS joint session, Tinubu said his ‘Budget of Renewed Hope’ would cement macroeconomic stability, reduce the deficit, increase capital spending, and reflect the administration’s priority areas. Optimistically, he declared that it “constitutes the foundation upon which we shall erect the future of this great nation.”

For many however, this is a stretch. The N27.5 trillion expenditure plan proposes N9.92 trillion for non-debt recurrent; debt servicing at N8.25 trillion, and N8.7 trillion for capital spending. Debt servicing is a hefty 45 per cent of total spending, while the deficit of N9.18 trillion is 3.88 per cent of GDP, though lower than the N13.78 trillion of 2023 that was 6.11 per cent of GDP.

These and other details belie the President’s rosy picture. New borrowings of N7.83 trillion, coupled with expected drawdown of N1.05 trillion on multilateral and bilateral loans for specific projects cement the country’s precarious revenue position. The N298.49 billion expected from privatisation proceeds is too meagre, and based on past hesitancy to privatise, may not even materialise.

The budget also rehashes lofty objectives such as achieving “job-rich” growth, better investment stability, and enhancing human capital development.

Some experts also fault its anchors. Its assumption of average oil price of $77.96 per barrel is precarious as prices averaged $74.38 on Friday, while estimated oil production of 1.78 million barrels per day is shakier. Production averaged 1.35mbpd this year, according to OPEC, which estimates output in 2024 at 1.38mbpd, and is aiming to reduce Nigeria’s quota to 1.58mbpd, down from 1.74mbpd in 2023, which it never met.

With 400,000bpd stolen, and OPEC seeking to cut production to boost prices, the output target appears unrealistic. Moreover, the national budget is still overly dependent on oil and gas revenues.

Other assumptions such as inflation at 21.4 per cent and debt servicing also raise questions. Inflation rose to 27.3 per cent in October, fuelled by high energy prices, rocketing naira exchange rates and runaway food prices.

With the government spending over 90 per cent of its revenue on debt-servicing, and still borrowing at breakneck pace, its deficits and borrowings could, as usual, eventually exceed estimates.

Experts describe annual budgets as an “important instrument of national resource mobilisation, allocation and economic management.” Well-planned and implemented they provide a framework for stimulating economic development.

Overall, however, this budget is largely more of the same annual fare. It sustains high recurrent spending. The N1.32 trillion or 5.0 per cent infrastructure vote falls short of the $1.5 billion required under the Reviewed Integrated Infrastructure Master Plan.

The social sectors – primarily education and health – which combined are allotted 12.5 per cent continue to get short thrift. This contradicts Tinubu’s electoral promise to allocate at least 10 per cent to health, and the 15 per cent combined agreed for health and education by African countries in 2010.

With the continued impact of petrol subsidy removal, and naira flotation, experts warn that the allocations to the social sector are inadequate and could deepen mass misery.

The 2023 N2.18 trillion supplementary budget approved in October was a foretaste of Tinubu’s unveiled first full year budget; apart from minor tweaks, it continues the consumptive budgeting of successive governments.